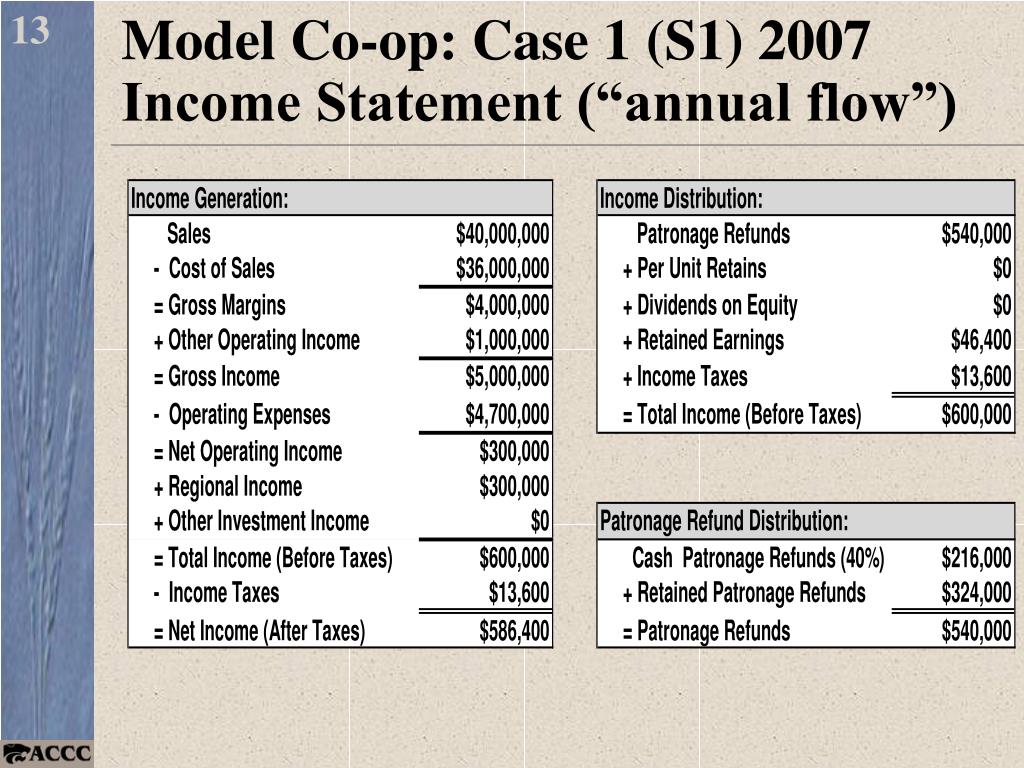

Patronage Dividends Income Statement

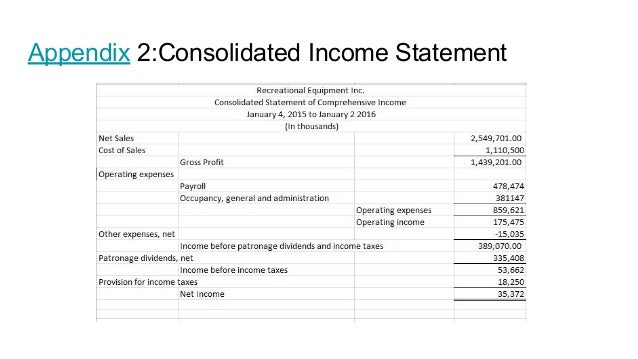

File form 1099 patr taxable distributions received from cooperatives for each person to whom the cooperative has paid at least 10 in patronage dividends and other distributions described in section 6044 b or from whom you withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

Patronage dividends income statement. Patronage dividends change the co op s liabilities to members and member owned assets. So this year remember to let your accountant know if any of your patronage dividends were earned for personal and family purchases so we can save you a little green. Patronage dividends are given based on a proportion of profit made by the business. Consequently patronage dividends are reported in the balance sheet rather than in the income statement.

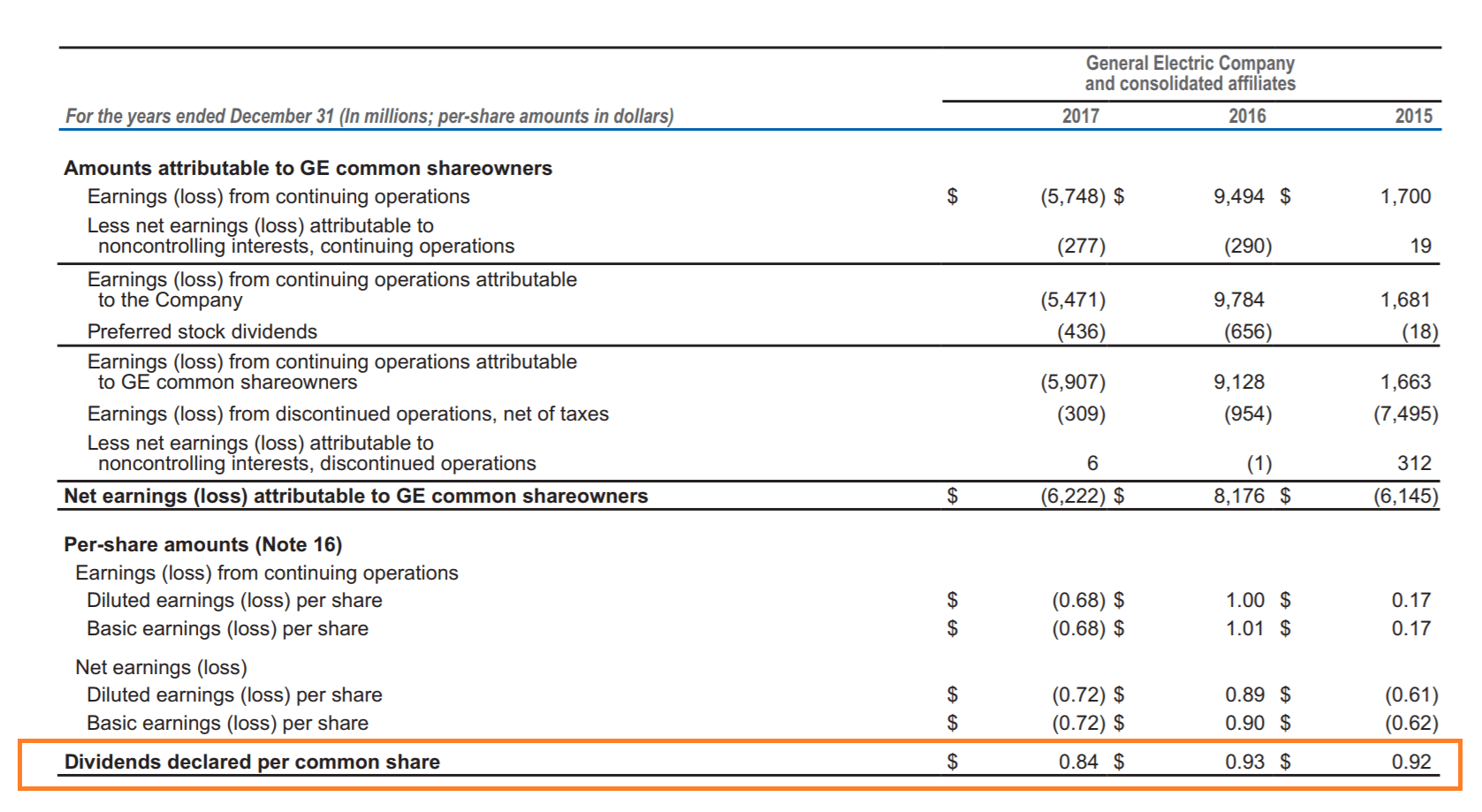

I am taking a tax deduction on the interest paid on this mortgage. Dividends on common stock are not reported on the income statement since they are not expenses. I also received a patronage dividend from the land bank that was reported on from 1099 patr. When filing its federal tax returns a cooperative may deduct the amount of the patronage dividends that it issues in a particular tax year from its gross income in that year.

As a result this income is not taxed at the corporate level. The dividends are not taxed because the purchase was never deducted from your income making the money spent already taxed. Should i report this patronage dividend as income. A dividend or distribution that a co operative pays to its members or investors.

Posted by nathan thieneman cpa cfe. Patronage dividends also are commonly referred to as patronage rebates or patronage distribution. I purchased a second home using a mortgage obtained through a land bank. Include on line 9 the patronage dividends and per unit retain allocations listed below.

Include the items listed below. If you don t know if the dividend is for business or personal items report the entire amount as income. Attach a statement listing the name of each declaring association from which the cooperative received income from patronage dividends and per unit retain allocations and the total amount received from each association. If the dividend is more than the adjusted basis of the property you must report the excess as income.

However dividends on preferred stock will appear on the income statement as a subtraction from net income in order to report the. Should i reduce the interest deduction by the amount of the patronage dividend br p. Garded patronage dividends as distributions of income rather than as price adjust ments clearly appears from the following language taken from its opinion.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png)

:max_bytes(150000):strip_icc()/rear-view-of-cheerful-stock-broker-with-fist-sitting-in-office-685080431-fb136c6689fb4a4da657a7651a9c7882.jpg)