Yearly Income Calculator California

While the income taxes in california are high the property tax rates are fortunately below the national average.

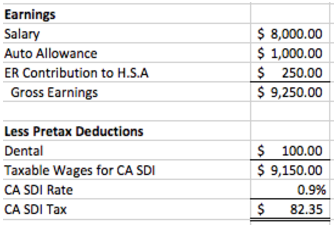

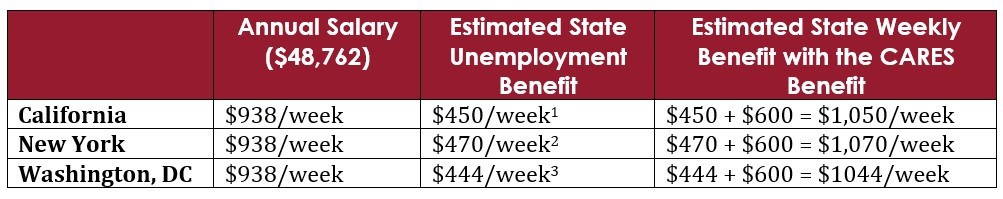

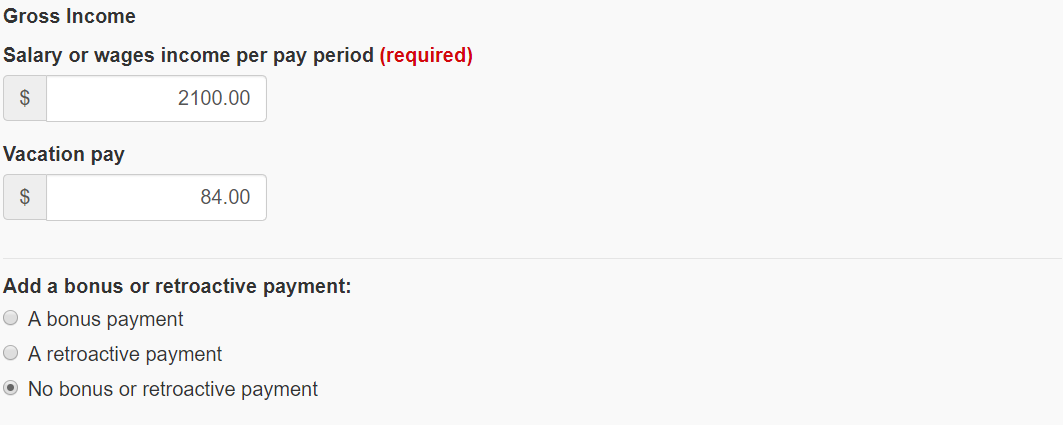

Yearly income calculator california. If you make 55 000 a year living in the region of california usa you will be taxed 11 394 that means that your net pay will be 43 606 per year or 3 634 per month. California salary paycheck calculator change state calculate your california net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free california paycheck calculator. What to know about california paychecks and taxes. Here s what you need to know about california payroll taxes and.

It s not as simple as taking their annual salary and dividing it by a set number of pay periods you have to withhold the appropriate amount of taxes from employee paychecks pay your own payroll taxes and follow numerous paycheck rules. Paying employees can get complicated. California salary tax calculator for the tax year 2020 21 you are able to use our california state tax calculator in to calculate your total tax costs in the tax year 2020 21.