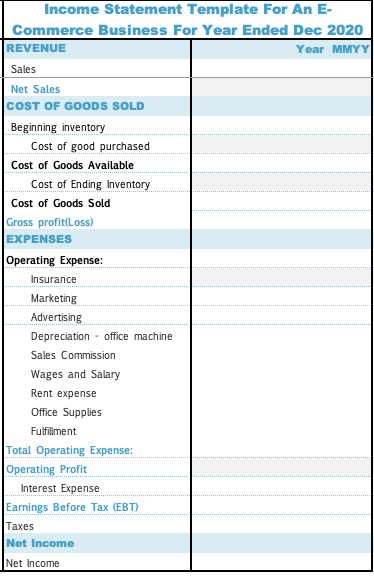

An Income Statement That Separates The Cost Of Goods Sold Into Categories

Your cost of goods sold includes the direct labor materials and overhead expenses you ve incurred to provide your goods or services.

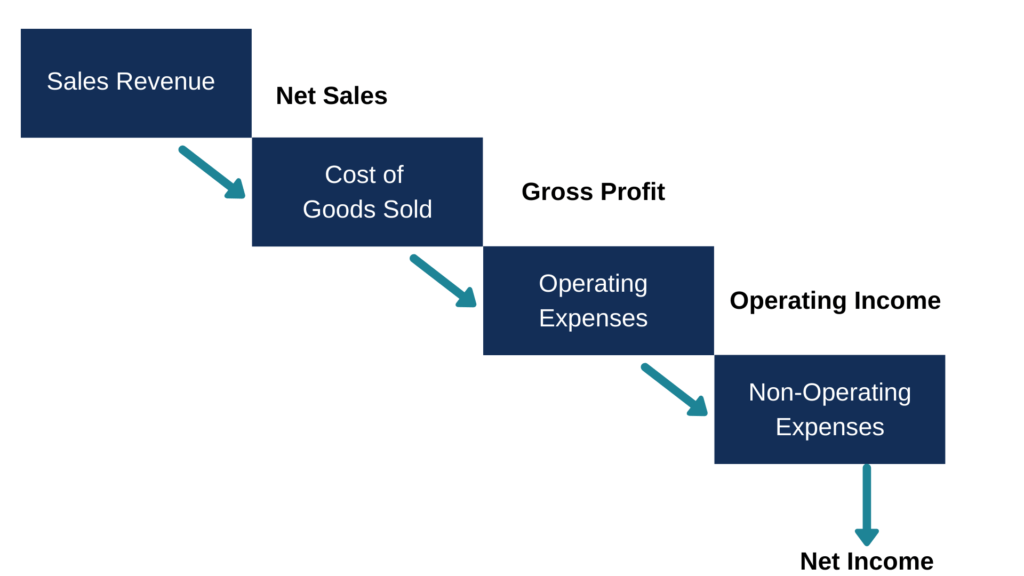

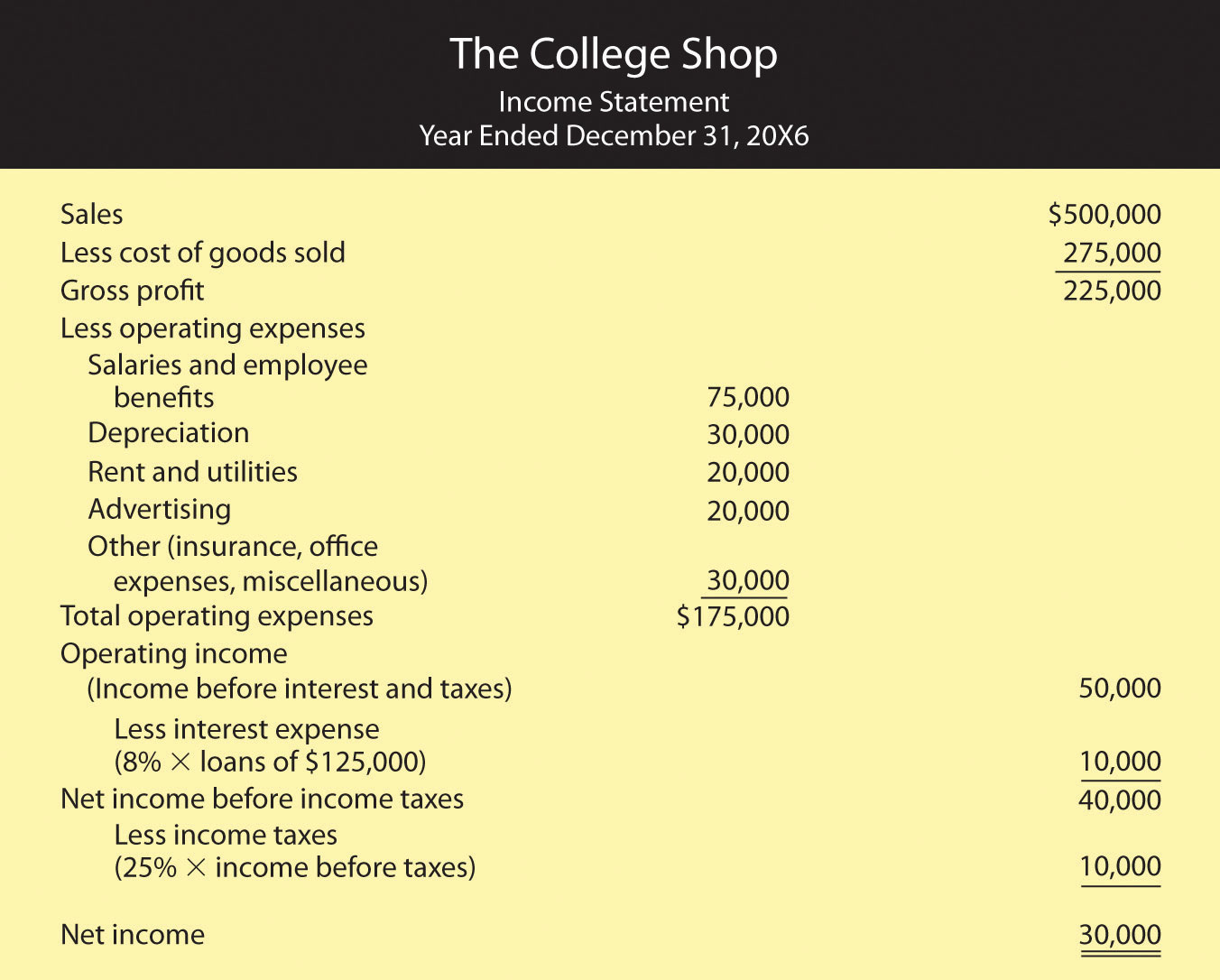

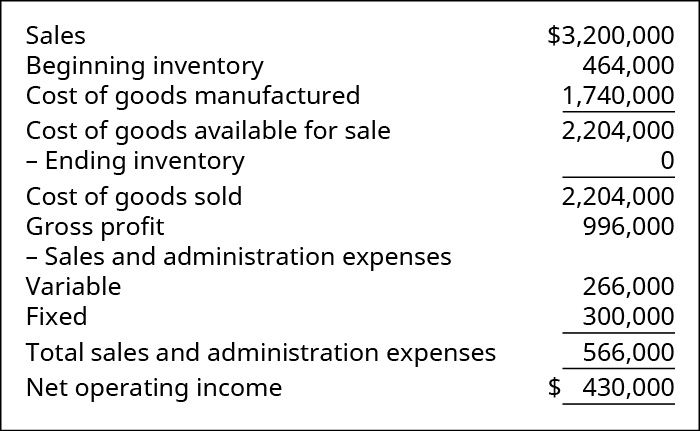

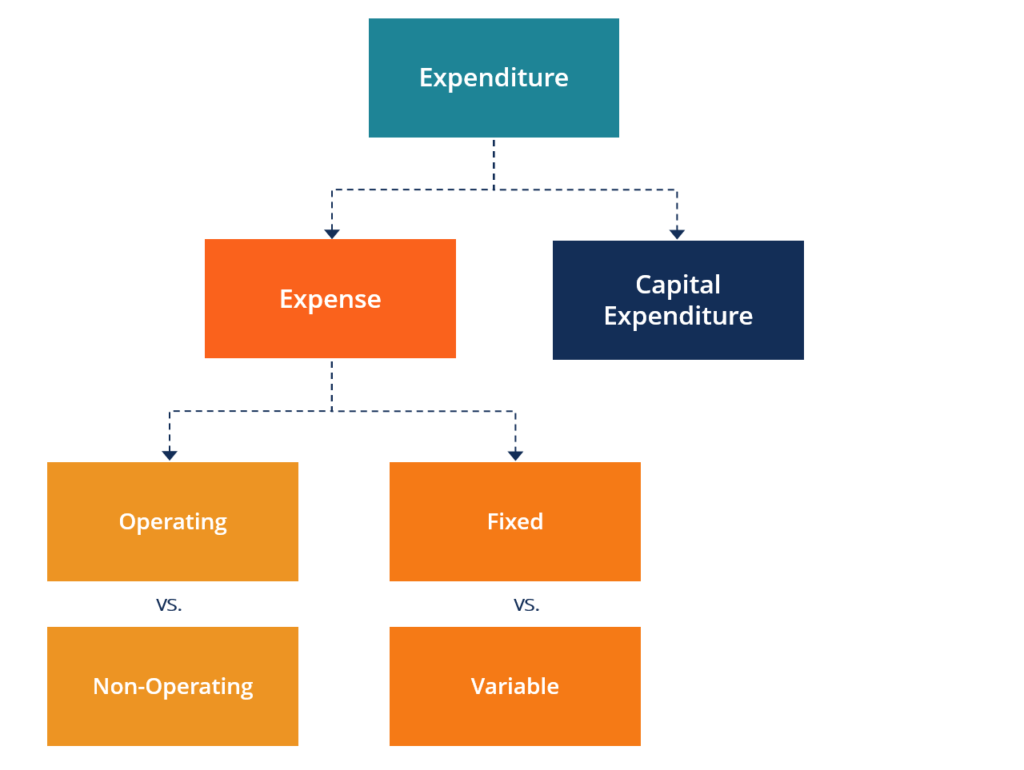

An income statement that separates the cost of goods sold into categories. The cost of goods sold is an expense and therefore goes under the expense accounts on the income statement. The traditional approach organizes costs into two categories cost of goods sold and selling and administrative expenses. Costs are separated into variable and fixed categories rather than being separated into product and period costs for external reporting purposes. Operating expenses are subtracted from gross profit to arrive at operating income.

Net income equals. Total revenues minus cost of goods sold b. Determine cost of goods sold. Multi step ans d.

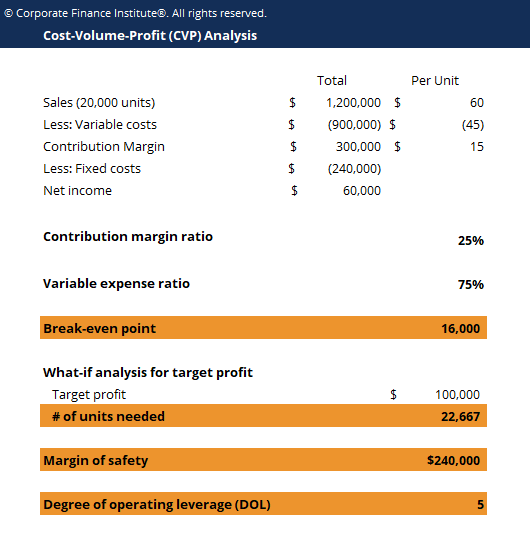

An income statement format that organizes costs by behavior. 9 when the costs for the period are broken into variable and fixed categories on the income statement it is known as the. The statement of cost of goods manufactured supports the cost of goods sold figure on the income statement. Be careful not to confuse the terms total manufacturing cost and cost of goods manufactured with each other or with the cost of goods sold.

Cogs is the companies expense to provide the goods it sales. Cost of goods sold is subtracted from net sales to arrive at the gross profit. Add up all the cost of goods sold line items on your trial balance report and list the total cost of goods sold on the income statement directly below the revenue line item. Cost of goods sold is reported on a company s income statement.

Ending inventory is subtracted to arrive at cost of goods sold. Total revenues minus total expenses c. The cost of goods sold per dollar of sales will differ depending upon the type of business you own or in which you buy shares a licensing company advertising group or law firm will have virtually no cost of goods sold compared to a typical manufacturing enterprise since they are selling a service and not a tangible product. Income statement format that separates cost of goods sold into categories.

Using the above multiple step income statement as an example we see that there are three steps needed to arrive at the bottom line net income. The statement starts with beginning inventory and adds in new purchases and expenses. The two most important numbers on this statement are the total manufacturing cost and the cost of goods manufactured. A cost of goods sold statement reflects a company s actual inventory costs.

9 a full costing income statement b functional income statement c contribution income statement d absorption income statement. The income statement and cogs an income statement is the financial statement in which a company reports its income and expenses. Manufacturing firms factor direct materials labor factory overhead work in progress and finished inventory into the expense section.