Absorption Costing Income Statement Calculator

Absorption costing is the costing method used for financial accounting and tax purposes because it reflects a more comprehensive net income on income statement and a more complete cost of inventories on balance sheet by shifting costs between different periods in accordance with the matching concept.

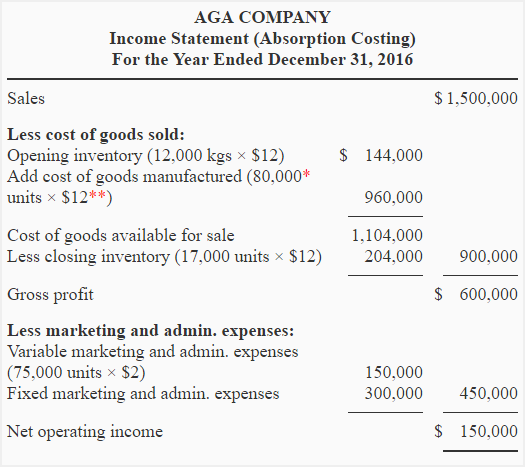

Absorption costing income statement calculator. Statement of profit worked example. Those include us gaap and ifrs. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost. Is taken care of and also all the direct costs associated with production.

Since absorption costing is gaap compliant many companies use this method of costing for financial statements reporting. We have already looked at the format of a statement of profit or loss under absorption costing here. Operating data for the month are summarized as follows. This income statement looks at costs by dividing costs into product and period costs in order to complete this statement correctly make sure you understand product and period costs.

The traditional income statement also called absorption costing income statement uses absorption costing to create the income statement. Manufactured 12 000 flat panel televisions of which 11 300 were sold. Cambrige as and a level accounting notes 9706 zimsec advanced accounting level notes. Sales 1 638 500 manufacturing costs.

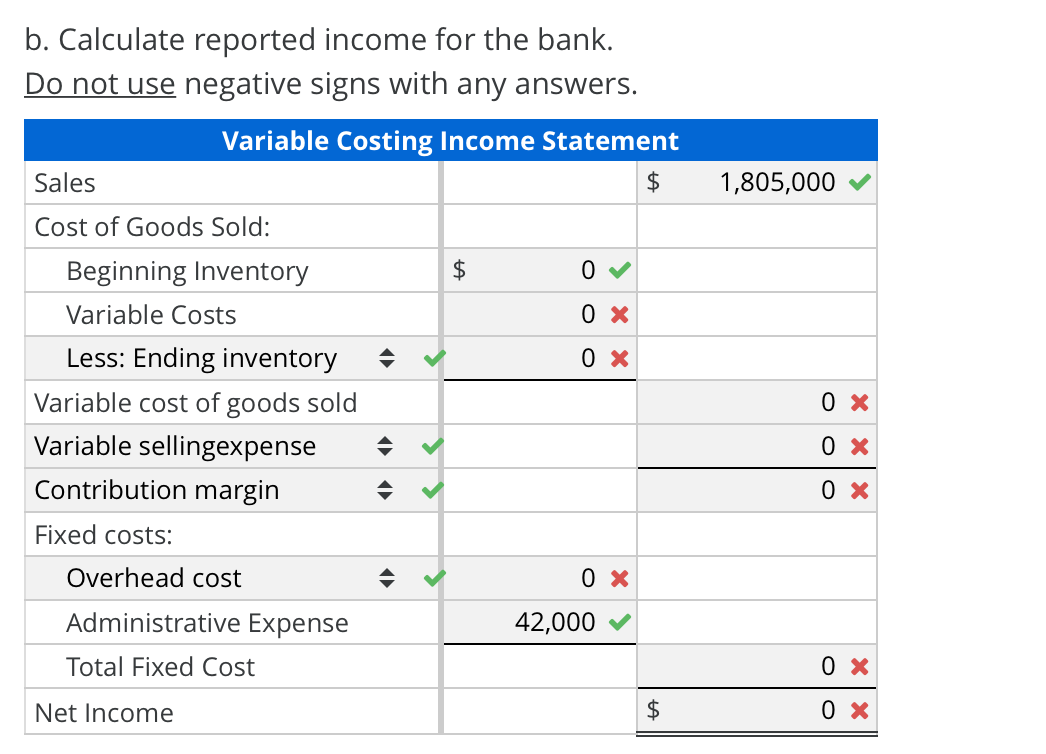

Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing. 80 000 x 12 960 000 17 000 x 12 204 000 cost of goods sold 756 000. With the absorption costing income statement you accounted for the costs of your beginning inventory twice. Also as we have seen above in the examples in absorption costing method all the production cost like fixed operation cost rent utility cost etc.

Also see the predetermined overhead rate to see how companies estimate the production costs of a product in advance. The following are the excerpts from the entity s income statement for the calendar year ending in december 2017. Calculator absorption and variable costing income statements during the first month of operations ended july 31 yosan inc. The absorption costing income statement is a necessary tool that helps manufacturing companies by breaking down those costs in a way that allows an in depth review of profitability.

Direct materials 816 000 direct labor 240 000 variable manufacturing. Do the calculation of absorption costing to find the order is profitable or not. Statement of profit worked example. You should have multiplied the total costs by 80 000 and then subtract that number by your ending inventory costs.