Does Ohio Tax Unemployment Income

If you received unemployment insurance this.

Does ohio tax unemployment income. Two states partially exempt a fixed dollar amount of benefits from state income tax but tax the rest following federal practice from 1982 to 1986. State taxes on unemployment benefits. State income tax range. Use form w 4v to withhold any tax from your unemployment income or pay quarterly taxes to ensure you don t owe the government any penalties come tax season.

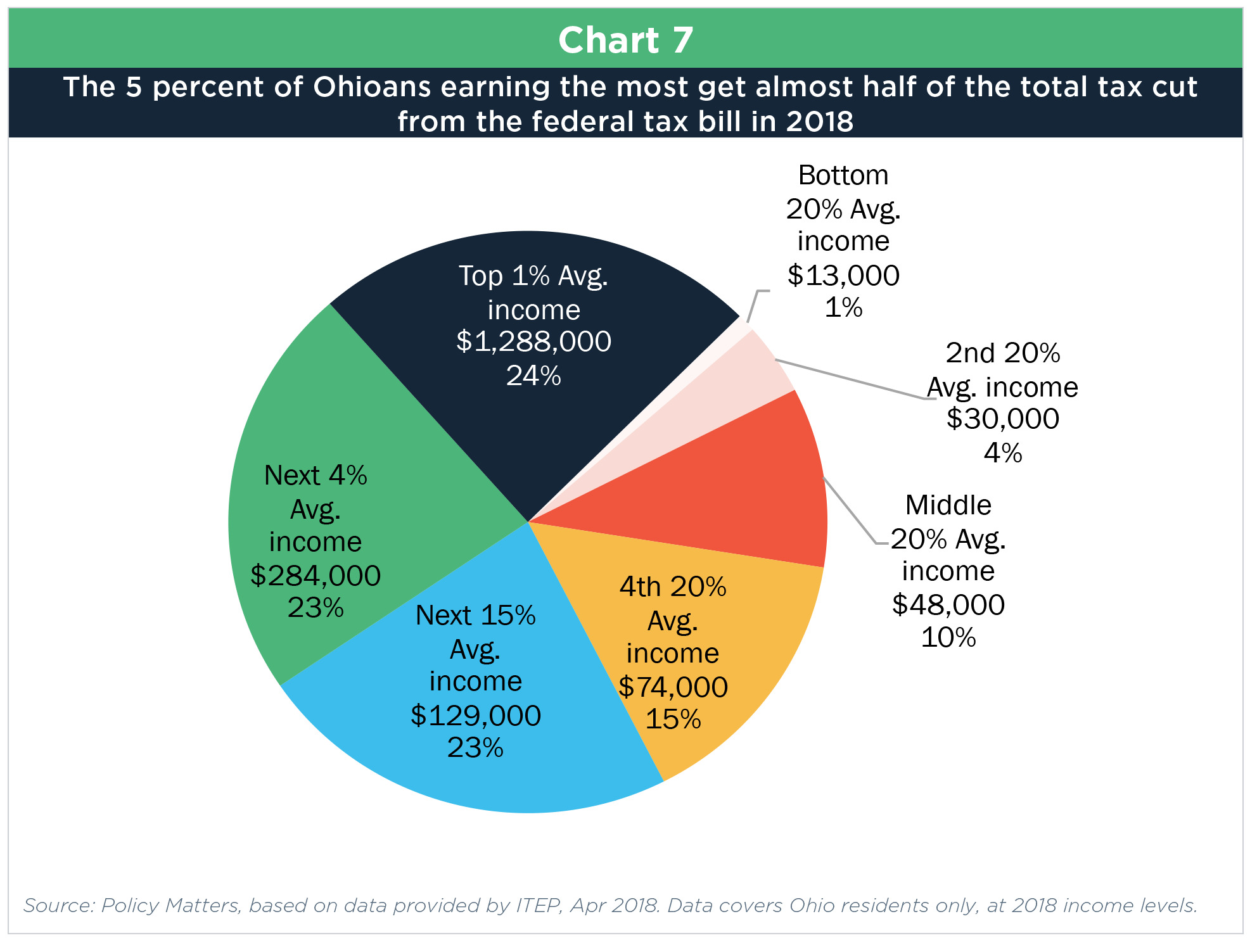

Income from boards of elections voting booth up to 1 000 00. You ll be taxed at your ordinary tax rate. Of the 41 states that tax wage income 5 states completely exempt unemployment benefits from tax california new jersey oregon pennsylvania and virginia. 2 85 on taxable income from 21 751 to 43 450.

Ultimately your unemployment income will be taxed right along with any other income you might have earned during the year. Arkansas began taxing unemployment benefits in 2018. State income tax range. Jobless workers will receive a 1099 g tax form next year to reflect the income from their unemployment checks evermore said.

When you file taxes next year for tax year 2020 you ll need to claim your unemployment checks as income. 2 on taxable income from 4 600 to 9 099. You need to pay the full amount in by on april 15 2021 to. While you don t have to pay social security or medicare taxes typically about a combined 7 65 rate while receiving unemployment benefits you do have to pay federal income taxes and state.

You are required to resume filing a form 37 if your status changes and you receive or earn taxable income. That s similar to what occurs when a taxpayer get a tax refund from. The bottom line. State taxes on unemployment benefits.

If you are retired and have no taxable income you are required to file an exemption form the first year that this applies. Ohio taxes unemployment compensation.