Other Comprehensive Income Statement Meaning

This statement requires that an enterprise a classify items of other comprehensive income by their nature in a financial statement and b display the accumulated balance of other comprehensive.

Other comprehensive income statement meaning. What is other comprehensive income. In simple words it is gain or loss that has not been realized. One of the most important financial statements is the income statement. Total comprehensive income is the combination of profit or loss and other comprehensive.

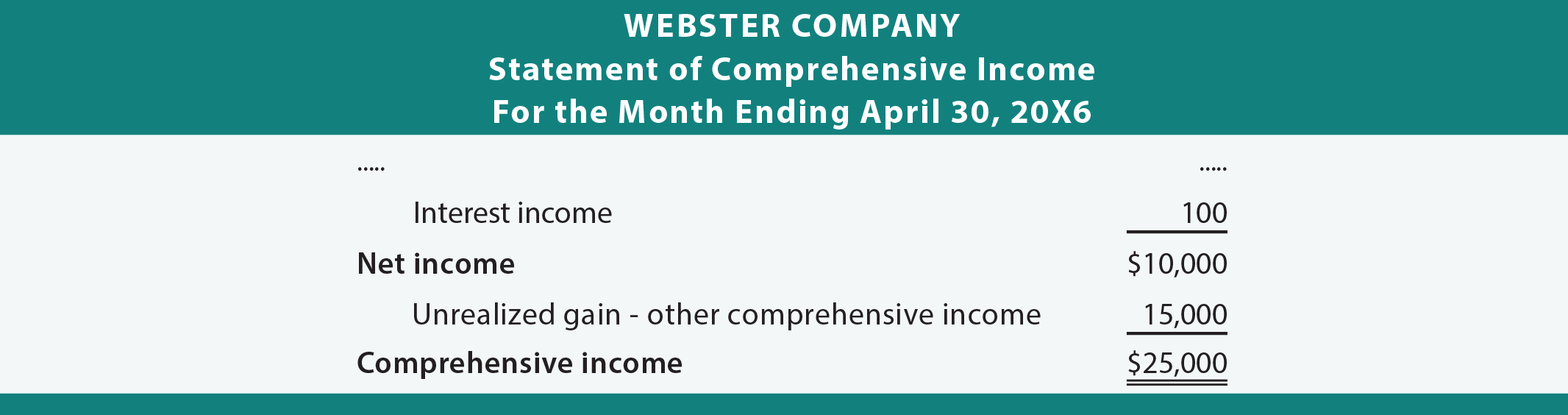

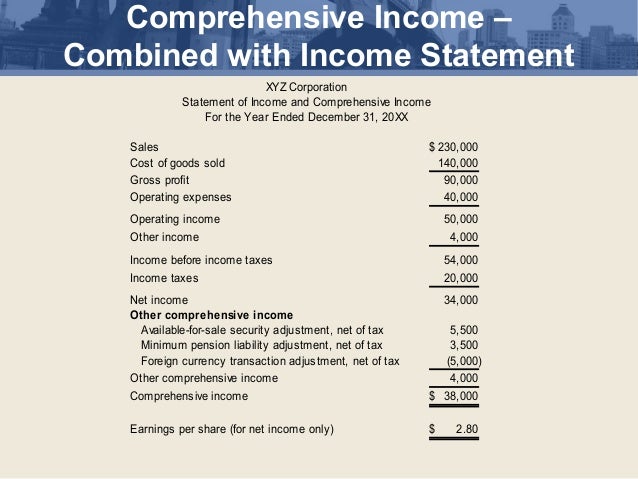

The net income is transferred down to the ci statement and adjusted for the non owner transactions we listed above to compute the total ci for the period. See examples whats included. It provides an overview of revenues and expenses including taxes and interest. Here s an example comprehensive statement attached to the bottom of our income statement example.

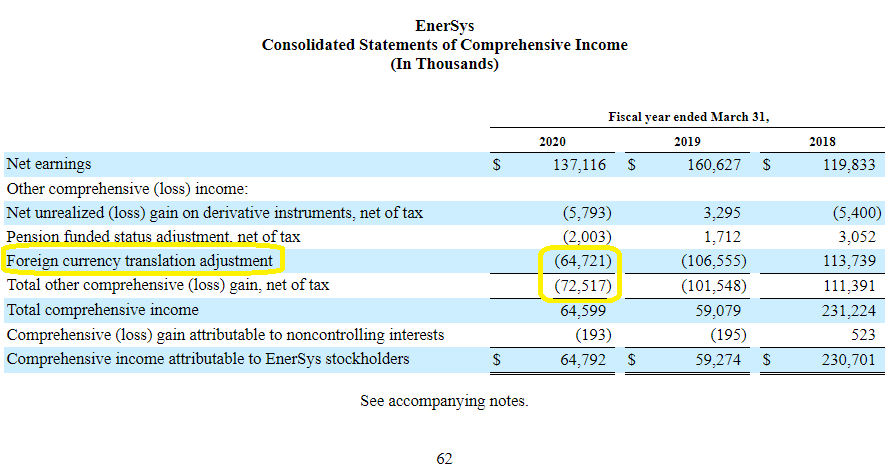

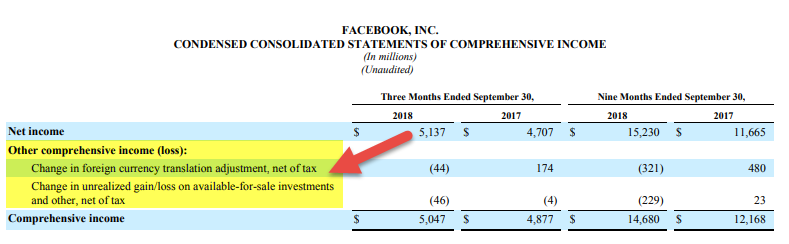

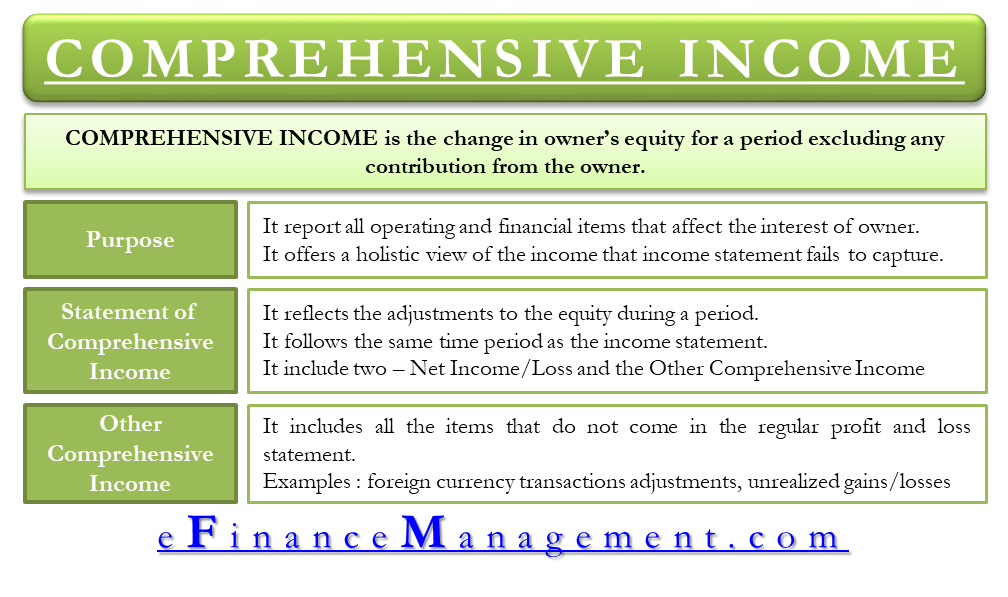

Other comprehensive income or oci consists of items that have an effect on the balance sheet amounts but the effect is not reported on the company s income statement. Comprehensive income in financial statements. Instead these changes are reported on the statement of comprehensive income along with the amount of net income from the income statement. Revenues expenses gains and losses that are reported as other comprehensive income have not been realized yet.

Other comprehensive income refers to that income expenses revenue or loss in the company which has not been realized at the time of preparation of the financial statements of the company during an accounting period and are thus excluded from the net income and shown after the net income on the income statement of the company. Other comprehensive income is designed to give the reader of a company s financial statements a more comprehensive view of the financial status of the entity though in practice it is possible that it introduces too much complexity to the income statement. Other comprehensive income comprises revenues expenses gains and losses that according to the gaap and ifrs standards are excluded from net income on the income statement.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)