Bad Debt Expense Affect Income Statement

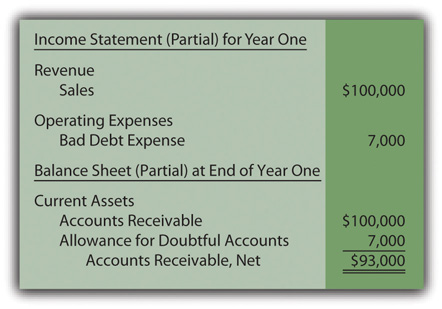

A credit loss or bad debts expense on its income statement and a reduction of accounts receivable on its balance sheet.

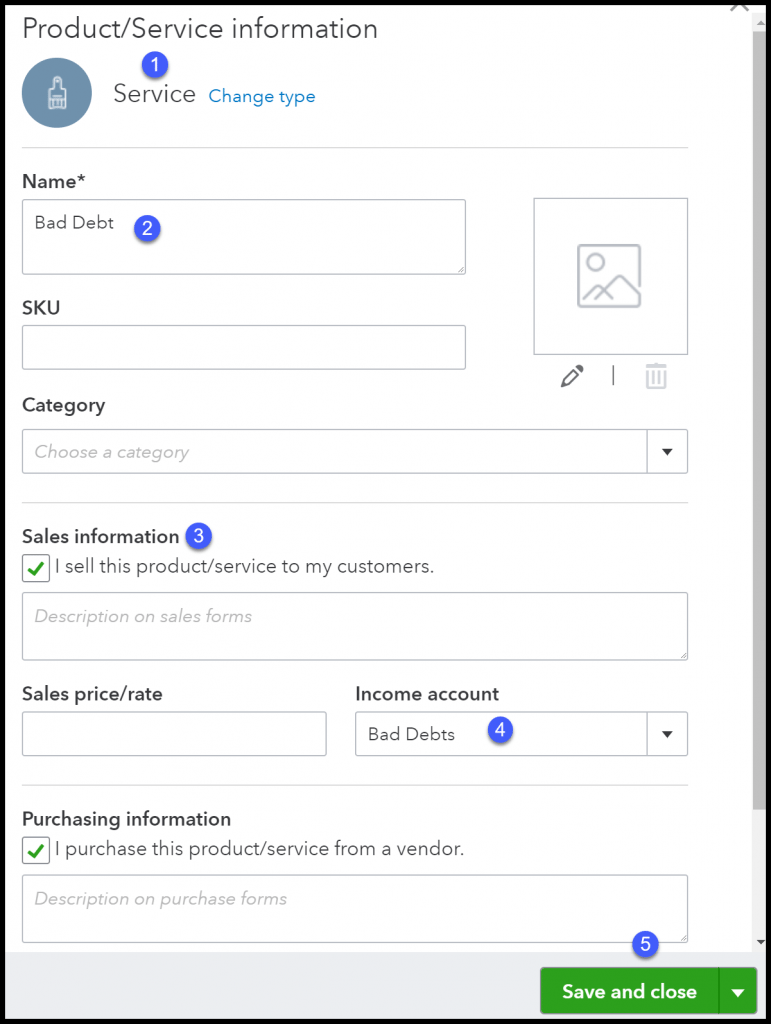

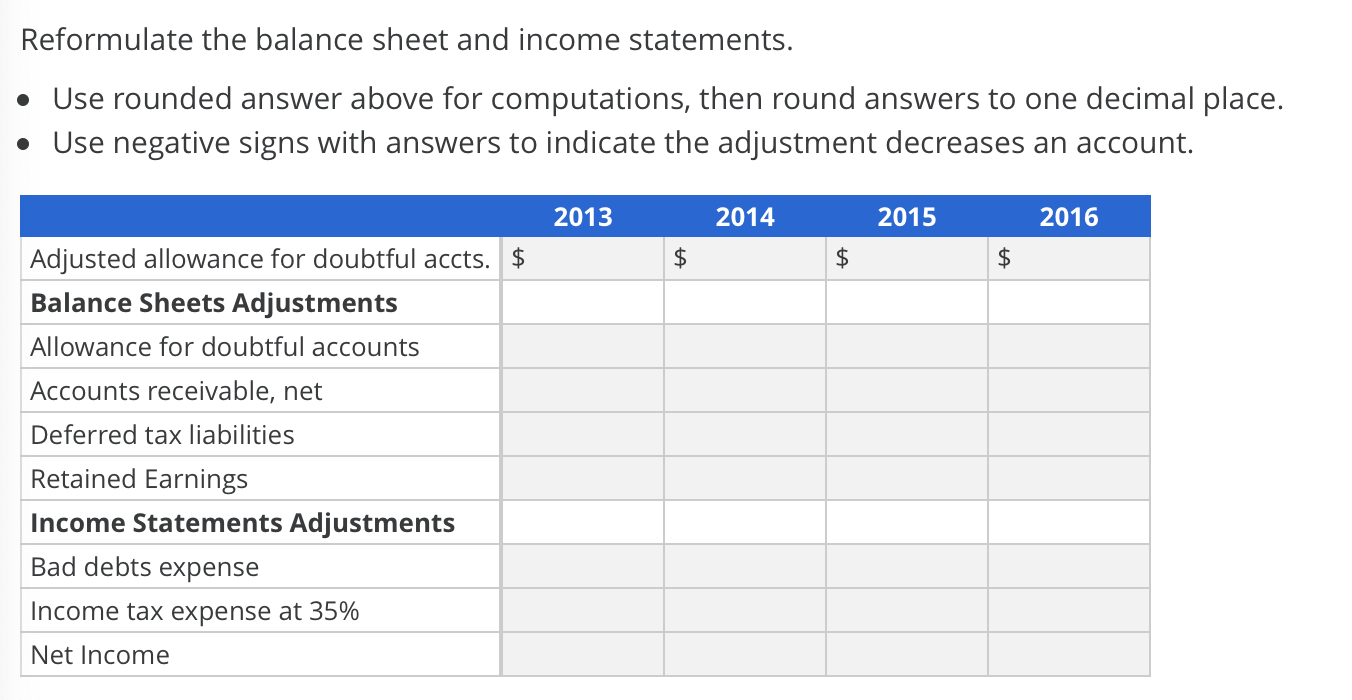

Bad debt expense affect income statement. Allowance for doubtful accounts on the balance sheet. Bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement. A percentage of the company s credit sales during the period or. With respect to financial statements the seller should report its estimated credit losses as soon as possible using the allowance method.

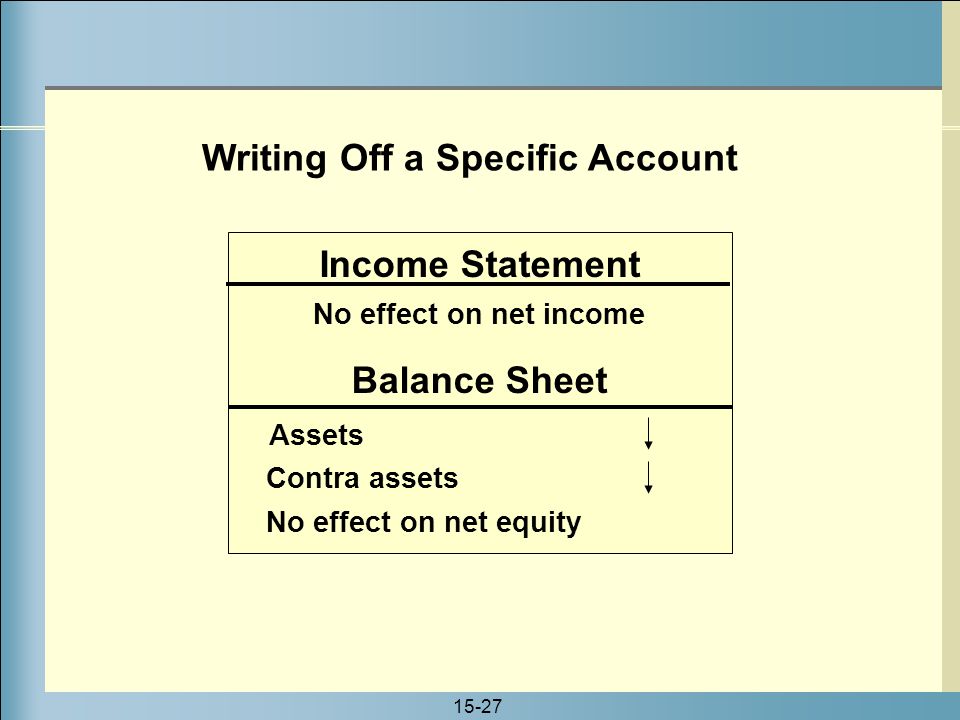

With both methods the bad debt expense needs to record in the income statement by a different time. Some companies just write off a bad debt as an expense on the income statement. A debt such as an accounts receivable is shown as an asset on the balance sheet. But my question is how does it affect the balance sheet.

The allowance for uncollectible accounts or allowance for doubtful accounts is a contra asset account that reduces the amount of accounts receivable to the amount that is more likely be collected. This method is based on an evaluation of the collectibility of accounts receivable. So if we remove an asset from the sheet won t this mean that the balance sheet no longer balances out. Dr bad debt expense 20 000 cr allowance for doubtful accounts 20 000 1 000 000ドルの2 ということで 20 000ドル分のallowance 引当金 を計上することになります 実際には貸し倒れていませんが bad debt expenseを予想で.

Accordingly they enter a bad debt expense of 3 000 on the company s monthly financial statement and add the same amount to the allowance for doubtful accounts on the balance sheet. Recognizing bad debts leads to an offsetting reduction to accounts. Bad debt expense is reported on the income statement bad debt is the expense account which will show in the operating expense of the income statement. The amount reported in the income statement account bad debts expense pertains to the estimated losses from extending credit during the period shown in the heading of the income statement.

The estimated amount of bad debts expense could be based on. You would also charge 2 000 to bad debt expense which appears on your income statement.

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)