Income Statement Shows The Cost Of Goods Sold

Sales revenue minus cost of goods sold is a business s gross profit.

Income statement shows the cost of goods sold. Some service companies may record the cost of goods sold as related to their services. Cost of sales this is the direct cost of the. We add cost of goods manufactured to beginning finished goods inventory to derive cost of goods available for sale. This preview shows page 6 11 out of 11 pages.

The pro forma free cash flow is 308 400. The cost of goods manufactured appears in the cost of goods sold section of the income statement. Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits. Gross profit in turn is a measure of how efficient a company is at managing its operations.

Twitty s books would then notate this amount on its 2018 income statement. 330 000 950 000 440 000 840 000 cost of goods sold. What is your proforma free cash flow. Cost of goods sold in a service business.

What are your proforma earnings. In the table above this is 100 000. The pro forma income statement shows sales of 966 000 cost of goods sold as 522 000 depreciation expense of 105 000 and taxes of 135 600. Cost of goods sold cogs is the cost of a product to a distributor manufacturer or retailer.

The cost of goods manufactured is in the same place that purchases would be presented on a merchandiser s income statement. These costs are treated as expenses of the accounting period in which they are incurred because they are expected not to benefit future periods. The pro forma earnings are 203 400. Cost of goods sold is deducted from revenue to determine a company s gross profit.

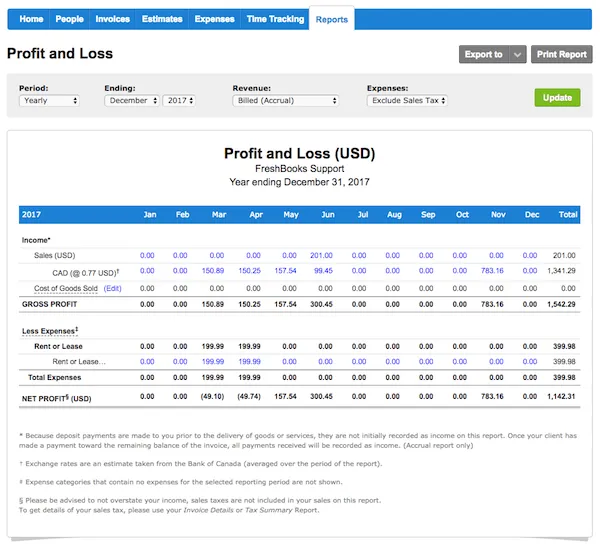

Cost of goods sold is considered an expense in accounting and it can be found on a financial report called an income statement. Sales this is the total value of the goods sold to customers. The main contents of the income statement are. A cost of goods sold statement compiles the cost of goods sold for an accounting period in greater detail than is found on a typical income statement the cost of goods sold statement is not considered to be one of the main elements of the financial statements and so is rarely found in practice if presented at all it appears in the disclosures that accompany the financial statements.

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)