An Income Statement Under Absorption Costing Includes All Of The Following

Absorption costing also called full costing includes anything that is a direct cost in producing a good in its cost base.

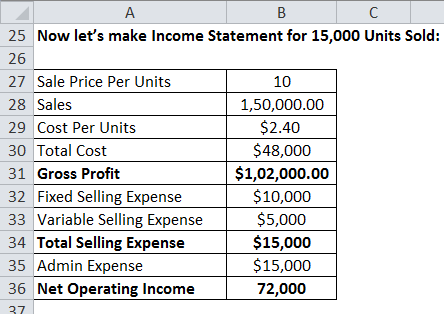

An income statement under absorption costing includes all of the following. An income statement under absorption costing includes all of the following you may select more than one answer. This includes the direct costs the company incurred to manufacture the product such as manufacturing supplies and necessary fixed costs such as salaries and utility overhead costs the direct or variable costing method does not consider both and variable costs and expenses are. Direct materials direct labor variable overhead. Under the absorption method of costing aka full costing the following costs go into the product.

Absorption costing also includes fixed overhead charges as part of the. Direct materials direct labor. The company produced 1 000 units and sold 1 000 units at a selling. Absorption costing is the costing method used for financial accounting and tax purposes because it reflects a more comprehensive net income on income statement and a more complete cost of inventories on balance sheet by shifting costs between different periods in accordance with the matching concept.

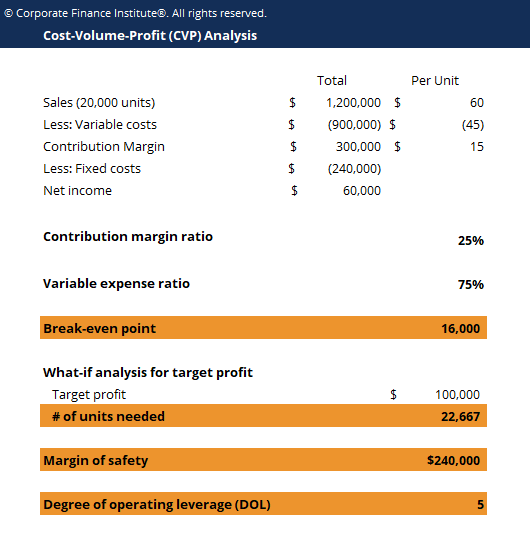

Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing. Absorption costing also called full costing is what you are used to under generally accepted accounting principles. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost. Absorption costing includes all.

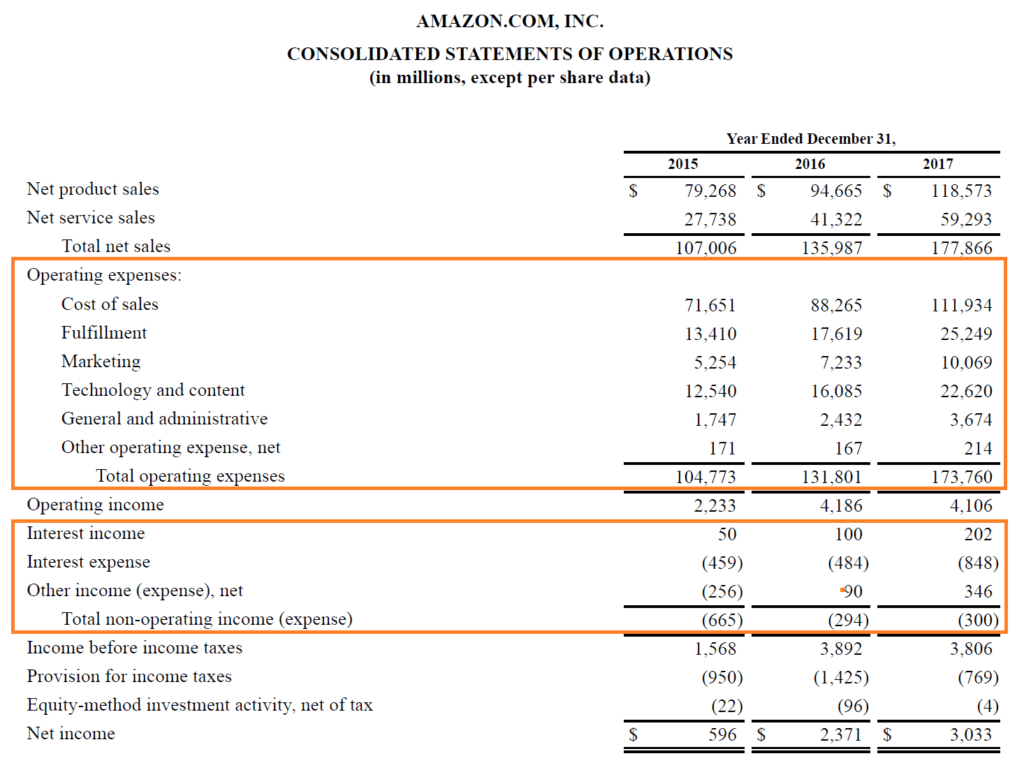

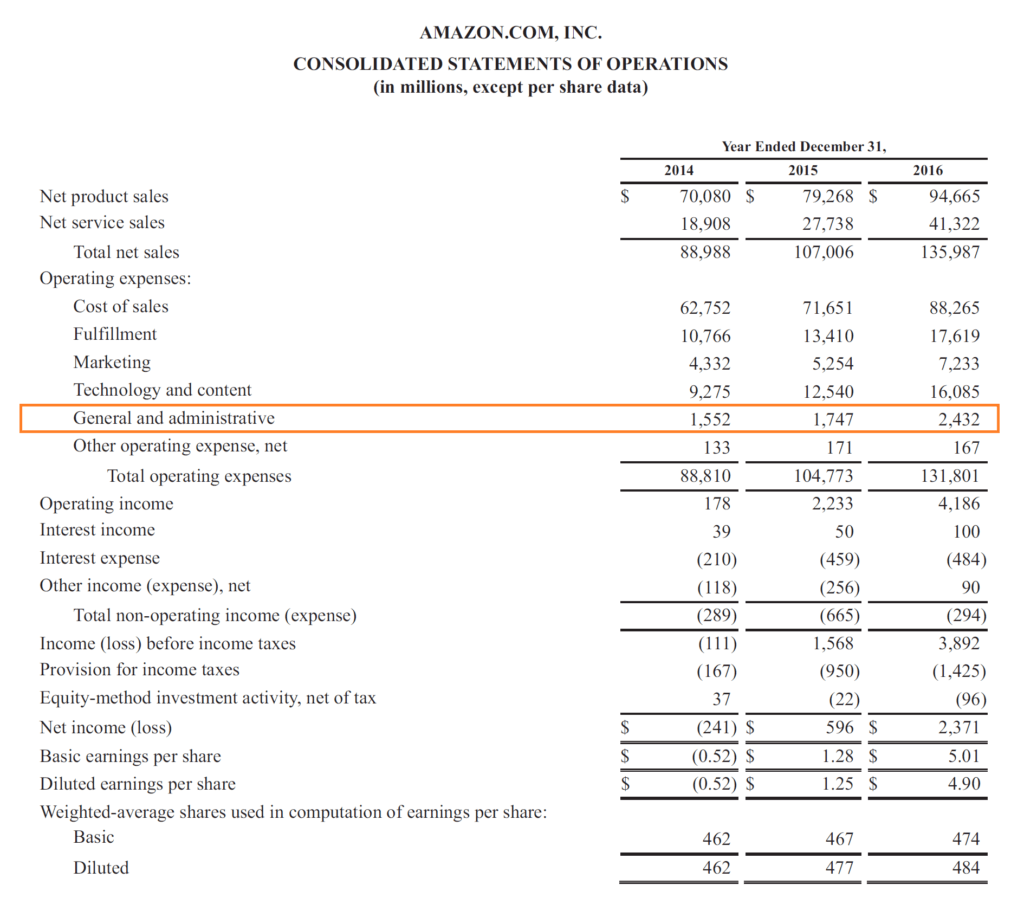

D fixed selling expenses. A fixed factory overhead. The traditional income statement also called absorption costing income statement uses absorption costing to create the income statement. In absorption costing fixed manufacturing overhead is allocated to the finished product and becomes part of the cost of inventory.

This income statement looks at costs by dividing costs into product and period costs in order to complete this statement correctly make sure you understand product and period costs. Under absorption costing companies treat all manufacturing costs including both fixed and variable manufacturing costs as product costs. An income statement under absorption costing includes all of the following. Components of absorption costing.

Absorption costing is also referred to as full costing. Freshmart inc began operations this year.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-02-6e3072bd99d74ee4a0492e799e21560b.jpg)

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)