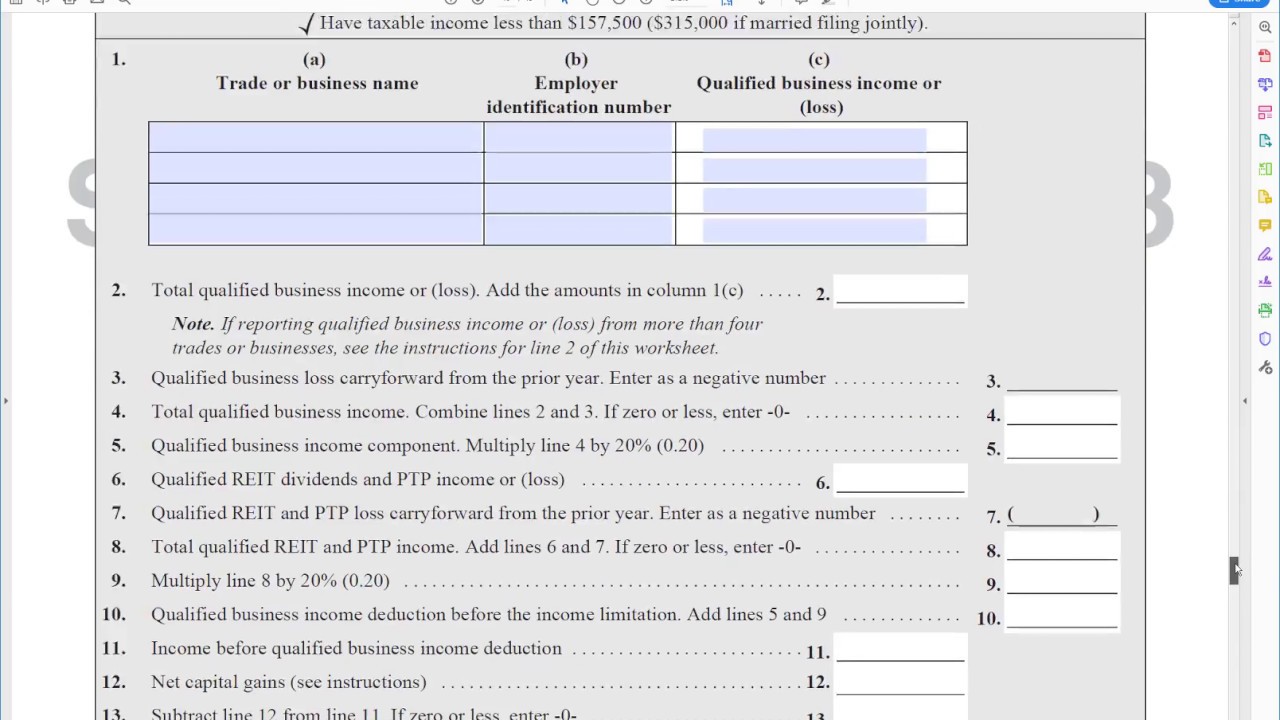

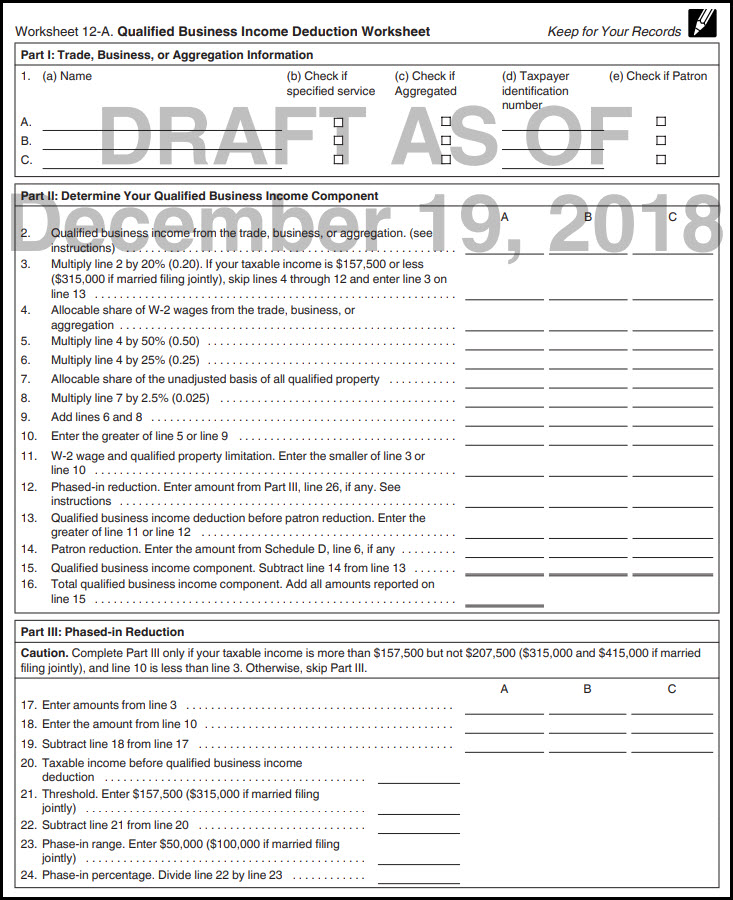

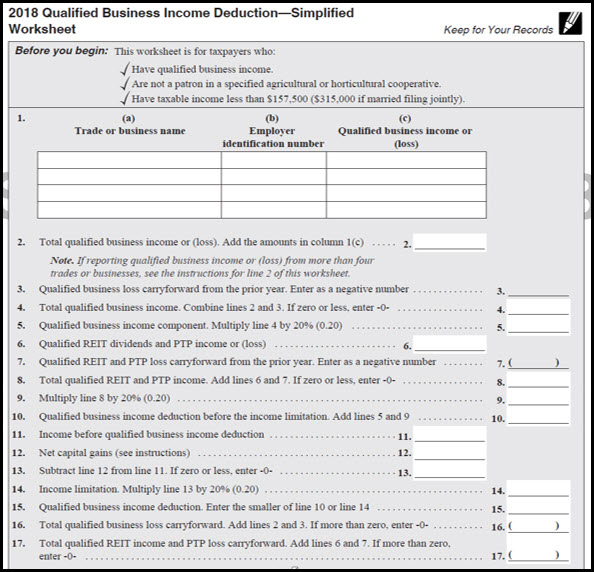

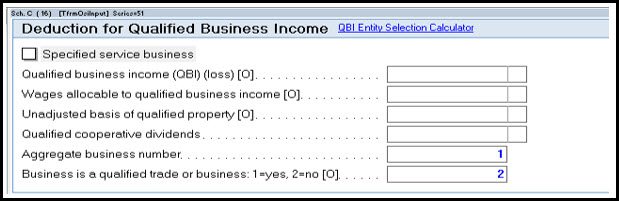

Qualified Business Income Deduction Worksheet 2019

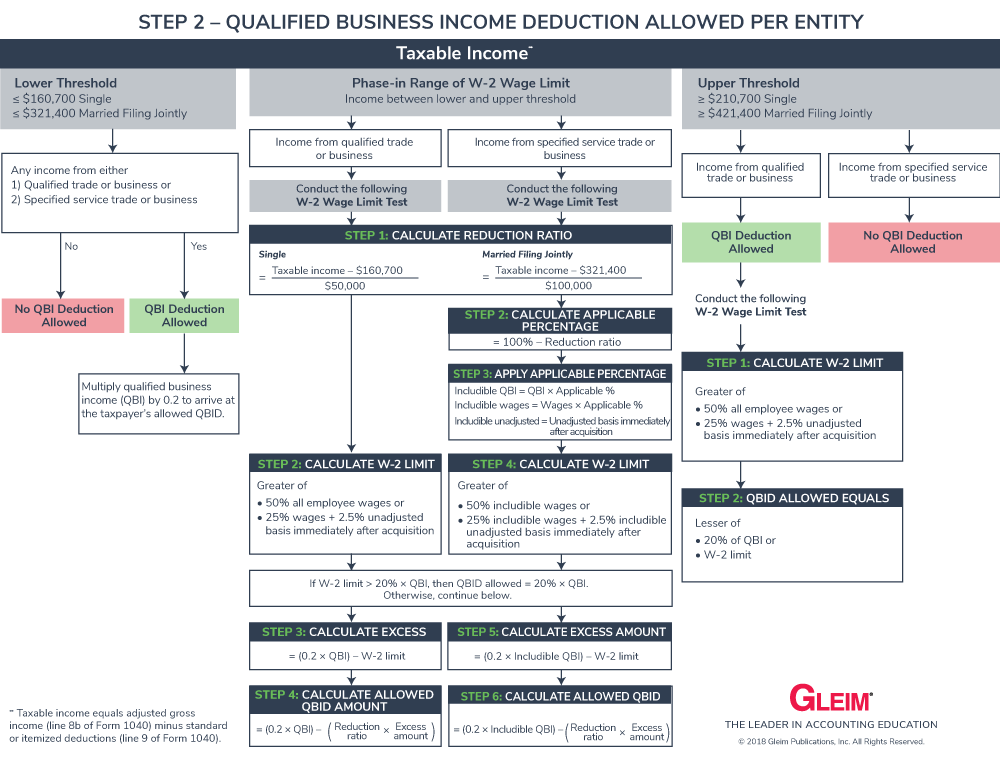

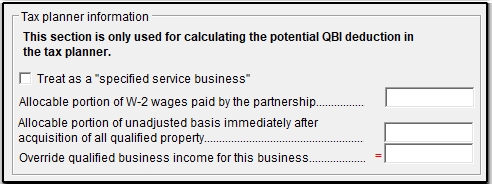

2019 11 this revenue procedure provides methods for calculating w 2 wages as defined in section 199a b 4 and 1 199a 2 of the income tax regulations 1 for purposes of section 199a b 2 of the internal revenue code code which for certain taxpayers provides a limitation based on w 2 wages to the amount of the deduction for qualified business income qbi.

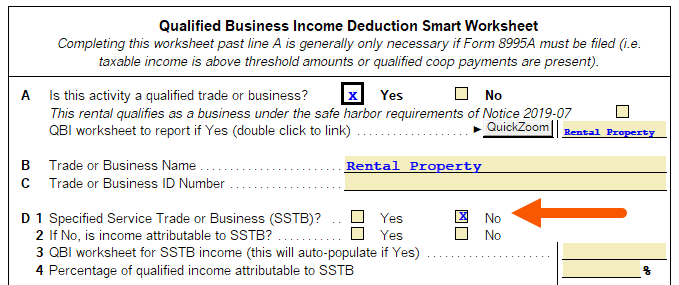

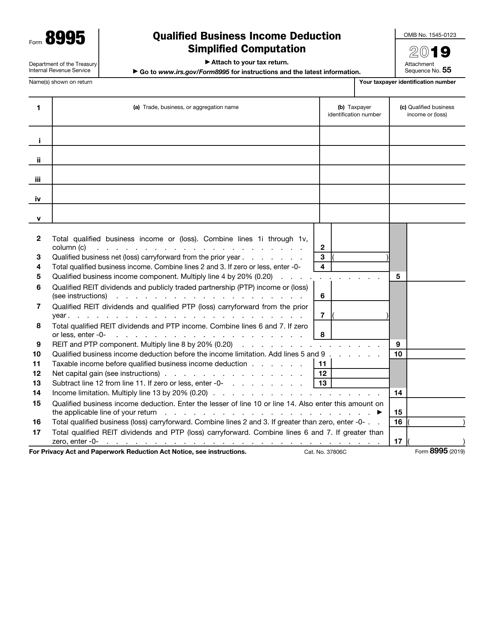

Qualified business income deduction worksheet 2019. 2019 form 8995 author. Qualified business income deduction simplified computation keywords. Some trusts and estates may also claim the deduction directly. Fs 2019 8 april 2019 many individuals including owners of businesses operated through sole proprietorships partnerships s corporations trusts and estates may be eligible for a qualified business income deduction also called the section 199a deduction.

12 30 2019 10 04 19 am. Many owners of sole proprietorships partnerships s corporations and some trusts and estates may be eligible for a qualified business income qbi deduction also called section 199a for tax years beginning after december 31 2017. Or itemized deductions line 8 of form 1040. The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income qbi plus 20 percent of qualified real estate. This worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider including the application of the qualified business income qbi deduction. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net qbi from a trade or business including income from a pass through entity but not from a c corporation plus 20 of qualified real estate investment trust reit dividends and qualified publicly. For tax years beginning after 2017 individual tax payers and some trusts and estates may be en titled to a deduction of up to 20 of their quali fied business income qbi from a qualified trade or business including income from a pass through entity but not from a c corpora.

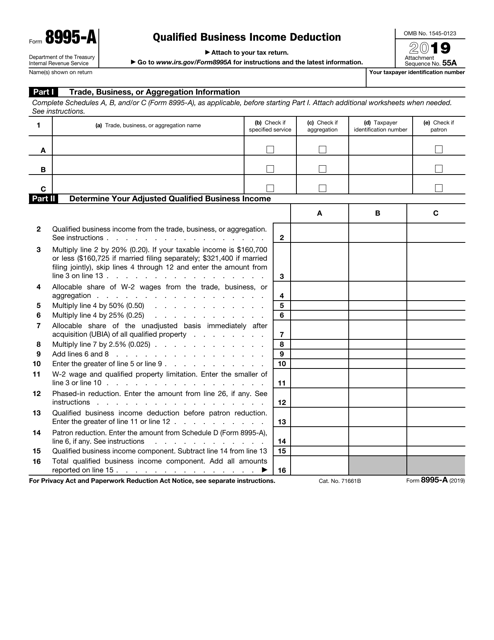

Qualified business income deduction. Qualified business income deduction simplified computation. No qbi deduction allowed. Draft 2019 form 8995 a qualified business income deduction irs has released two draft forms which are to be used to compute the qualified business income deduction under code sec.

And 2 for. Use form 8995 to figure your qualified business income qbi deduction.