Income Tax Definition In English

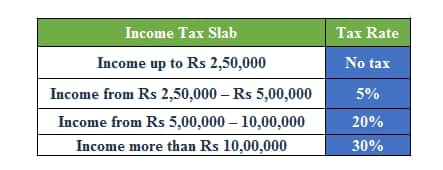

Income tax generally is computed as the product of a tax rate times taxable income.

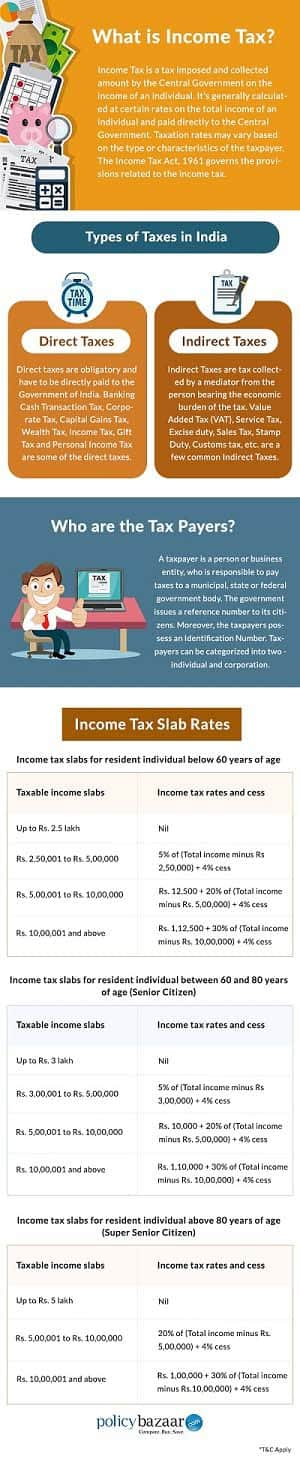

Income tax definition in english. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Income tax is usually paid on a progressive scale see progressive tax. Taxation rates may vary by type or characteristics of the taxpayer. A declaration of personal income made annually to the tax authorities and used as a basis for assessing an individual s liability for taxation.

Income tax in american english. An amount of money paid to the government that is based on your income or the cost of goods or services you have bought. An annual government tax on personal incomes. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and other sources determined in accordance with the internal revenue code or state law.

ˈɪnkʌm tæks ˈɪnkəm tæks. Modified entries 2019 by penguin random house llc and harpercollins publishers ltd. Income tax is used to fund public services pay government. A tax that you have to pay on your income usually higher for people with larger incomes 2.

The standard rate of income tax was cut to 23p in the pound. Taxes have been called the building block of civilization. A tax levied on incomes esp. ˈɪnkʌm tæks ˈɪnkəm tæks.

An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income. Copyright harpercollins publishers. They re increasing the tax on cigarettes. What do you earn before after tax before after you have paid tax on the money you earn.

Most material 2005 1997 1991 by penguin random house llc. Tax cuts reductions in taxes are always popular.