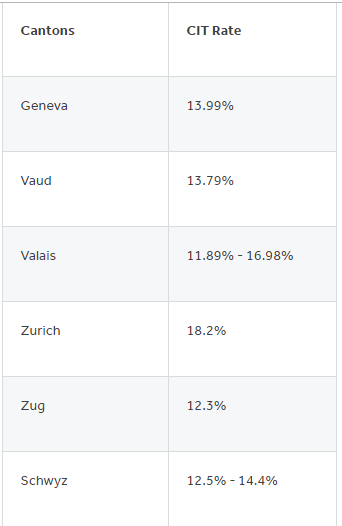

Income Tax Rates Switzerland By Canton

Income tax rates for tax year 2019 including federal canto nal and communal income taxes on net profit before taxes.

Income tax rates switzerland by canton. Corporate income tax rates chf capital of canton 100 000 lowest communal rate 100 000 where zug 11 35 11 34. Capital tax tax on capital is 0 5. The higher the income the higher the applicable tax rate. Due to the federalist tax system in switzerland the taxation of income and assets varies not only by canton but also by individual muncipality.

In most cantons the rate is proportional with a maximum rate of 6 5 in bern whereas in zurich it was 13 and in geneva 17 58 76 depending upon taxes as single or jointly. Income taxes are levied at three different levels. This means that the tax laws and tax rates vary widely from canton to canton. Capital intensive holding companies enjoy the lowest tax on capital in switzerland with a fixed rate.

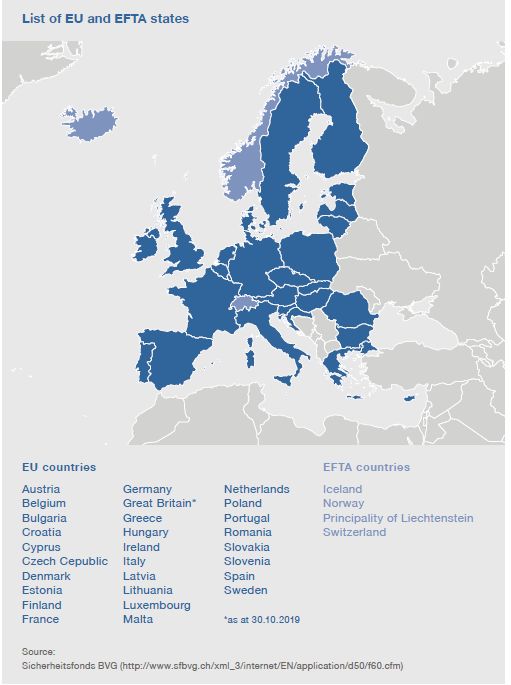

They are subject to a withholding tax levied on wages and salaries in the event that employment costs are recharged or borne by the swiss entity or if the conditions to establish a swiss economic employer are met depending on canton. Comparison of taxes in switzerland. Foreign employees residing in switzerland whose gross salary does not exceed chf 120 000 per year chf 500 000 in the republic and canton of geneva but who have additional sources of income or additional assets e g income from securities real estate property are also obliged to file a tax return. Non residents are subject to swiss federal and cantonal income taxes with respect to certain swiss sourced income only.

Corporate income tax the actual tax on company earnings at a federal cantonal and muni cipal level in the canton lucerne is between 11 3 meggen and 13 2 hasle and 12 3 in the city of lucerne. The income tax rates for individuals in switzerland are progressive. They have the power to charge any tax that the confederation does not claim exclusive rights over. The above tax rates are basically applicable to taxpayers filing a tax return.

With the tax comparison from comparis ch you can find out how much you could save on taxes in another muncipality within the same canton. Effective cantonal income and wealth tax is determined by multiplying the basic tax by the multiplier applicable for the tax calendar year in question and then by adding the supplementary tax on wealth. At the federal level which is the same all over switzerland at the cantonal level which is the same within a certain canton and is based on the canton s own tax law and tax rates and at the municipal level municipalities follow the cantonal tax law but are entitled to set their own. Tax rates may vary in different communities within the same canton and are subject to changes in future tax years.