Income Tax Rates In Canada Vs Us

For individuals whose adjusted gross incomes range between 34 000 and 81 940 taxes are higher in the united states.

Income tax rates in canada vs us. In the u s the lowest tax bracket for the tax year ending 2019. To find the quebec provincial tax rates go to income tax return schedules and guide revenu québec web site. You will find the provincial or territorial tax rates on form 428 for the respective province or territory all except quebec. Depending on where in that range your income falls your taxes could be 3 to 10 percent higher in the u s.

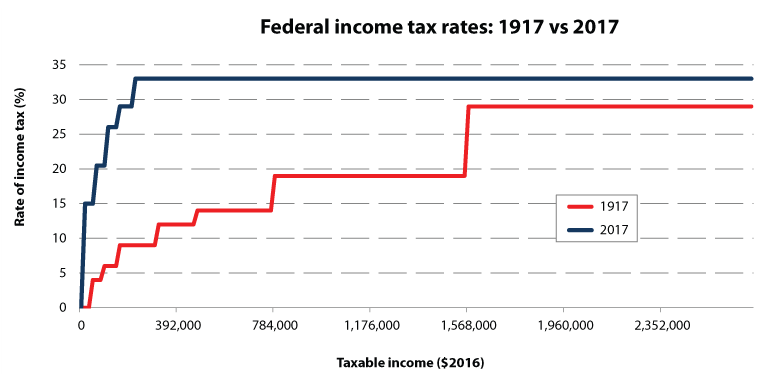

In canada the range is 15 to 33. Results are the same at an income of ca 150 000 and canada s marginal tax rates are also uncompetitive at incomes of ca 75 000 and ca 50 000. Are 2 percent higher than in canada for individuals whose adjusted gross income falls between 82 400 and 127 021. Federal income tax brackets range from 10 to 37 for individuals.

Taxes in the u s.