Deferred Tax Asset Income Statement Presentation

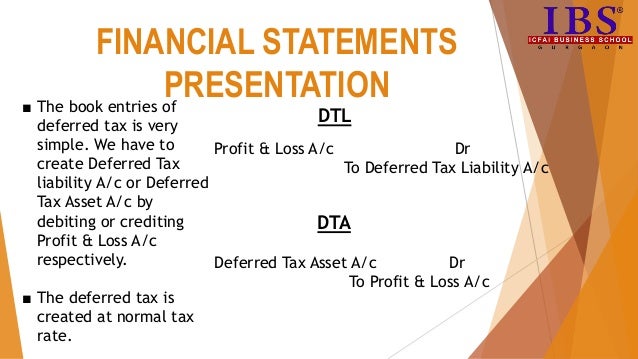

Similarly deferred tax is a non cash item and shall be treated accordingly in the operating activities section of the cash flow statement.

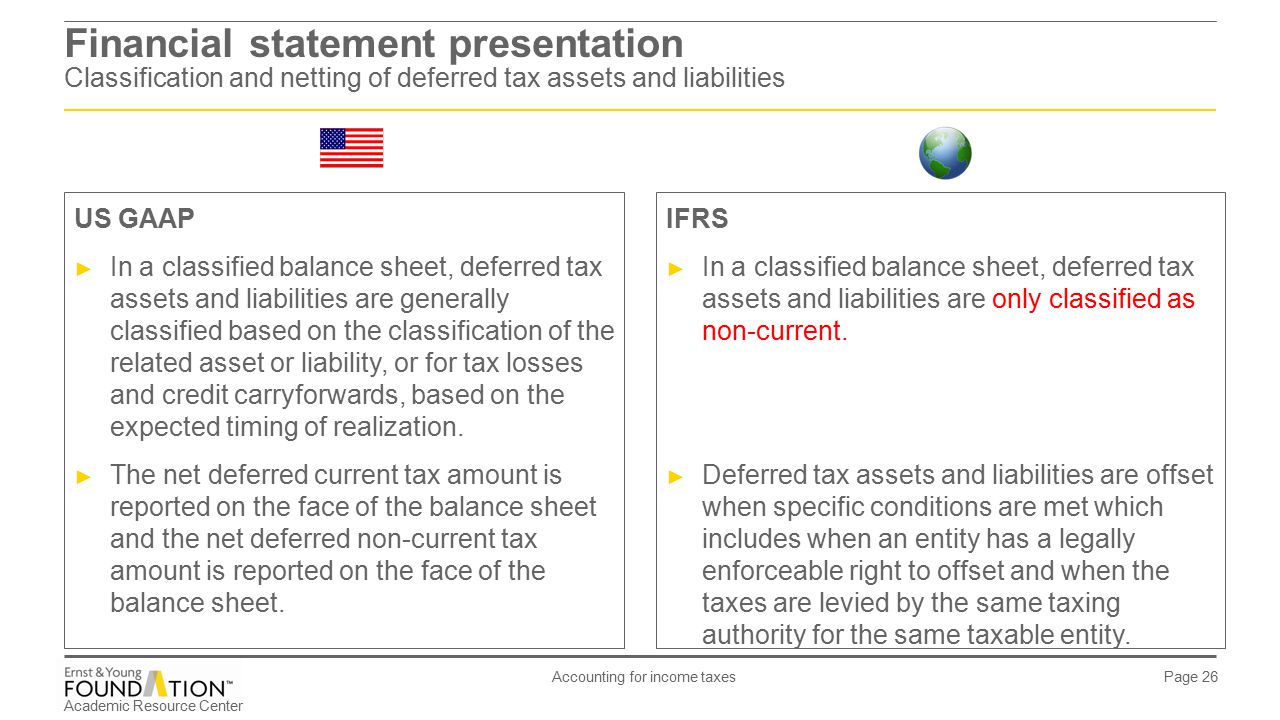

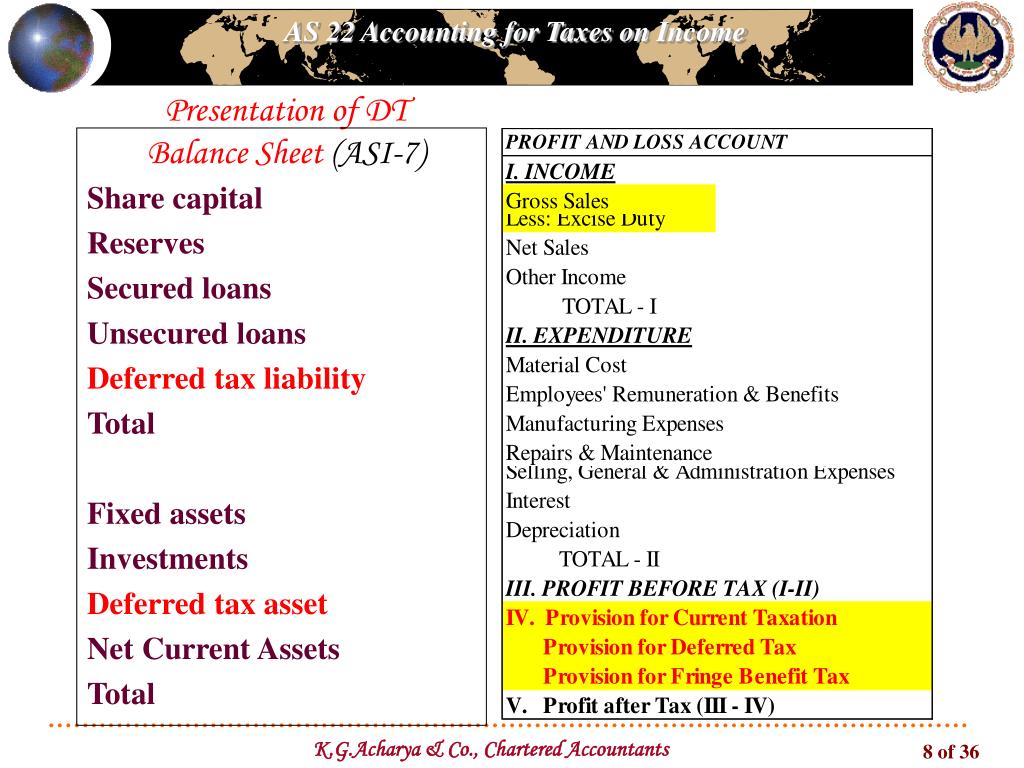

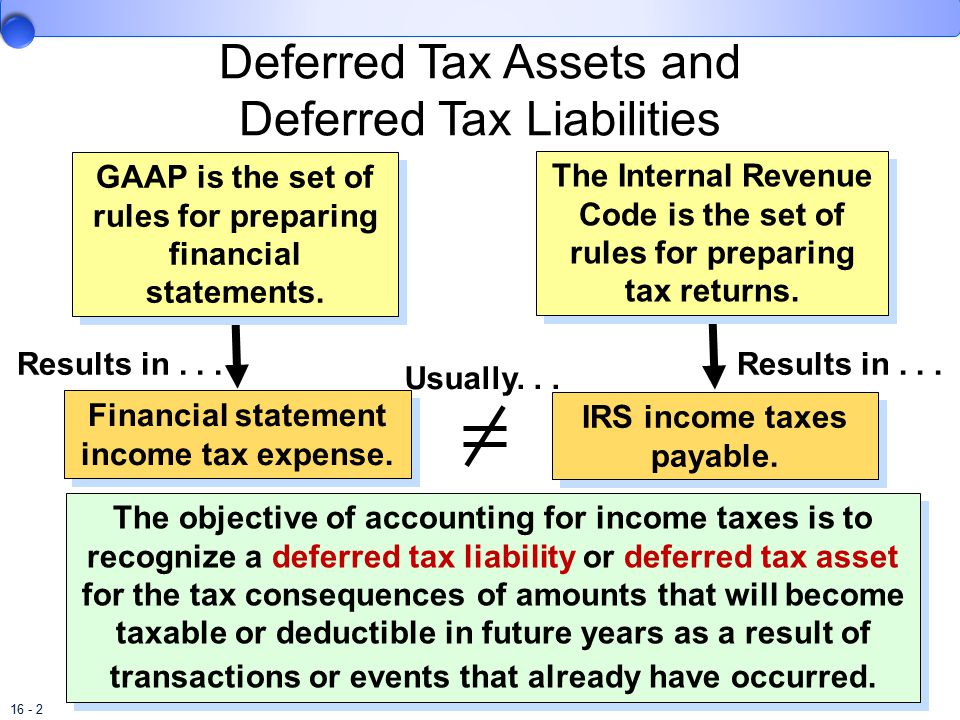

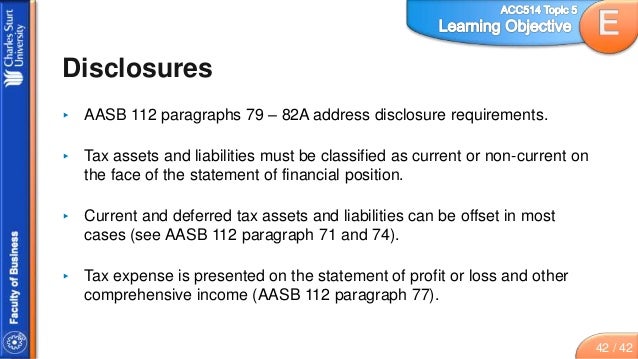

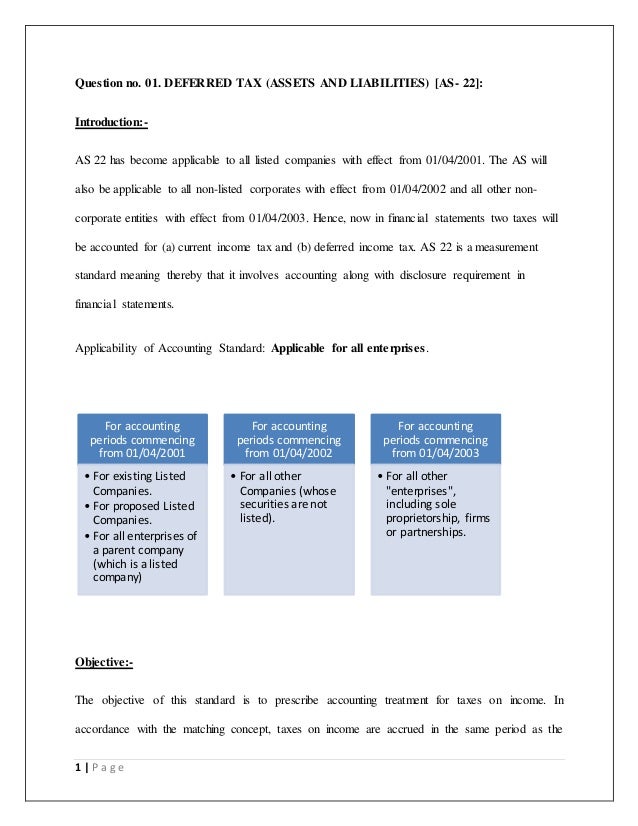

Deferred tax asset income statement presentation. The new standard will align the presentation of deferred income tax and liabilities with ifrs which requires deferred tax assets and liabilities to be classified as noncurrent in a classified statement of financial position. Deferred tax assets arise when the tax amount has been paid or has been carried forward but has still not been recognized in the income statement. Deferred tax assets may be presented as current assets if a temporary difference between accounting income and taxable income is reconciled the following year. Microsoft deferred income tax statement.

If the tax rate for the company is 30 the difference of 18 60 x 30 between the taxes payable in the income statement and the actual taxes paid to the tax authorities is a deferred tax asset. Deferred tax asset deferred tax can arise as a result of timing difference or temporary differences in accounting. The standard applies to all organizations that present a classified balance sheet. The larger income tax payable on tax returns creates a deferred tax asset which companies can use to pay for deferred income tax expense in the future.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)