How Does Cost Of Goods Sold Affect The Income Statement

Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits.

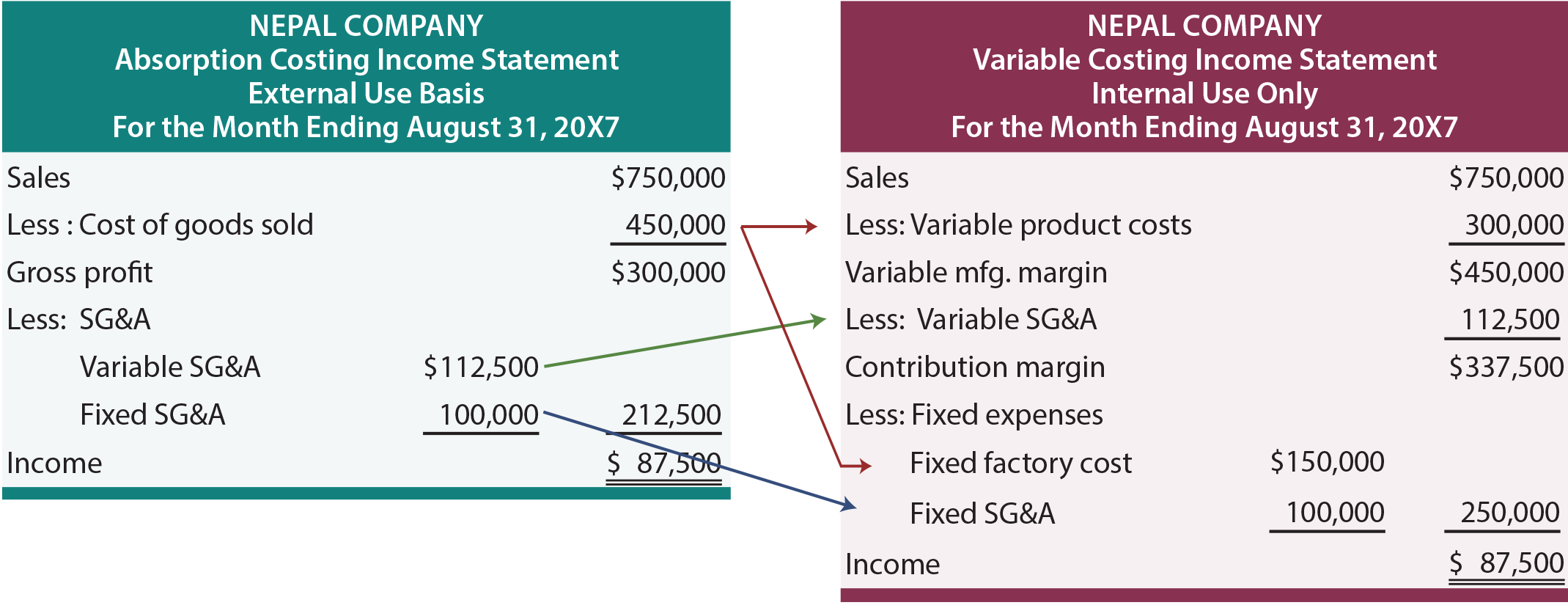

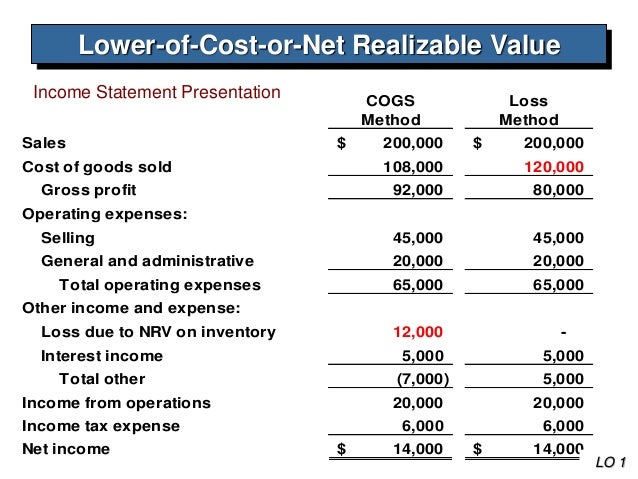

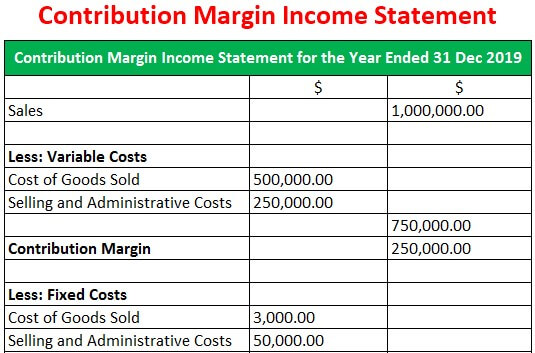

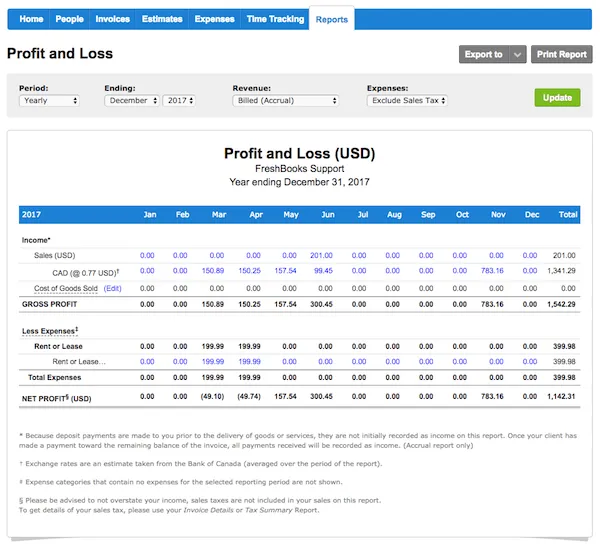

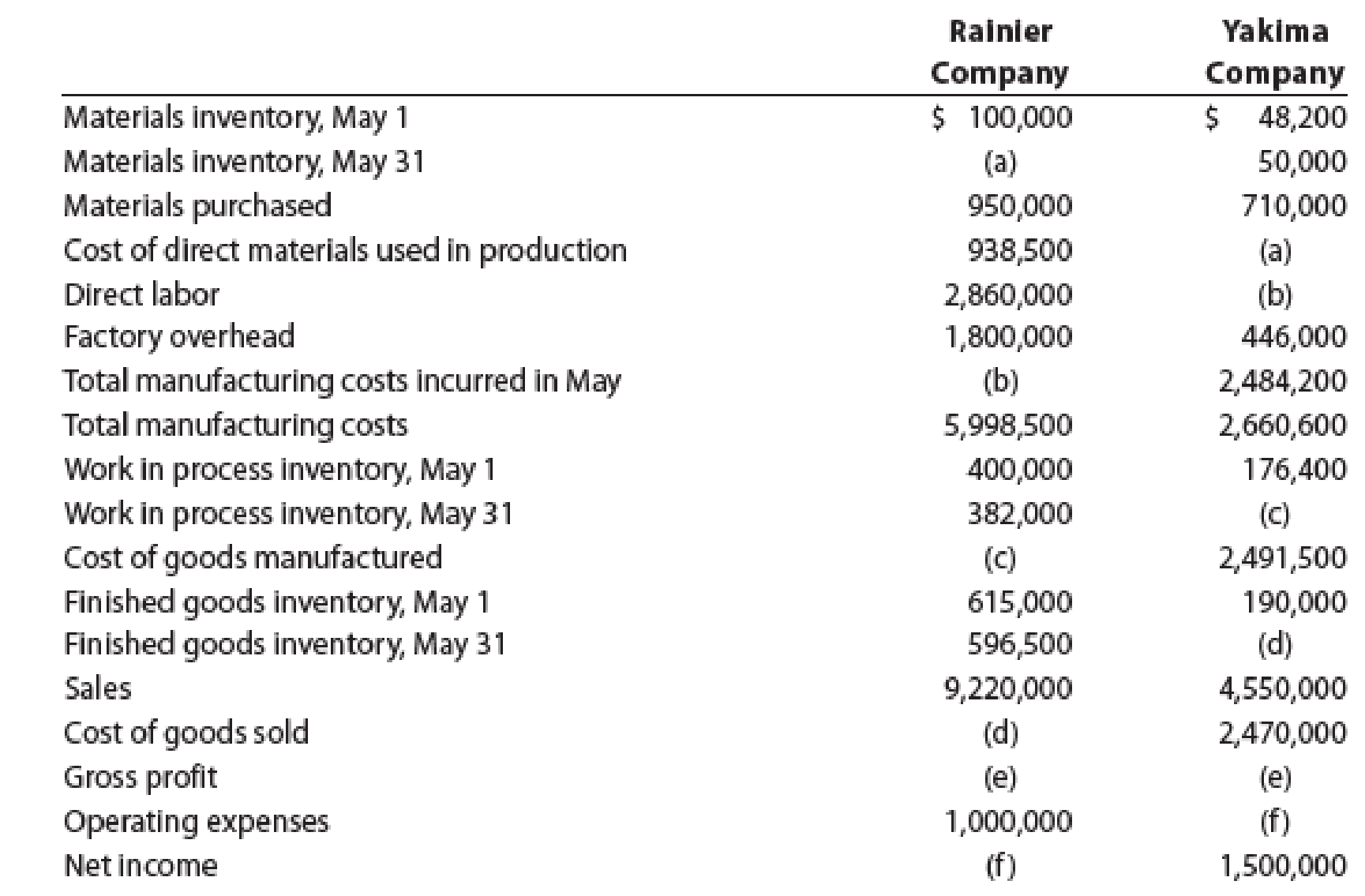

How does cost of goods sold affect the income statement. Gross profit and cost of goods sold are affected by anything that makes it more expensive for you to produce or purchase the items that you sell. Cost of goods cogs sold is one of the key elements that influences the gross profit of an organization. An increase in cost of goods sold may come from cumbersome production systems raised prices from wholesalers or inadequate equipment. Cost of goods sold is deducted from revenue to determine a company s gross profit.

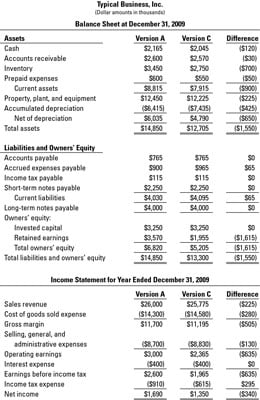

On the income statement the cost of inventory sold is recorded as cost of goods sold. Inventory is a current asset appearing in the balance sheet under the head current asset as well as a major item of the income statement. Gross profit in turn is a measure of how efficient a company is at managing its operations. Cogs figure is reported on the face of a firm s income statement cogs figures are presented under the head expenses as the costs related.

The cost of goods sold is the direct charge cost or expense associated with the manufacturing of merchandise and services that are retailed to buyers. Operating expenses and cost of goods sold are both expenditures used in running a business but are broken out differently on the income statement. R d is the money a company spends to research and develop new products each year. The cost of goods sold for a particular service or product refers to the direct costs that are associated with its production which includes labor necessary to produce the product and materials for the product.

Inventories are goods held for sale in the ordinary course of business that can help the management of the company to control and improve the business profitability and operate efficiently. Since the cost of goods sold figure affects the company s net income it also affects the balance of retained earnings on the statement of retained earnings. On the balance sheet incorrect inventory amounts affect both the reported ending inventory and.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)