A Multi Step Income Statement Shows Sales Cost Of Goods Sold And Gross Margin

Bb critical thinking aicpa.

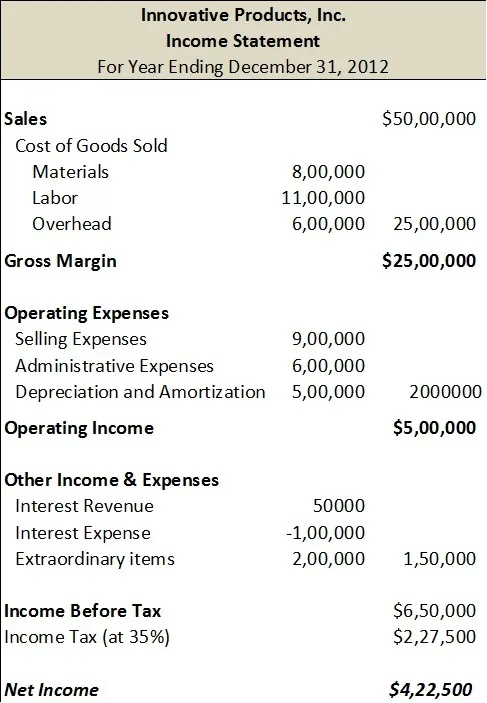

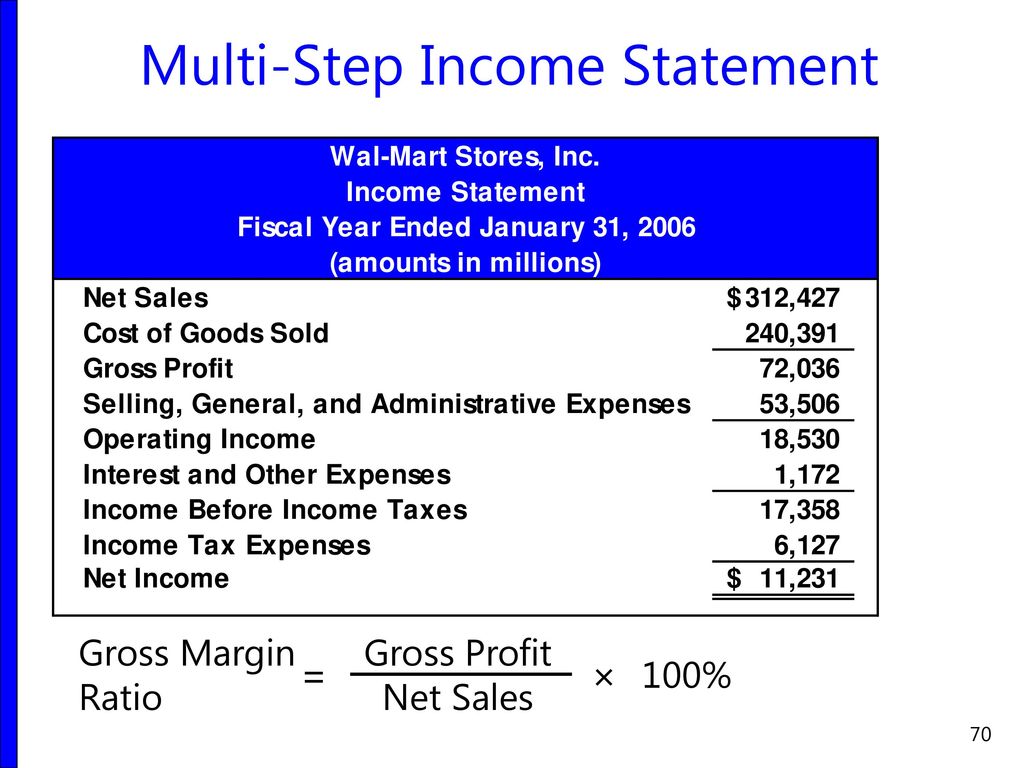

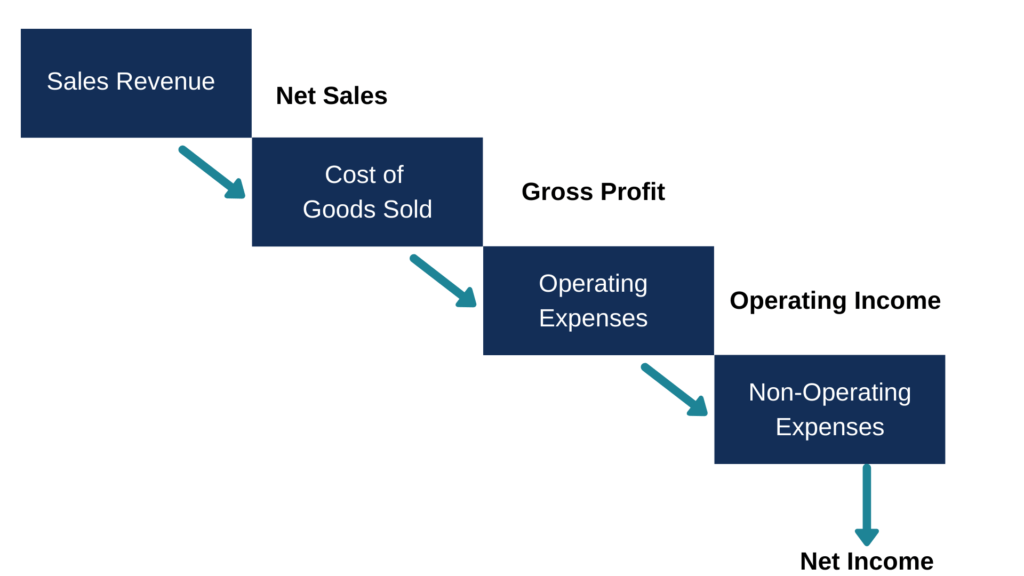

A multi step income statement shows sales cost of goods sold and gross margin. The multi step income statement uses three different accounting formulas to arrive at the net income. Operating income gross profit operating expenses. Cost of goods sold is an expense charged against sales to work out a gross profit see definition below. Multistep income statements show gross margin but single step income statements do not.

Cost of goods sold includes the expenses of buying and preparing an item for sale. Cost of goods sold is commonly abbreviated as c o g s. Although a company s bottom. Cost of goods sold is.

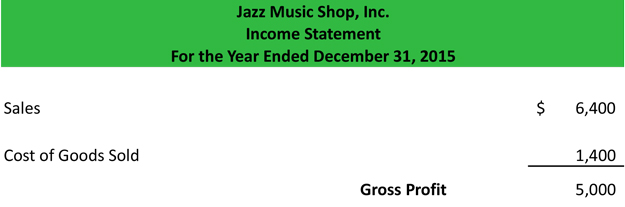

The format of the multi step income statement contains gross profit as the first section. Gross profit net sales cost of goods sold. Operating expenses are subtracted from gross profit. A multistep income statement shows sales cost of goods sold and gross margin.

Using the above multiple step income statement as an example we see that there are three steps needed to arrive at the bottom line net income. Cost of goods sold is subtracted from net sales. It includes material cost direct labor cost and direct factory overheads and is. Multistep income statements aacsb.

Income statement accounts multi step format net sales sales or revenue. This is particularly important because it gives investors creditors and management the ability to analyze the financial statement sales and purchasing efficiency. Understand level of difficulty. The multiple step income statement also shows the gross profit net sales minus the cost of goods sold.

The operating section clearly lists the operating income of the company. Cost of goods sold is also called cost of sales. Cost of goods sold is an expense reported on the income statement. The cost of goods sold is separated from the operating expenses and listed in the gross margin section.

The calculation of the first section shows the gross profit of business by deducting the cost of goods sold cogs from the total sales. Cost of goods sold is used to figure gross profit. It is an important figure for the creditors investors and internal management as it depicts how profitable a company. And is also known as cost of sales.

Cost of goods sold or cost of sales cost of goods sold refers to the cost of all the goods that we sold this year. These terms refer to the value of a company s sales of goods and services to its customers. Here is a sample income statement in the multiple step format.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)