Louisiana Income Withholding Order

Lac 67 iii 2509 income assignment.

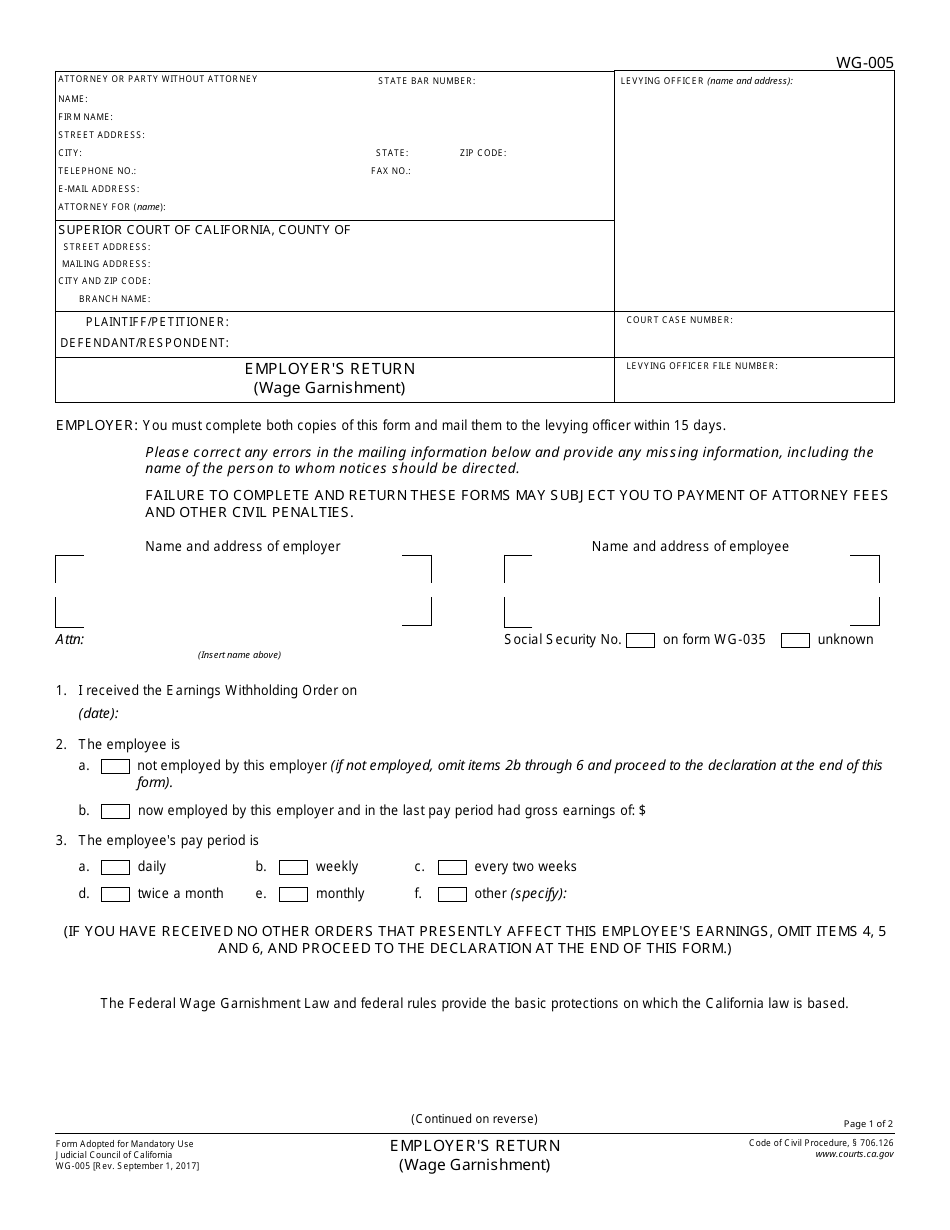

Louisiana income withholding order. L 3 this form is the employer s annual reconcilation of louisiana income tax withheld used to reconcile the total amount of income tax withheld that was reported with form. Income subject to support withholding includes wages salary interest commission pay as an independent contractor compensation disability benefits unemployment compensation workers compensation annuity and. The withholding amounts are used to pay child support spousal support medical support or other types of support. Employers should note that they cannot contest the income withholding order.

An income withholding order iwo is an order that directs you the employer to withhold a specific amount from the paychecks of an employee. Since 1988 all court orders for child support include an automatic income withholding order. Employers must treat an income withholding order issued from a court in another state as if it had been issued in louisiana. Copies of w 2 s are submitted with the annual reconciliation form l 3.

The other parent can also get a wage garnishment order from the court if you get behind in child support payments. Each return covers one quarterly taxable period and must be filed by the filing deadline. However the employer should contact the issuing agency if unable to implement the withholding either because the individual named in the order is not an employee or a withholding is already in place for the child and employee. Louisiana revised statutes rules.

Louisiana revised statute rs 46 236 3 states upon receipt of a notice to withhold the payor of income shall withhold from the income of the obligor the amount order for support as it becomes due together with an additional sum determined by the obligee subject to limitation provided by rs 13 3881. Income subject to support withholding includes wages salary interest commission pay as an independent contractor compensation disability benefits unemployment compensation workers compensation annuity and. 46 236 3 e enforcement and termination of income assignment orders. Every employer who withheld or was required to withhold income tax from wages must file the employer s quarterly return of louisiana withholding tax form l 1.

Louisiana wages earned and state income taxes withheld from employees wages during the year. Employers must treat an income withholding order issued from a court in another state as if it had been issued in louisiana.