Income Statement Formula For Variable Costing

Variable costing statement is different.

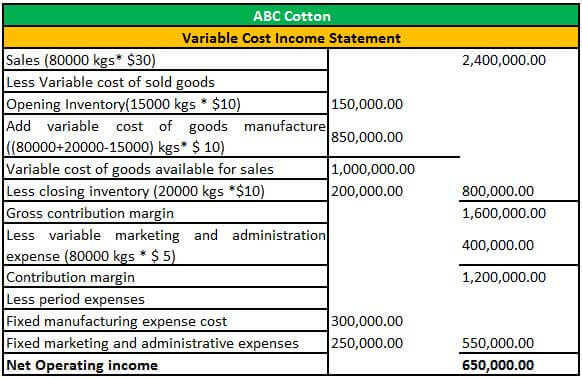

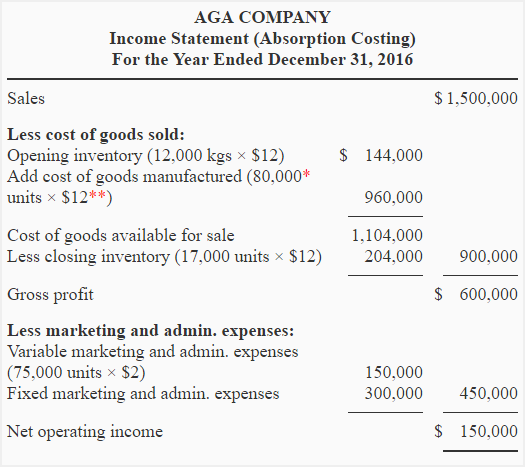

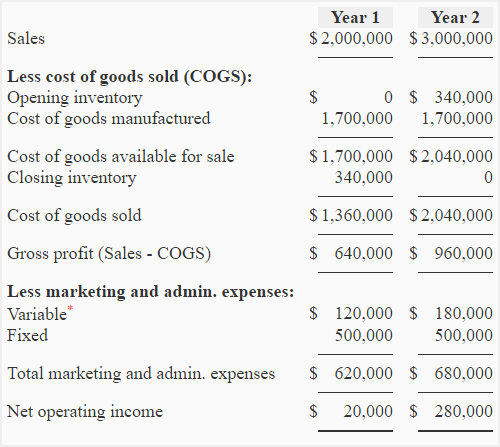

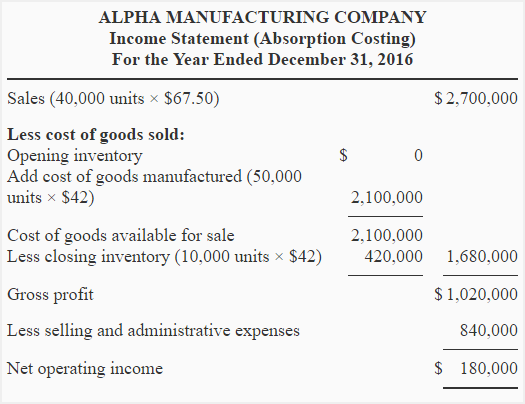

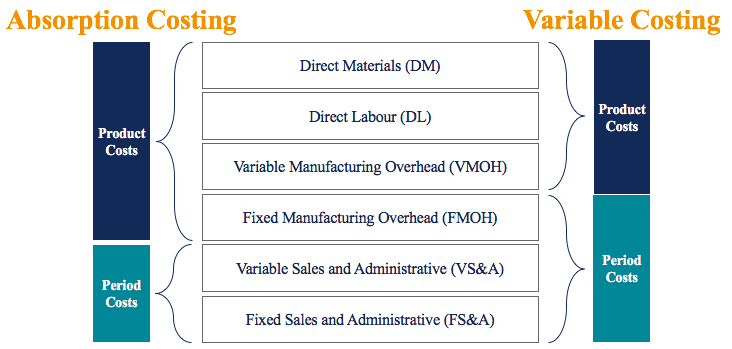

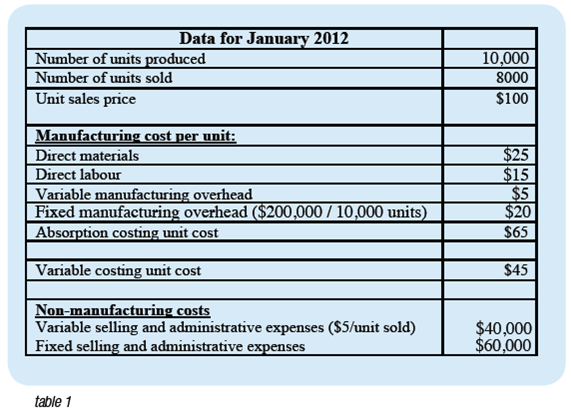

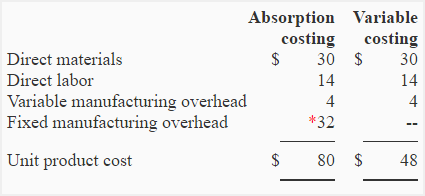

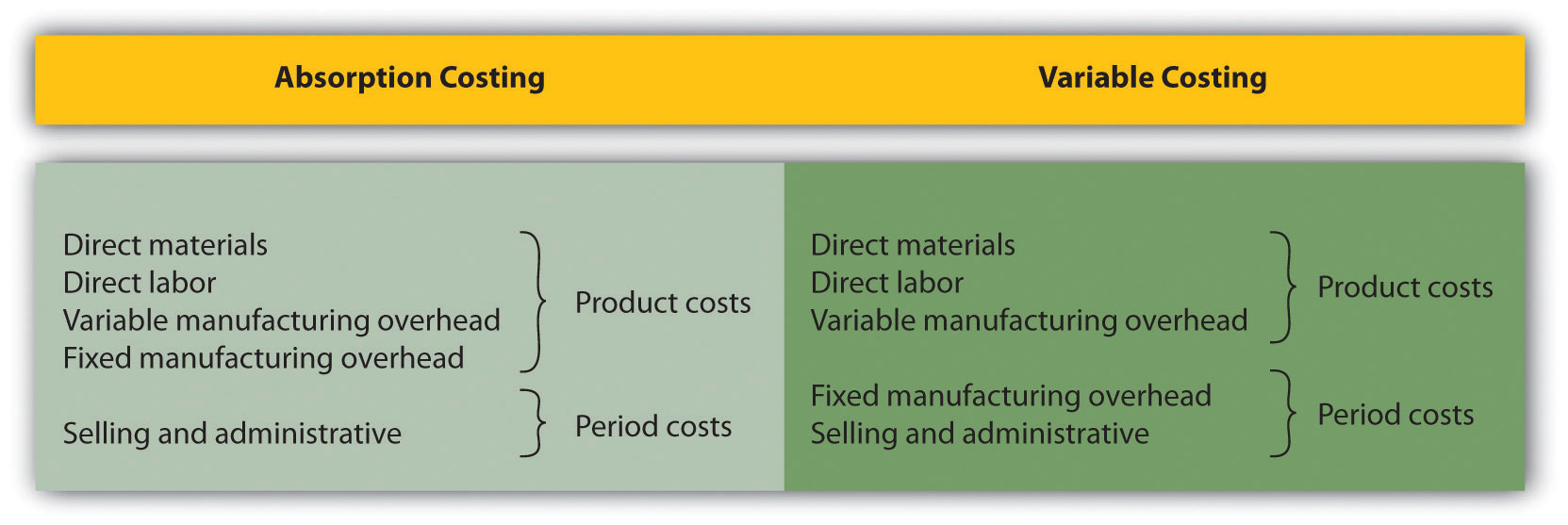

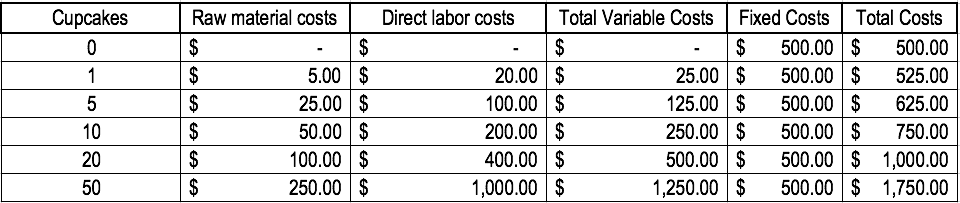

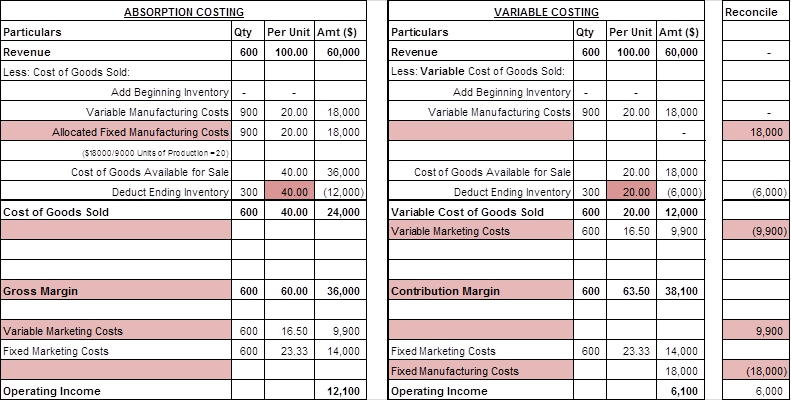

Income statement formula for variable costing. Notably traditional reports can be. Direct materials direct labor and variable manufacturing overheads. Explanation of the variable costing formula. Variable costing also called marginal costing is a costing method in which fixed manufacturing overheads are not allocated to units produced but are charged completely against revenue in the period in which they are incurred.

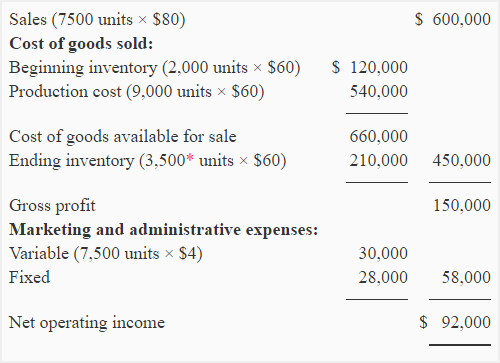

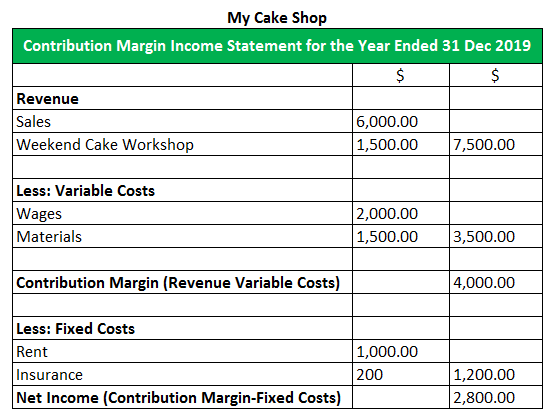

The normal income statement has a gross margin whereas variable costing income statements have a contribution margin. The variable costing formula can be calculated in the following five steps. In variable costing income statements all variable selling and administrative expenses group with variable production cost. Firstly direct labor cost directly attributes to production.

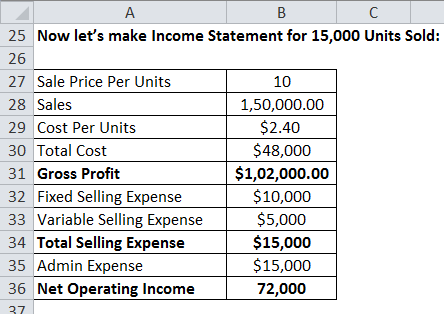

It is useful to create an income statement in the variable costing format when you want to determine that proportion of expenses that truly. It considers the variable costs exclusively. A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a separately stated contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period. The direct labor cost is derived according to the rate level of expertise of the labor and the number of hours employed for the production.

Variable costing income statement.