The Income Statement Shows Whether Or Not

1 08 what is the difference between a cash flow statement and an income.

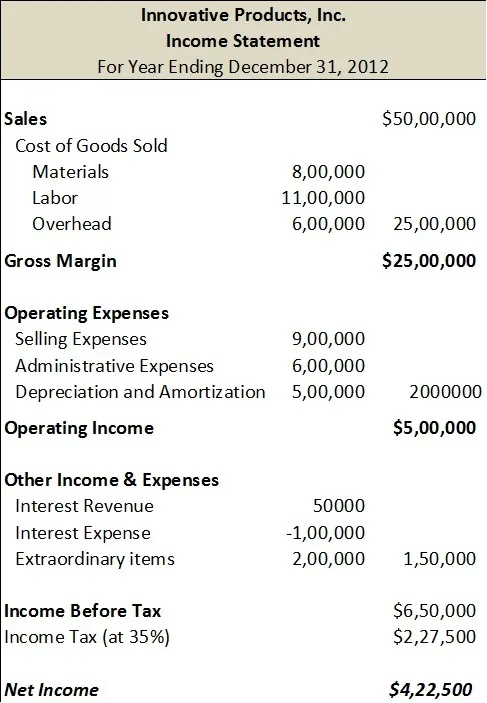

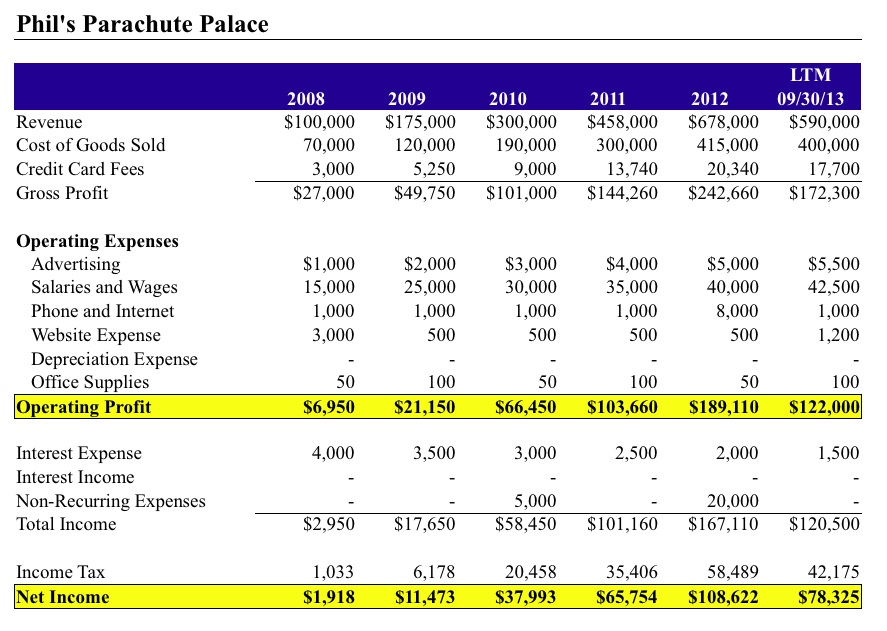

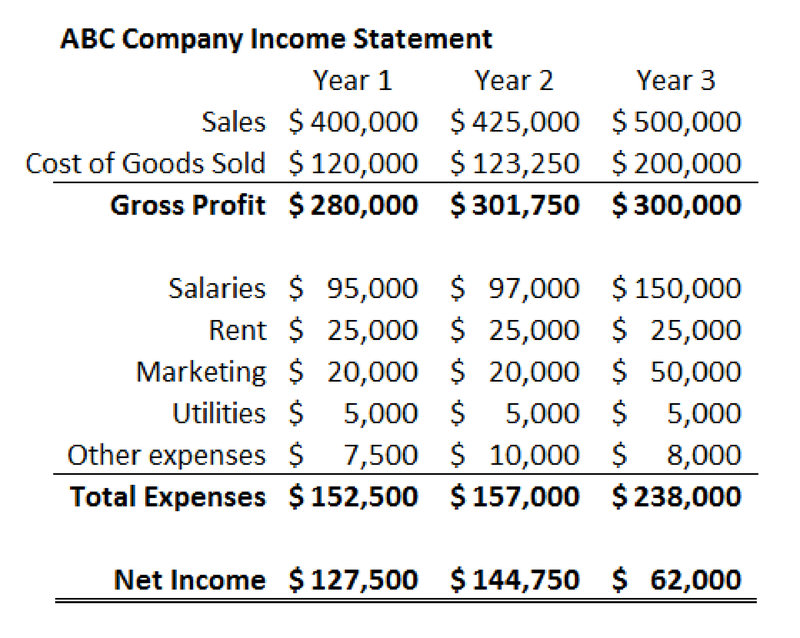

The income statement shows whether or not. An income statement is one of the three major financial statements that reports a company s financial performance over a specific accounting period. Measurement 2 the balance sheet shows whether or not a business is earning profits. An income statement shows whether a company made a profit and a cash flow statement shows whether a company generated cash. When the money is actually received in march the march income statement will not show revenues for this transaction.

If a company provided a 1 000 service on january 31 and gave the customer until march 10 to pay for the service the company s january income statement will show revenues of 1 000. Both revenue and expenses are monitored closely. The income statement shows investors and management if the firm made money during the period reported. This contrasts with the balance sheet which represents a single moment in time.

Its crucial for management to grow revenue. The purpose of the income statement is to show managers and investors whether the company made money profit or lost money loss during the period being reported. Learning objective 1 6 1 the income statement shows whether or not a business can ge. The income statement consists of revenues and expenses along with the resulting net income or loss over a period of time due to earning activities.

View test prep 01 from econ 121 at university of maryland baltimore county. An income statement represents a period of time as does the cash flow statement. The operating section of an income statement includes revenue and expenses. The income statement also called the profit and loss statement is a report that shows the income expenses and resulting profits or losses of a company during a specific time period.

Learning objective 1 6 1 the income statement shows whether or not a business can generate enough cash to pay its liabilities. This preview shows page 1 3 out of 5 pages.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)