Income Statement Reports A Single Measure Of Income

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

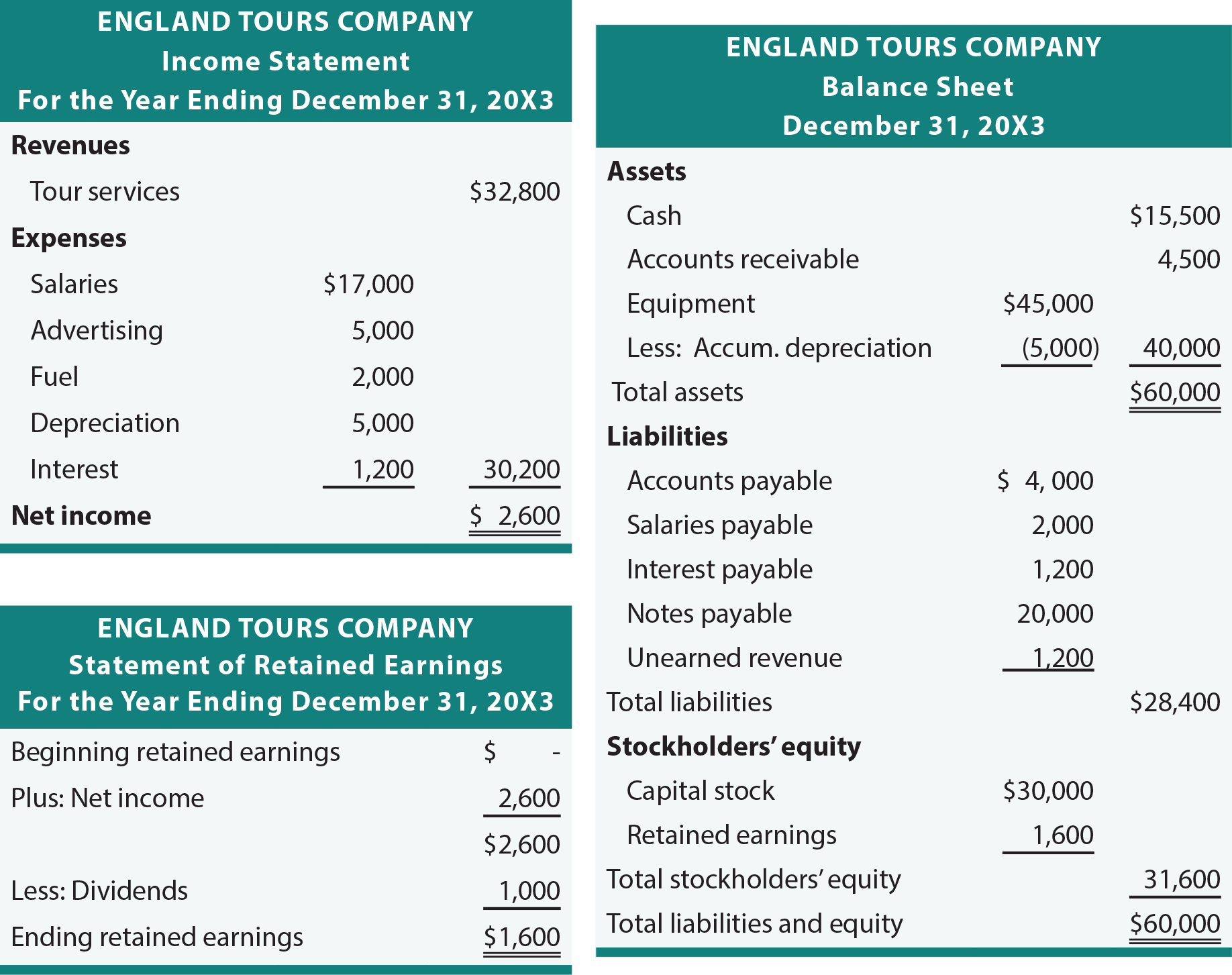

Order of statement of retained earnings items.

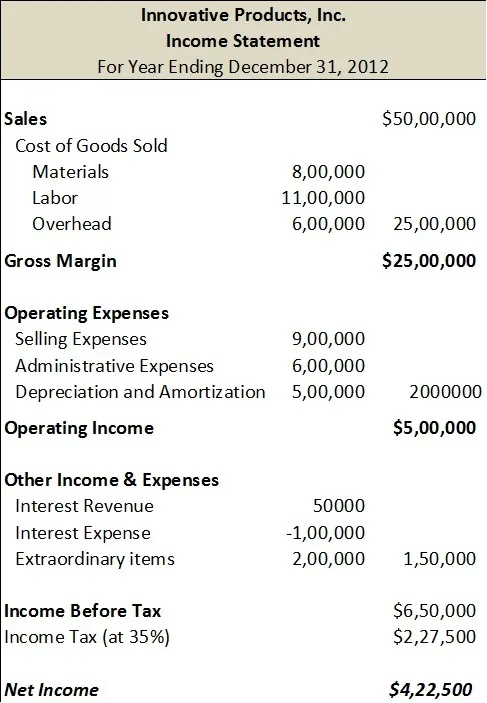

Income statement reports a single measure of income. A major expense shown in our first income statement example above is tax. A income statement reports a single measure of income. Tax or taxation is actually shown in a simplified way in that income statement as it is a single step income statement. In the case of a single step the income statement formula is such that the net income is derived by deducting the expenses from the revenues.

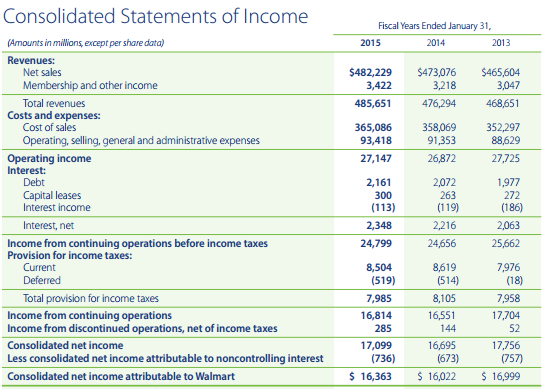

According to ias 1 para 81 entity may report its financial performance either in a single statement or in two separate statements as follows. The first is the single step income statement which is the most common. The income statement comes in two forms multi step and single step. Either in a single statement i e.

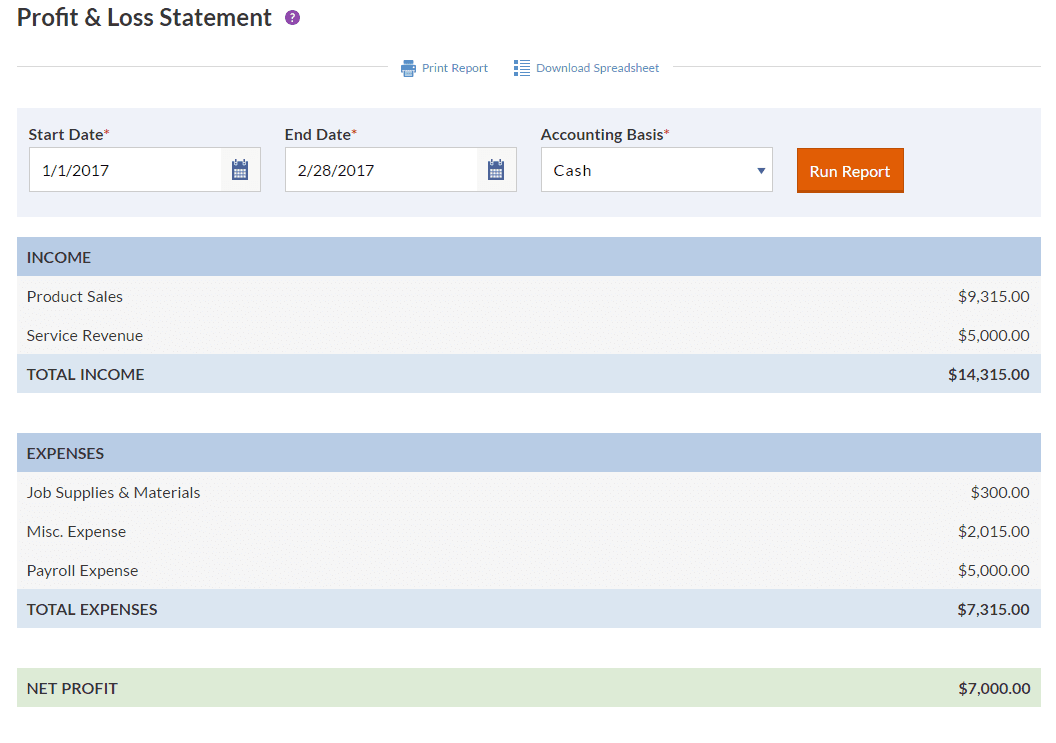

Both single step and multi step income statements report on the revenues expenses and the profit or loss of a business during a specific reporting period. Statement of comprehensive income. It reports the different revenues and total expenses. The income statement is also referred to as the statement of earnings or profit and loss p l statement.

On the multi step income statement the items appear differently with their calculations which ultimately provides more data to the reviewer at the expense of being more. Ias 1 para 81 allows that all the items of income and expenses recognized in the period. Retained earnings sep 1 net income dividends retained earnings sep 30. Single step income statement the single step statement only shows one category of income and one category of expenses.

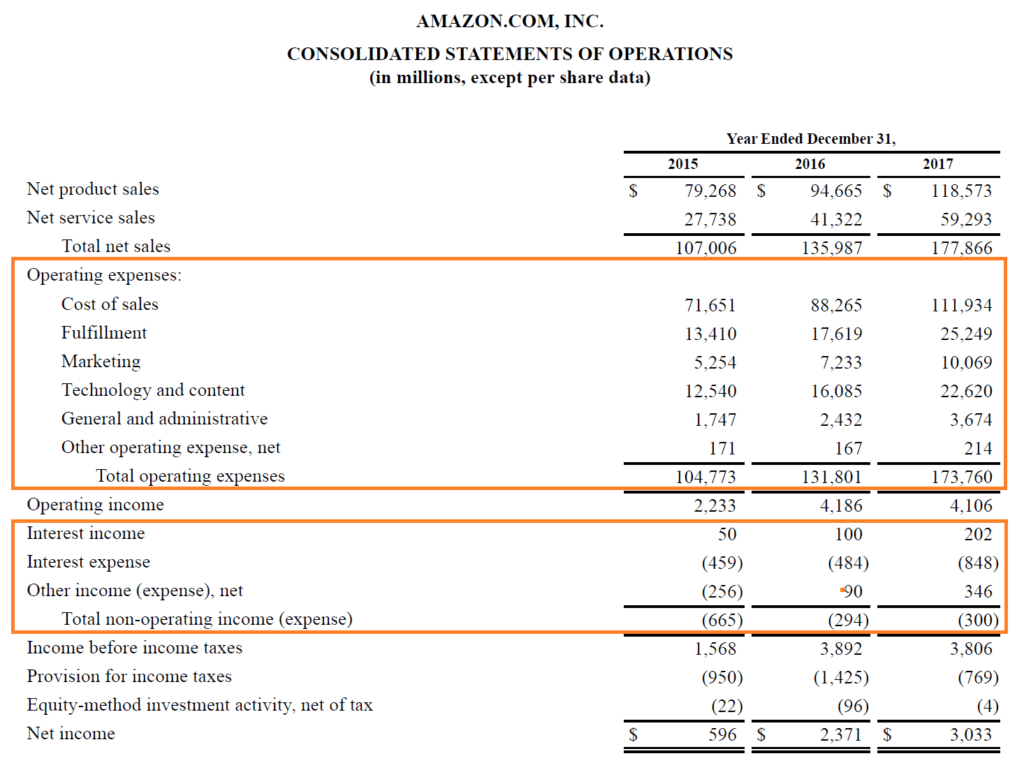

Statement of comprehensive income combining income statement as first section with other comprehensive income statement as second section after income statement as a single. There are two income statement formats that are generally prepared. In reality companies often use more complicated multiple step income statements where key expenses are separated into groups or categories. This income statement formula calculation is done by a single step or multiple steps process.

The income statement summarizes a company s revenues and expenses over a period either quarterly or annually. This format is less useful of external users because they can t calculate many efficiency and profitability ratios with this limited data. Income statement and statement of comprehensive are differentiated because ias 1 gives two options to present the items of incomes and expenses recognized during the period. In multiple step income statements tax is shown on.

A single step income statement offers a simple report of a business s profit using a single equation to calculate net income.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)