Ohio Income Tax Estimated Payments

Joint filers should determine their combined estimated ohio tax liability and make joint estimated payments.

Ohio income tax estimated payments. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. 2020 ohio estimated income tax instructions do i have to make estimated payments. View prior year tax returns and payments made in the last 61 months. Below are the helpful webpages that can assist you with any additional questions you may have.

Ohio tax brackets for use with the 2019 ohio estimated income tax payment worksheet you must round your tax to the nearest dollar. Ohio epayment allows you to make your ohio individual income and school district income payments electronically. If your income is subject to ohio withholding you generally do not need to make estimated payments. Allows you to electronically make ohio individual income and school district income tax payments.

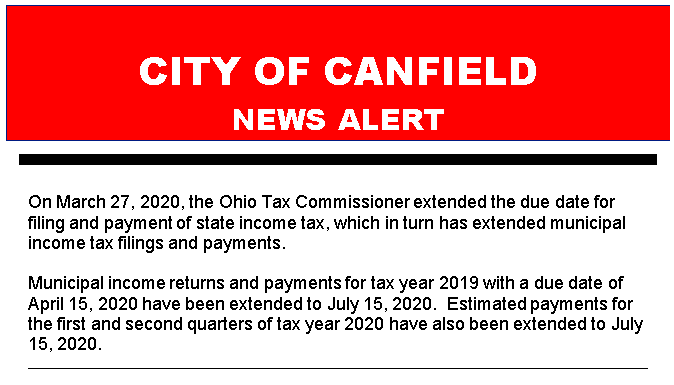

2020 ohio estimated income tax instructions do i have to make estimated payments. If you estimate that you will owe more than 500 in tax for 2020 after. Payments by electronic check or credit debit card. Several options are available for paying your ohio and or school district income tax.

If you earn income not subject to withholding while living in ohio or from ohio resources you may need to make estimated tax payments to the ohio department of taxation. Payments by electronic check or credit debit card. You should make estimated payments for tax year 2020 if your estimated ohio tax liability total tax minus total credits less ohio withholding is more than 500. Income and school district estimated payments.

This includes extension and estimated payments original and amended return payments billing and assessment payments. For more information about the ohio income tax see the ohio income tax page. Printable ohio income tax form it 1040es. Also you have the ability to view payments made within the past 61 months.

2019 ohio nonbusiness income tax ohio taxable nonbusiness income for line 8a of the worksheet from line 7 of the worksheet 0 10 851 16 300 21 750 43 450 86 900 108 700 more than 10 850 16 300. Ohio estimated tax payments. If your income is subject to ohio withholding you generally do not need to make estimated payments. Use the ohio it 1040es vouchers to make estimated ohio income tax payments.

Tax returns awaiting action you may view and continue filing your ohio individual income and school district income tax returns awaiting. You should make estimated payments for tax year 2020 if your estimated ohio tax liability total tax minus total credits less ohio withholding is more than 500. Estimated tax payments must be sent to the ohio department of revenue on a quarterly basis. Use the ohio sd 100es vouchers to make estimated ohio school district tax payments.