Zimbabwe Income Tax Act

The income tax act chapter 23 06 and subject to subsection 2 of section seven the tax with which a taxpayer is chargeable in respect of a in the case of a taxpayer who has before the 1st april 1965 attained.

Zimbabwe income tax act. 3 amendment of schedule to chapter i of cap. Section 2 interpretation of the income tax act chapter 23 06 is amended by the insertion of the following definition 5 new. That together with the aids levy gives an overall effective rate of 24 72. Income tax act chapter 23 06 updated income tax act chapter 23 06 updated pdf download details income tax bill 2012 income tax bill 2012 pdf download details income tax transitional period provisions act chapter 23.

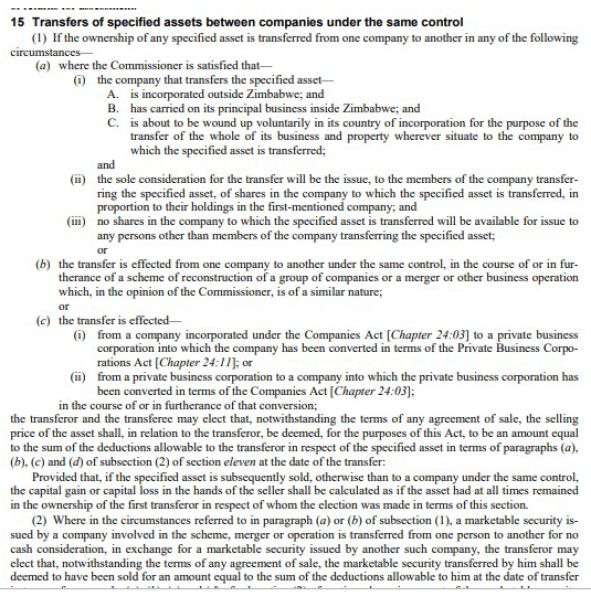

The new minister of finance issued a number of proposals to the income tax act chapter 23 06 most of which take effect from 1 january 2019. Zimbabwe amendments to the income tax act and introduction of new transfer pricing regulations. Income tax act chapter 23 06 thirteenth schedule requires an employer to withhold and remit employees tax paye in. 20 september 2020 authorised economic operators aeo programme zimbabwe has implemented the authorised economic operator aeo programme in line with international best practice and the.

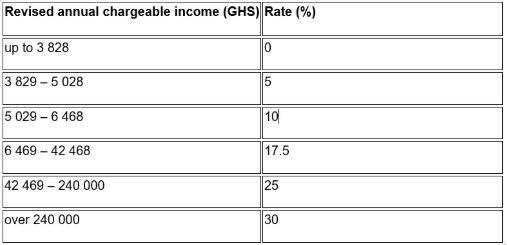

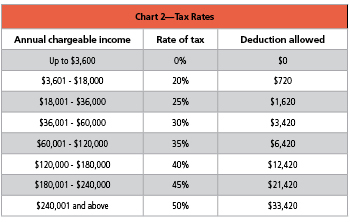

56 760 40 for each usd above 180 001. Yes investment income is taxable at an effective rate of 25 75 percent being 25 percent plus 3 percent aids levy while capital gains on specified assets are taxable at 20 percent. Business rents is taxed at the corporate rate of tax currently 24. Act to be income derived from a source within zimbabwe at the specifiedpercentage of each united states dollar of that income.

Amendments to income tax act chapter 23 06 4 amendment of section 2 of cap. 23 04 with effect from the year of assessment. Income tax is levied on earnings income of an individual or a business. 2 interpretation 1 in this act affiliate in relation to a petroleum operator has the meaning given by subsection 4 of section thirty two.