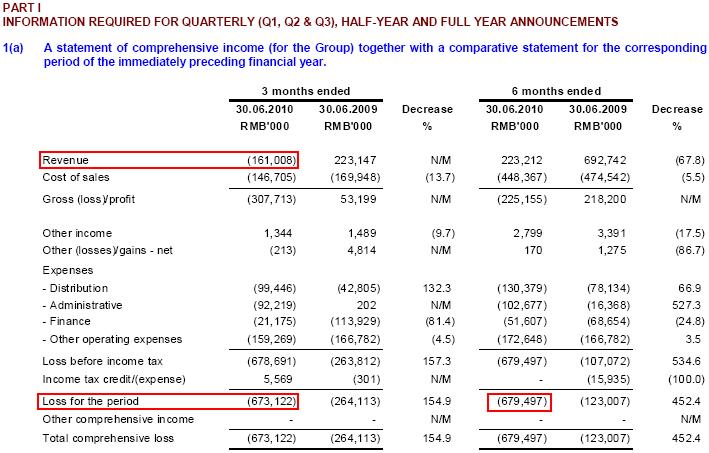

Negative Revenue Income Statement

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

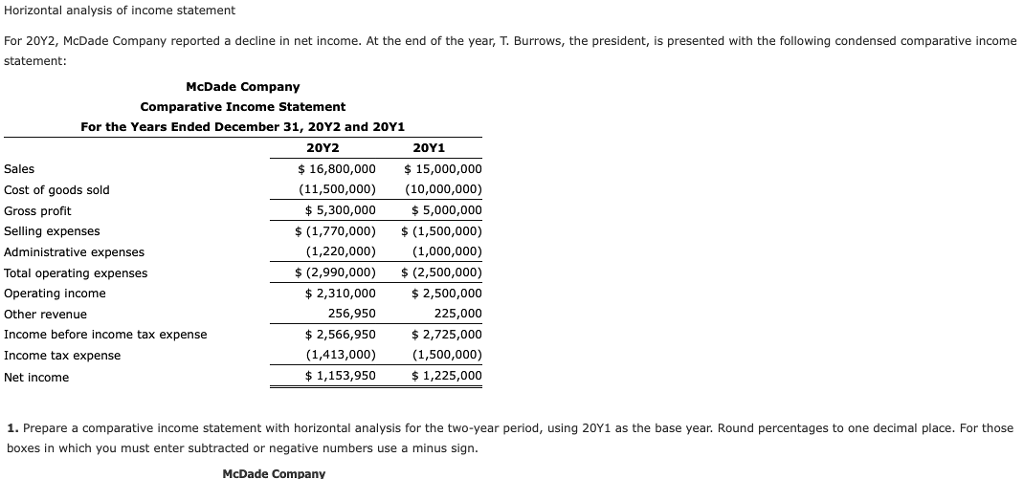

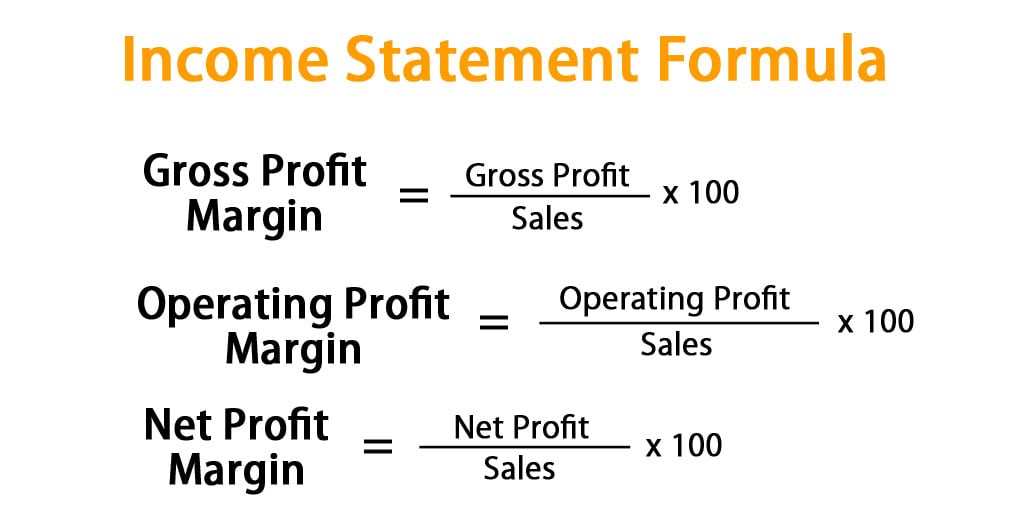

With a negative gross profit of 50 000 the operating income is 125 000.

Negative revenue income statement. Actual expenses of 20 800. The company is definitely generating an income year over year so that s why placing all revenue with a negative sign was confusing for me. A negative difference is a loss and is shown in brackets. To have a maximum either a must be negative or x must lie within fixed limits.

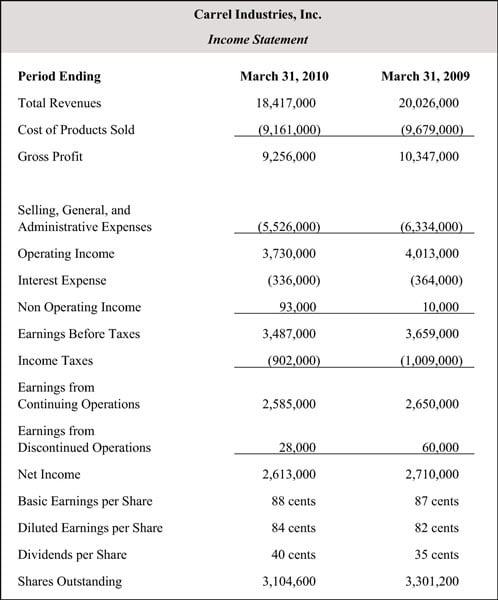

Budgeted net income of 8 000. Actual revenues of 28 500. Yes there are times when a company can have positive cash flow while reporting negative. The income statement shows the company s revenues and expenses.

For a company to remain healthy and stay in business this number needs to be positive the majority of the time. If there was a net loss in that period it would be shown as a negative either with a negative sign or in parentheses. If the difference is positive it is profit. Based on the above information the company s will be reported as shown here.

On a company s income statement operating income sits right below gross profit near the top of the statement. In this case i d expect there to be a line in the financial statement under the revenue section titled something like gains losses on investments. All revenue in their system is showing up as a negative number so i believe you are correct that the accounting system shows all credits regardless of what they are as negative numbers. Actual net income of 7 700.

This is what the company has left after subtracting all its expenses from its total revenue. A negative income figure appears on a company s income statement also known as a profit and loss statement. If the company has 100 000 in gross profit and 75 000 in expenses the operating income is 25 000. Net income is commonly referred to as the bottom line since it sits at the bottom of the income statement.

The company may receive revenues from sales of goods and services dividends and interest.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)