Zakat On Income Islamqa

If the money is less than the nisaab then no zakaah is due on it.

Zakat on income islamqa. The kuffaar may be given zakaah funds to ransom this prisoner. You pay zakat on the rental income which remains in your possession on your zakat date so let s say you pay zakat on 15 ramadan every year. If a person receives an amount of money that he could not have received before like a bonus or lump sum paid at the end of a period of work or on retirement no zakat is due for the time that has passed. Zakaah does not have to be paid in ramadan.

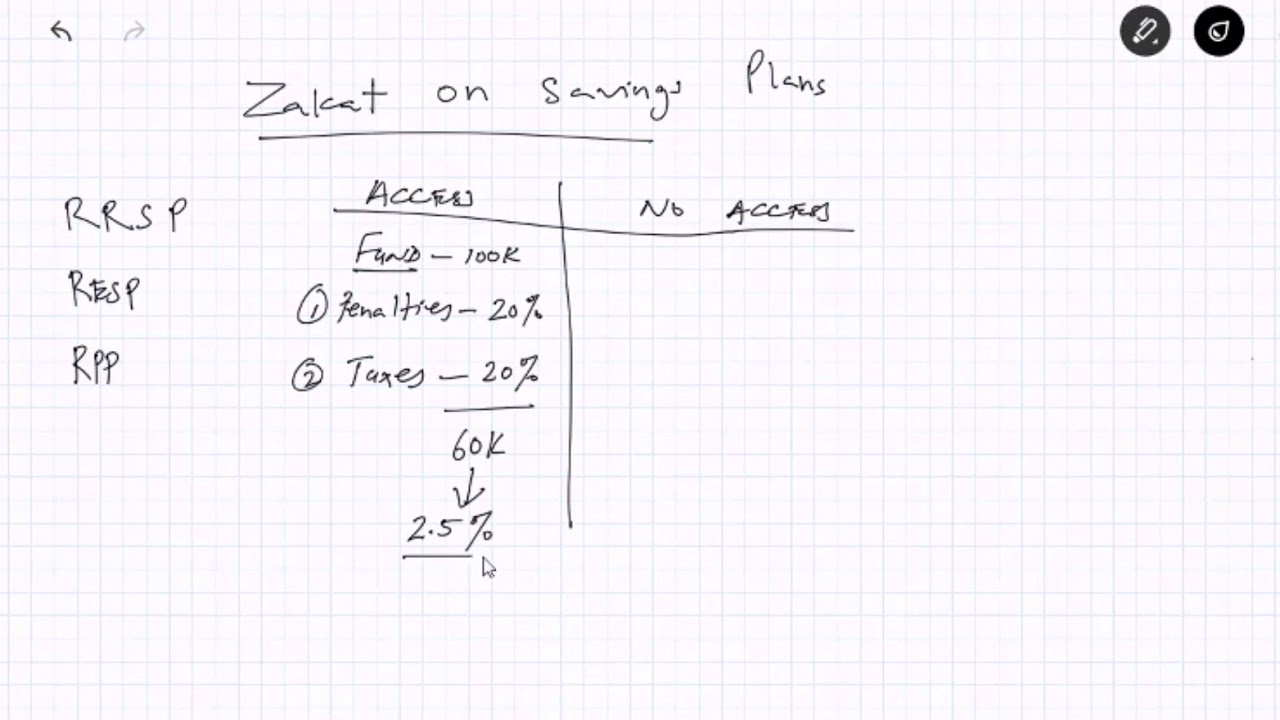

If you took possession of it in muharram then zakaah must be paid in muharram and so on. If one has us 10 000 above the nisab at the beginning of the zakat year and by end of that year he earns another us 5 000. The zakat on 25 camels is 1 bint makhad though if a bint makhad is unavailable such as when one does not possess it at the time of distributing zakat one gives 1 ibn labun. Each month s savings would get its own zakat taken out after a year.

If you took possession of the gold in ramadan then the time for the zakaah is in ramadan. Iii a muslim prisoner who has been captured by the kuffaar. Hiqqun since a hiqqun is better than an ibn labun nihayat al muhtaj 3 49 taqrirat al sadidah pg. Mahalli ala al minhaj w qalyubi.

Therefore making it us 15 000. 1 that it reaches the nisaab minimum threshold 2 that one year has passed since it reaches the nisaab. In order for zakaah to be due on money two conditions must be met. How zakat is paid in such cases in which legal responsibility is not present it is obligatory for their legal guardian to pay the zakat on their behalf from their wealth.

In one approach which imam bayhaqi ascribes to a number of shafi i fuqaha the ahadith that obligate payment of zakah on jewellery are placed within a time when the use of gold jewellery was prohibited. Zakat is therefore also obligatory upon the wealth of 1 a child or 2 a person with a mental health condition al majnun. So you would pay zakat on 800. 2 6 it is also valid to give a male camel in its fourth year ar.

Al sunan al kubra 4 140 the hadith of jabir would then date from a later period when gold jewellery came to be allowed. If you have 279 in the bank at lunar month 1 and at lunar month 2 you add another 500 to your savings then once a lunar year passes you would pay 2 5 of the 279 as zakat and a month later you would pay 2 5 of the 500. On that day you have in your bank account 2000 of rent but you also have 1000 to pay as a mortgage payment for this month and 200 to the plumber for some work. If a kaafir or muslim has kidnapped a muslim there is nothing wrong with ransoming this person with zakaah funds because the purpose is the same namely releasing a muslim from captivity.

But the extra 5 000 have not been in his possession for a full zakat.