Local Income Tax Form Ohio

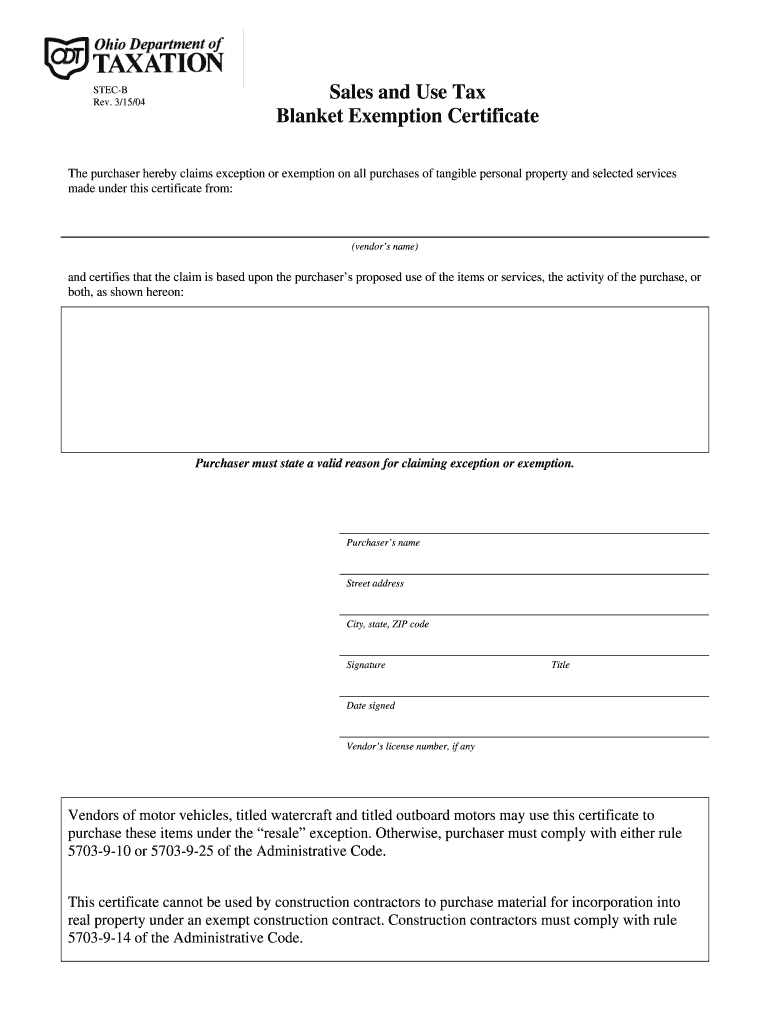

Letters to contractors and sub contractors refund claim form and instructions ordinance rules and regulations ordinance amending chapter 95 of ordinances for the city of cambridgein effect jan 1 2016 income tax.

Local income tax form ohio. File online more information. Military service nonmilitary 4 then the income is. A few other resources on the municipal income tax are available on our main municipal income tax page. The ohio department of taxation s role in the municipal income tax is limited to administration of the tax for electric light companies and local exchange telephone companies and for those businesses that have opted in with the tax commissioner for municipal net profit tax all other business taxpayers as well as all individual taxpayers should.

We will update this page with a new version of the form for 2021 as soon as it is made available by the ohio government. Letters refund claims. Pdf pdf fill in it 40p. 3 and the source of the income is.

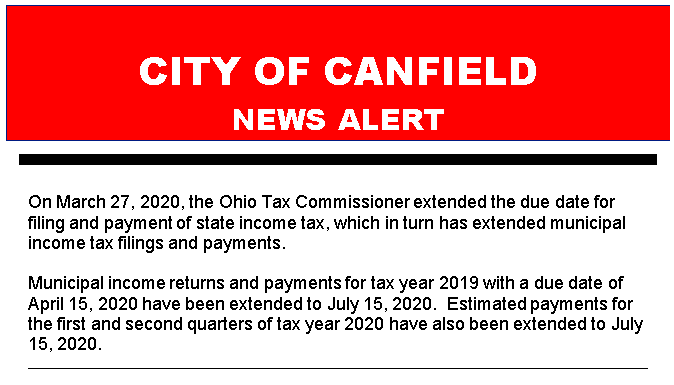

Taxability of a military servicemember s income in ohio 1 if the servicemember is a. Ohio has a state income tax that ranges between 2 85 and 4 797 which is administered by the ohio department of taxation taxformfinder provides printable pdf copies of 83 current ohio income tax forms. Taxed in ohio taxed in ohio resident of ohio in ohio nonresident of ohio outside of ohio military. Columbus and cleveland s 2020 local tax rates are both 2 5.

2 and the income is earned. Ohio has 649 municipalities and 199 school districts that have income taxes. 2019 filing 2020 5 2020 remittance forms 2 2018 filing 2019 4 2019 remittance forms 2 2018 remittance forms 5. 2019 employers monthly income tax withholding forms 2019 employers quarterly income tax withholding forms.

The current tax year is 2019 and most states will release updated tax forms between january and april of 2020. Its state average local tax is second only to maryland for highest local tax rates. Other ohio other forms. The forms are available at tax ohio gov.

In 2020 local rates range from 0 to 3 with the higher rates in heavy metropolitan areas such as cleveland. The regional income tax agency rita has been collecting and processing the municipal income tax for the city of oxford since august 2007. Tax filings transmitted by wednesday july 15 2020 at 11 59 pm will not be assessed penalty or interest for late filing. This form is for income earned in tax year 2019 with tax returns due in april 2020.