The Income Statement Approach Used To Estimating Bad Debts

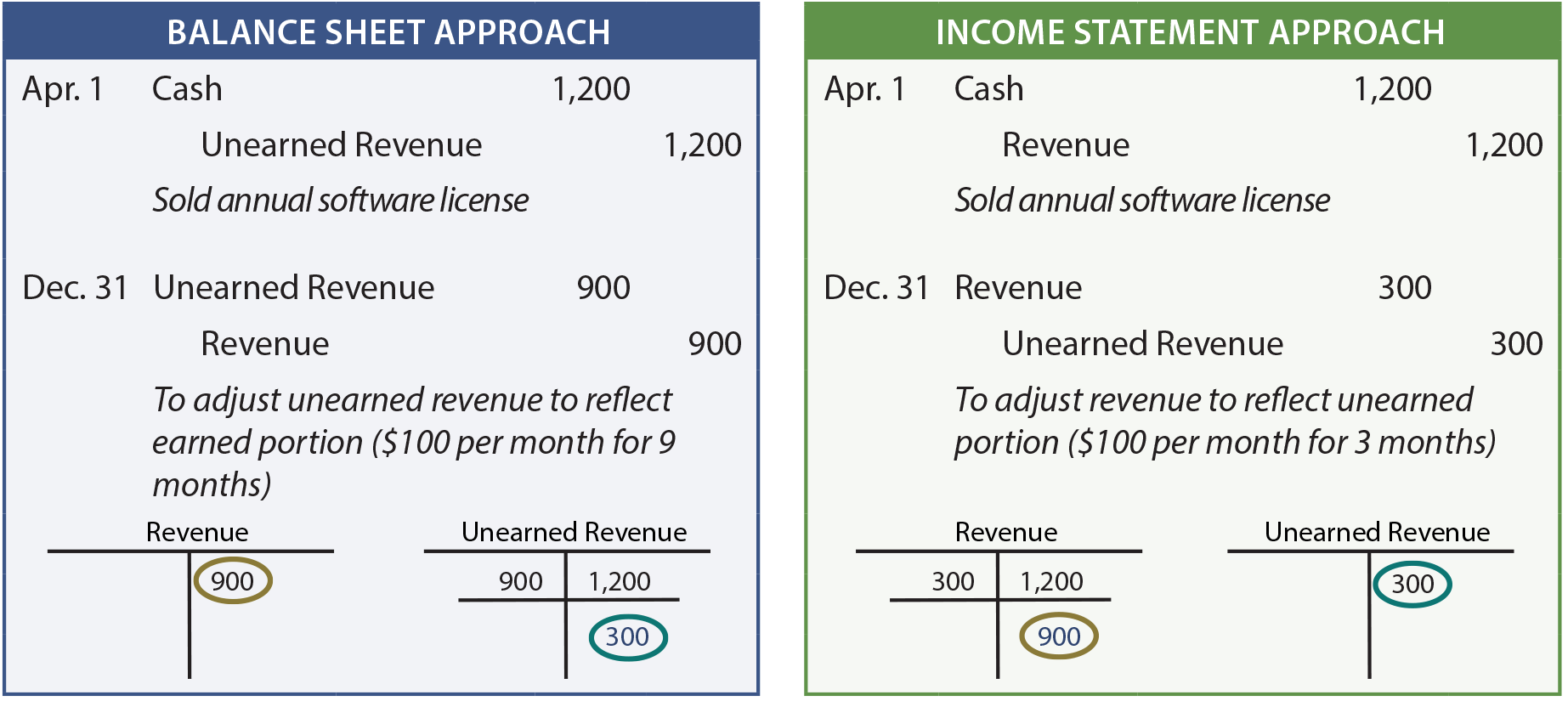

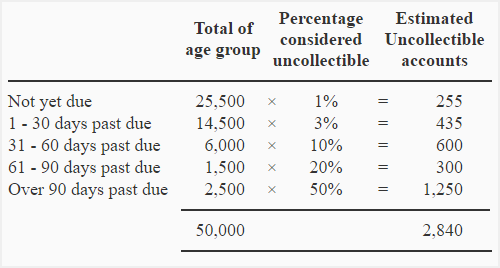

The second is a balance sheet approach that measures uncollectibles.

The income statement approach used to estimating bad debts. The company uses the income statement approach to estimating bad debts. College accounting 13th edition edit edition problem 7dq from chapter 13. There are two primary methods for estimating bad debt expense. False under ifrs accounts receivable can be accounted for at fair value whenever company management wants to do so.

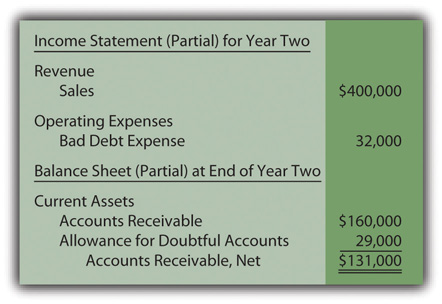

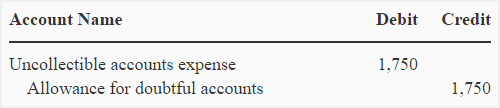

Under this method bad debts expense is calculated as percentage of credit sales of the period. On february 28 the firm had accounts receivable in the amount of 555 000 and allowance for doubtful accounts had a credit balance of 370 before adjustment. Which of the following statements is true with respect to the percentage of credit sales method for estimating uncollectible accounts. The first is an income statement approach that measures bad debt as a percentage of sales.

The income statement approach to estimating bad debts requires an adjusting entry at the end of the period to reduce receivables to net realizable value. Net credit sales for february amounted to 3 000 000. The income statement approach for estimating bad debts uses a percentage of net credit sales sales to customers in which the customers pay within 30 to 60 days are referred to as credit sales or sales on account a is. In this example estimated bad debts are 5 000.

Started business on january 1 20x1. On the income statement bad debt expense would still be 1 of total net sales or 5 000. Percentage of sales method is an income statement approach for estimating bad debts expense. The company incorrectly used the actual write off of the receivable for the recorded bad.

The credit manager estimated that uncollectible accounts would amount to 5 of. Answer to the income statement approach used to estimate bad debts is based on accounts receivable on the balance sheet. In applying the percentage of sales method companies annually review the percentage of uncollectible accounts that resulted from the previous year s sales.