Income Tax Withholding Choice Unemployment

31 the tax payment is due jan.

Income tax withholding choice unemployment. Publication 505 tax withholding and estimated tax. Taxpayers report this information along with their w 2 income on their 2020 federal tax return. You ll receive a form 1099 g after the end of the year reporting in box 1 how much in the way of benefits you received and the irs will receive a copy. Unemployment payments are taxed as unearned income.

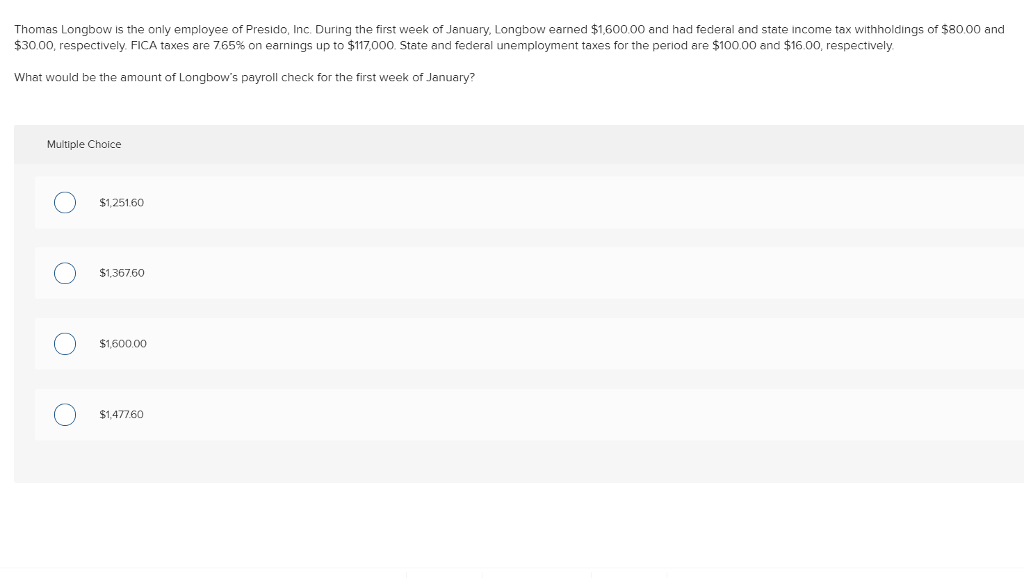

For income from sept. While you don t have to pay social security or medicare taxes typically about a combined 7 65 rate while receiving. It s assumed that the adults receiving unemployment will make the best tax decision for themselves. Ok so let s do the numbers.

The form will show the amount of unemployment compensation they received during 2020 in box 1 and any federal income tax withheld in box 4. Taxpayers should report this information along with other income on their 2020 federal tax return. Jobless workers will receive a 1099 g tax form next year to reflect the income from their unemployment checks evermore said. Ideally you knew this was going to happen so you asked to have income tax withheld from your payments.

The easiest way to elect income tax withholding is during the application process by completing form w 4v. Form 1040 es estimated tax for individuals. For income from june 1 to aug. You can elect to have federal income tax withheld from your unemployment compensation benefits much like income tax would be withheld from a regular paycheck.

31 the tax payment is due sept. When collecting unemployment you can ask for 10 of your payments to be withheld for federal taxes. This form will show the amount of unemployment compensation received during 2020 and any federal income tax withheld. Unemployment benefits are income just like money you would have earned in a paycheck.

In ny you have an option to ask the department of labor to withhold 10 of your unemployment payments to submit to the irs on your behalf as federal taxes and you also have the option to. But that money is considered taxable income even the new 600 boost. You can expect your state to keep up to 10 of your benefit amount. With unemployment typically maxing out at 26 weeks and with some states.

Withholding taxes from unemployment compensation. Too often however taxpayers choose not to withhold taxes from unemployment and don t consider what that will mean at the end of the year. For more information on unemployment see unemployment benefits in publication 525.