Income Tax Withholding In Puerto Rico

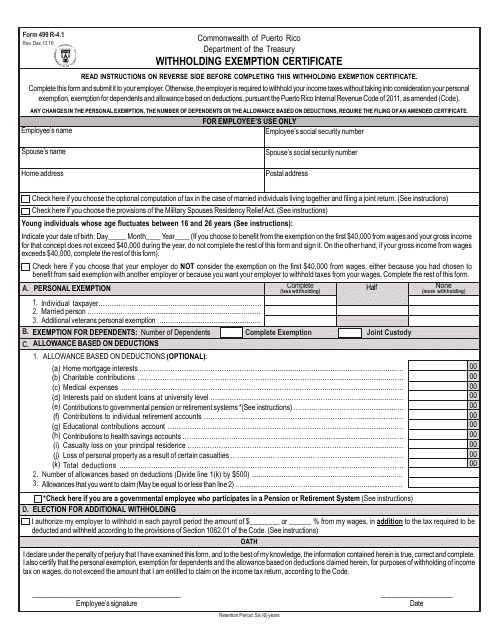

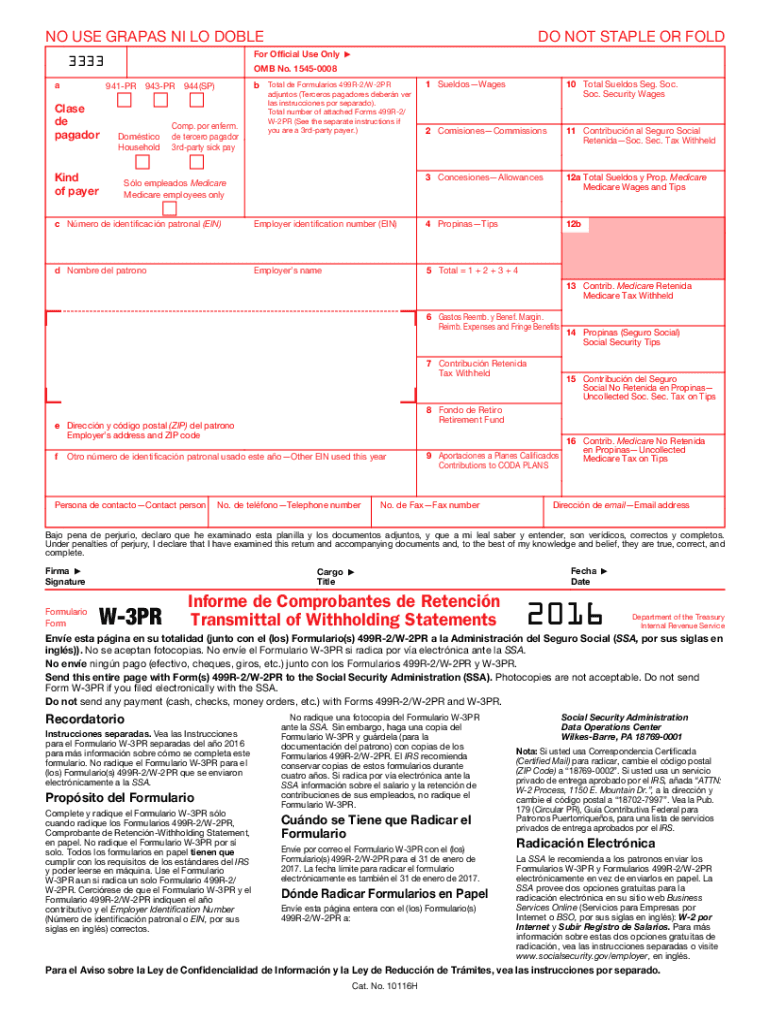

In this connection the employer is required to register its employer s identification number with the puerto rico treasury department by filing form sc 4809 information of identification numbers.

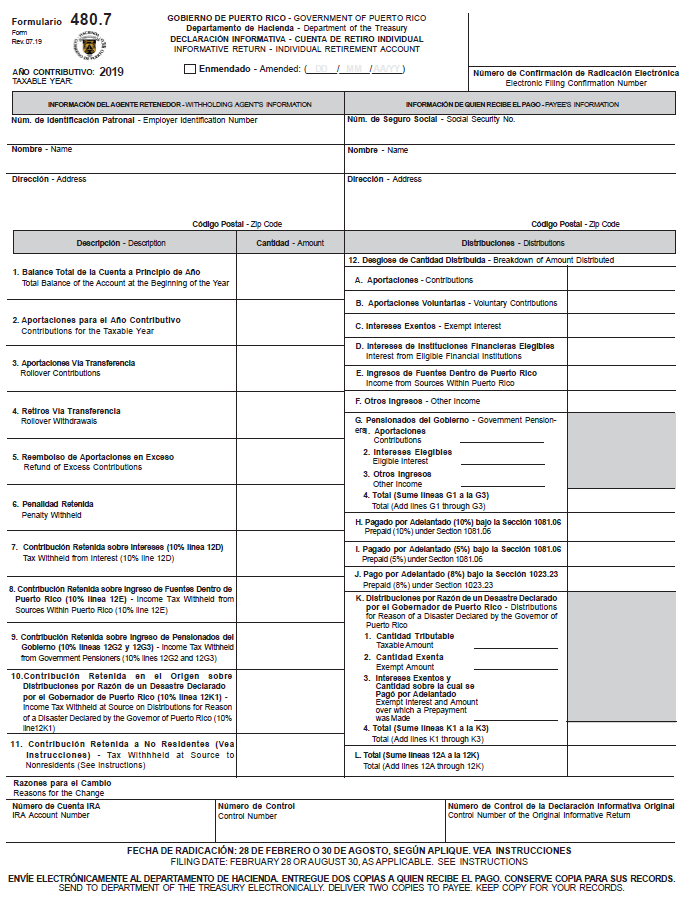

Income tax withholding in puerto rico. Puerto rico activities is subject to branch profits tax at a rate of 10 in lieu of the 10 withholding tax on dividends. The income tax withholding formula for puerto rico has changed. Submit a copy of the last three 3 income tax returns. Puerto rico income tax rate.

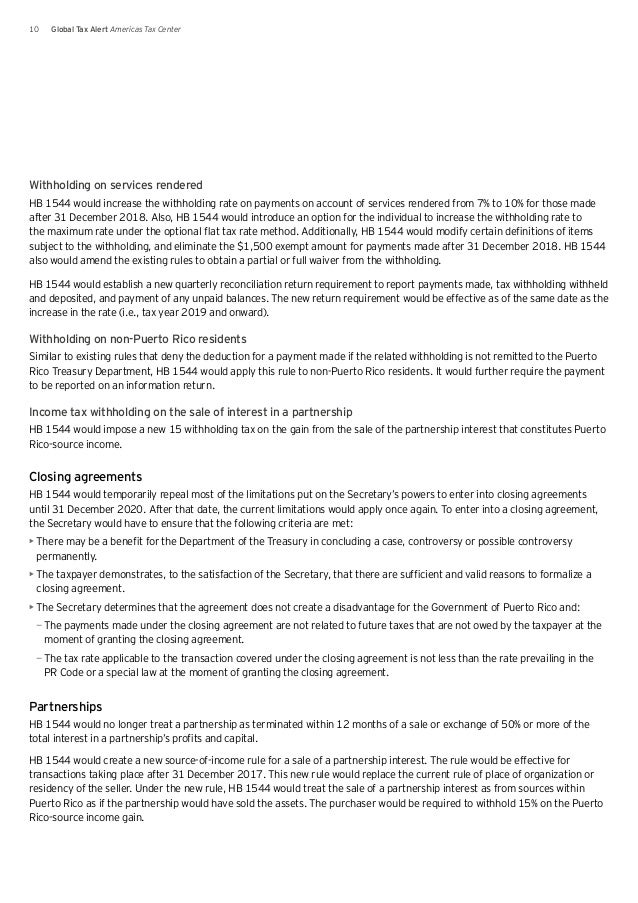

Payment for services rendered in puerto rico by entities doing business in puerto rico not registered in puerto rico state department. 29 foreign corporations and partnerships not engaged in trade or business within puerto rico except on dividends and interest paid to an unrelated person see below. No withholding is required on items of income that are effectively connected with the conduct of a puerto rico trade or business except compensation for personal services. The ten 10 percent withholding has to be sent to the puerto rico treasury department hacienda every month.

Corporate withholding taxes last reviewed 30 june 2020 corporations not engaged in a trade or business in puerto rico are subject to a 29 wht at source on certain gross income items considered fixed or determinable annual or periodical fdap from puerto rico sources. Foreign merchants not registered in puerto rico that will be considered non withholding agents may request to be considered as voluntary withholding agents by filing a request with the puerto rico treasury department and thus avoid applicable reporting and notifications. Puerto rico has a de minimis rule to avoid sourcing to puerto rico very small amounts of income from personal services. An exemption of the income tax withholding is provided for employees from ages 16 to 26 on the first 40 000 of taxable wages.

The previous exemption from tax withholding for all employees whose estimated annual wages do not exceed 20 000 is being eliminated. According to the pew research center two thirds of people in the states who earn 30 000 or less per year pay no income tax the average income in puerto rico in 2018 was roughly 20 078 which means that most puerto ricans would not have had to pay federal income taxes even if the federal law applied to the territory. This is an annual determination made at the time the income tax return is filed and the tax is due even when an actual dividend has not been paid. The full puerto rico tax formula will be applied for all residents and nonresidents to determine the appropriate annual taxable wages.