Income Statement Warranty Expense

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

Has no related balance sheet account.

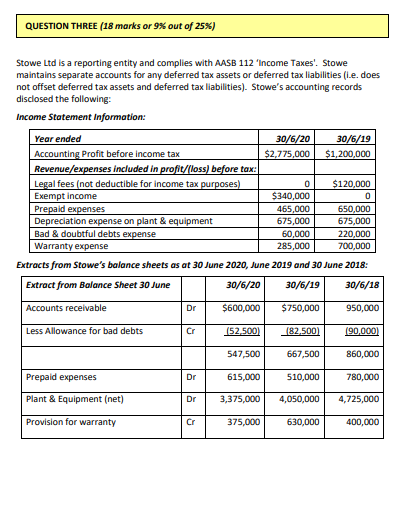

Income statement warranty expense. When claims appear in the later accounting periods the only further impact is made on the balance sheet since the company reduces both the warranty liability and inventory accounts. What amount of warranty expense will appear on the income statement for 2002 and what will be reported in the estimated warranty liability account on the december 31 2002 balance sheet. The matching principle states that a company must match revenue with expenses. When must the company record the warranty expense.

This article has been a guide to the warranty expense. During 2002 the actual costs of servicing products under warranty were 11 900 and sales were 4 200 000. Is deducted from cost of goods sold d. If weber sells a smoker in 2013 but expenses a warranty claim in 2020 remember it is a 10 year warranty the company is violating the matching principle.

Warranty expense can be included as part of cost of sales or operating expenses. The estimated warranty cost is debited as an expense to the income statement and credited to the warranty costs liability account sometimes referred to as a warranty reserve to reflect the contingent liability the business has for products sold in year 1. Warranty expense income statement and statement of cash flows. Reflects actual payments to fix the product c.

If you review public company financials you will see a 50 50 split. The amount of warranty expense that occurred in fy 2019 20 is nil or none. The warranty expense occurs because the sale took place. Warranty expense on the income statement.

Here we discuss the definition formula and recording of warranty expense journal entries with practical examples. Thus the income statement is impacted by the full amount of warranty expense when a sale is recorded even if there are no warranty claims in that period. As claims appear in later accounting periods the only subsequent impact is on the balance sheet as the warranty liability and inventory accounts are both reduced. Because we have already expensed it in fy 2018 19.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

:max_bytes(150000):strip_icc()/Screenshot2019-08-21at10.58.51AM-049e1ab335434a16ab7ddc69664758a7.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)