How To Prepare Common Size Income Statement

The same calculation for company b shows operating profits at 75 of sales 15 20.

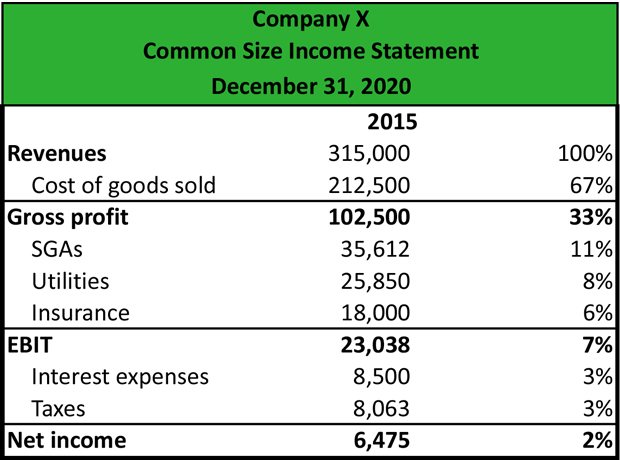

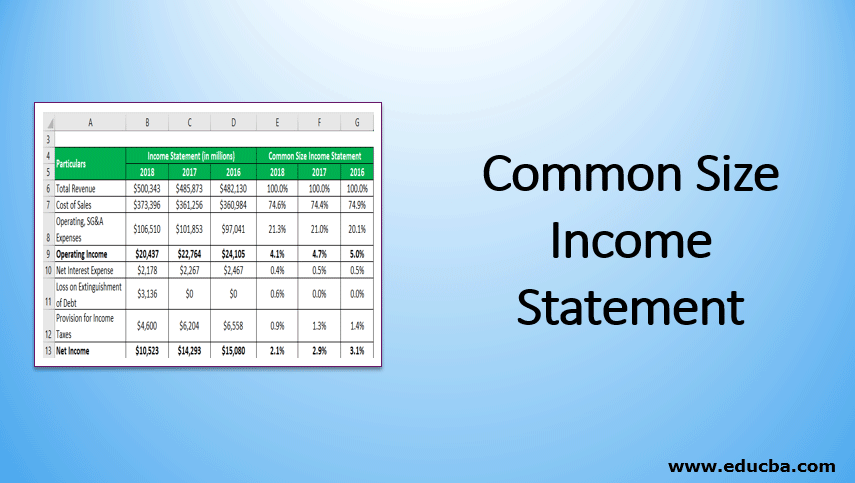

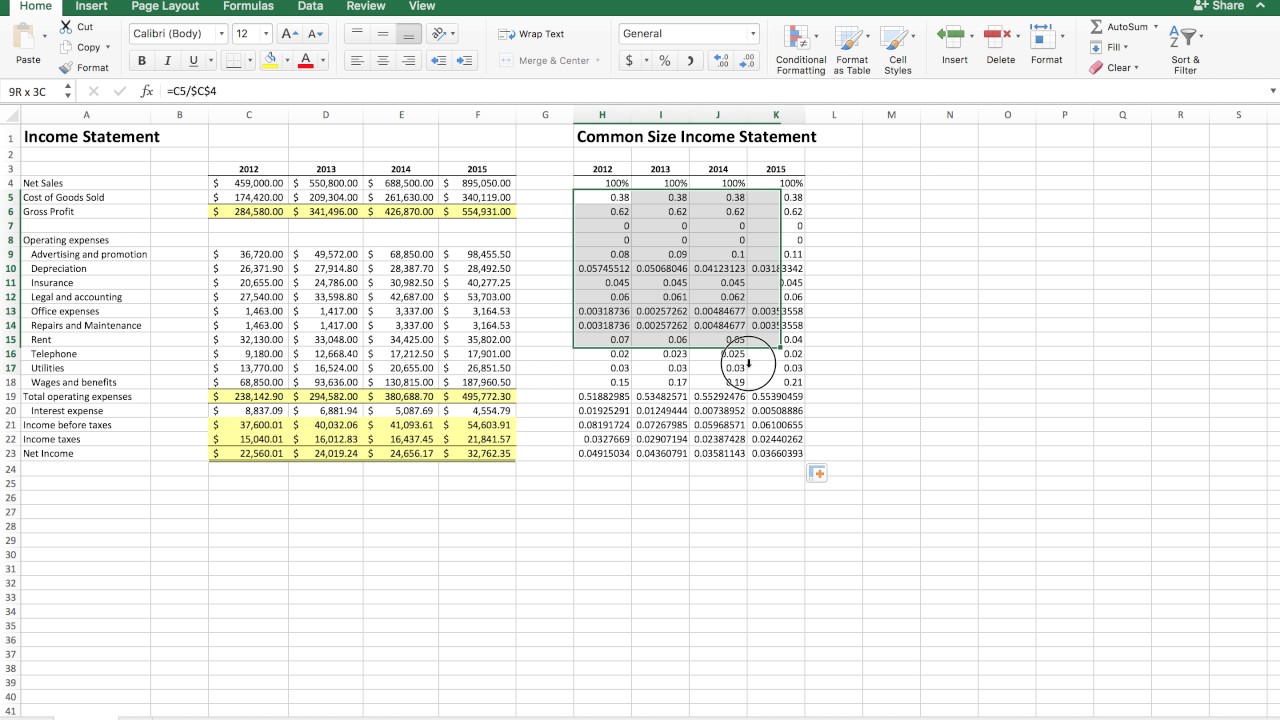

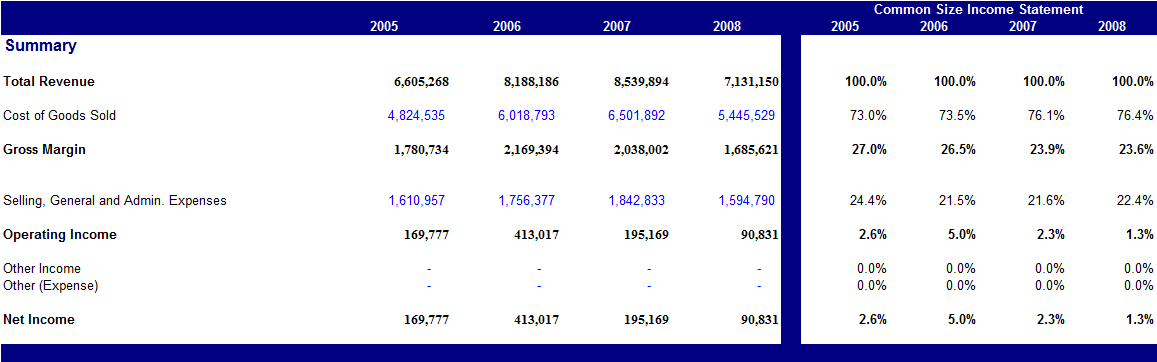

How to prepare common size income statement. We can compute common size income statement analysis for abc company for 2017. It is not another type of income statement but it is just one type of technique used by financial managers to analyze the income statement of a. To prepare an income statement generate a trial balance report calculate your revenue determine the cost of goods sold calculate the gross margin include operating expenses calculate your income include income taxes calculate net income and lastly finalize your income statement with business details and the reporting period. The common size percentages help to show how each line item or.

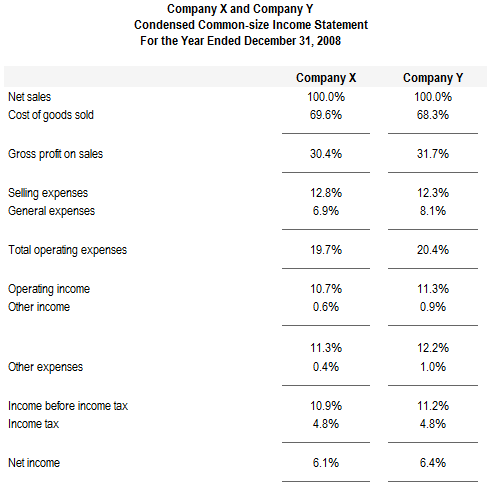

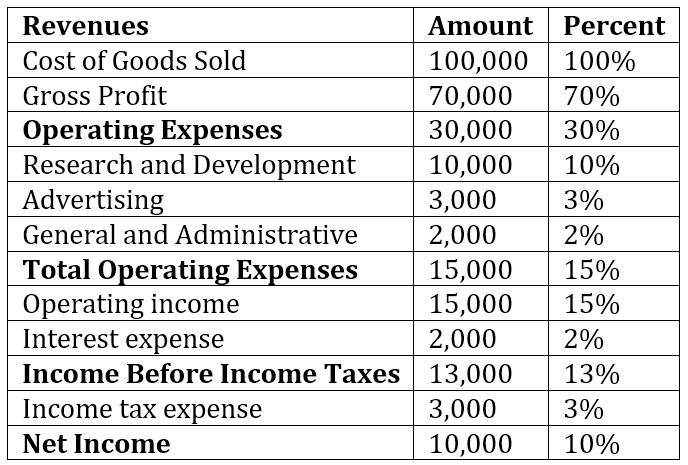

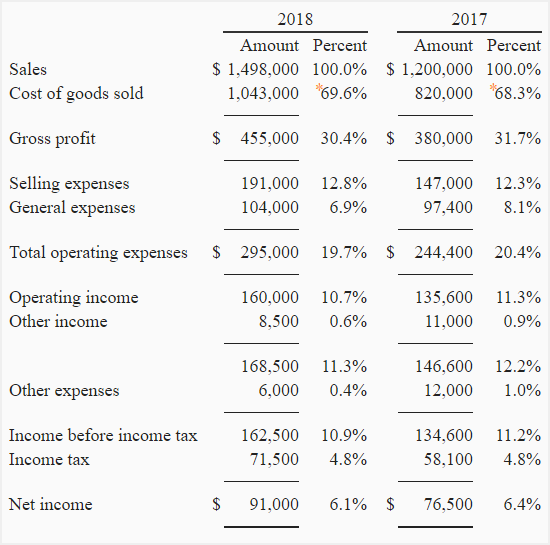

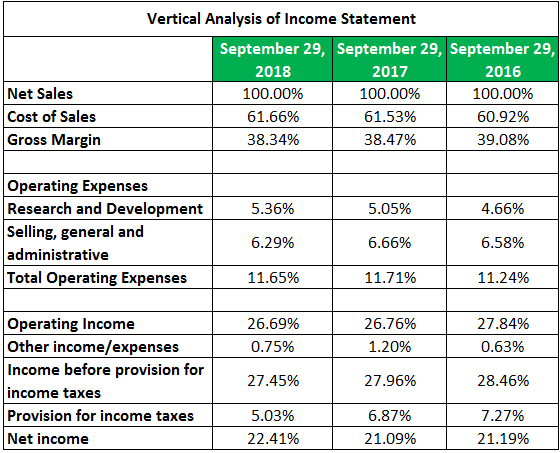

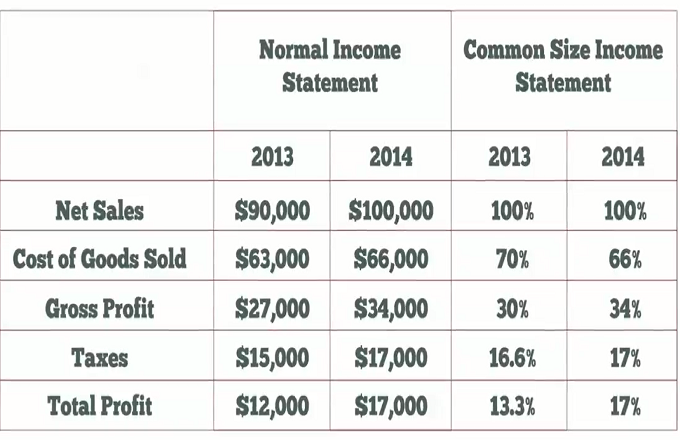

By looking at this income statement we can see that in 2017 the amount of money that the company invested in research and development 10 and advertising 3. The common size income statement for company a shows operating profits are 25 of sales 25 100. It would be good to know how much the sales figure has changed. The statements of an individual business for two or more different periods the statements of two or more different companies in.

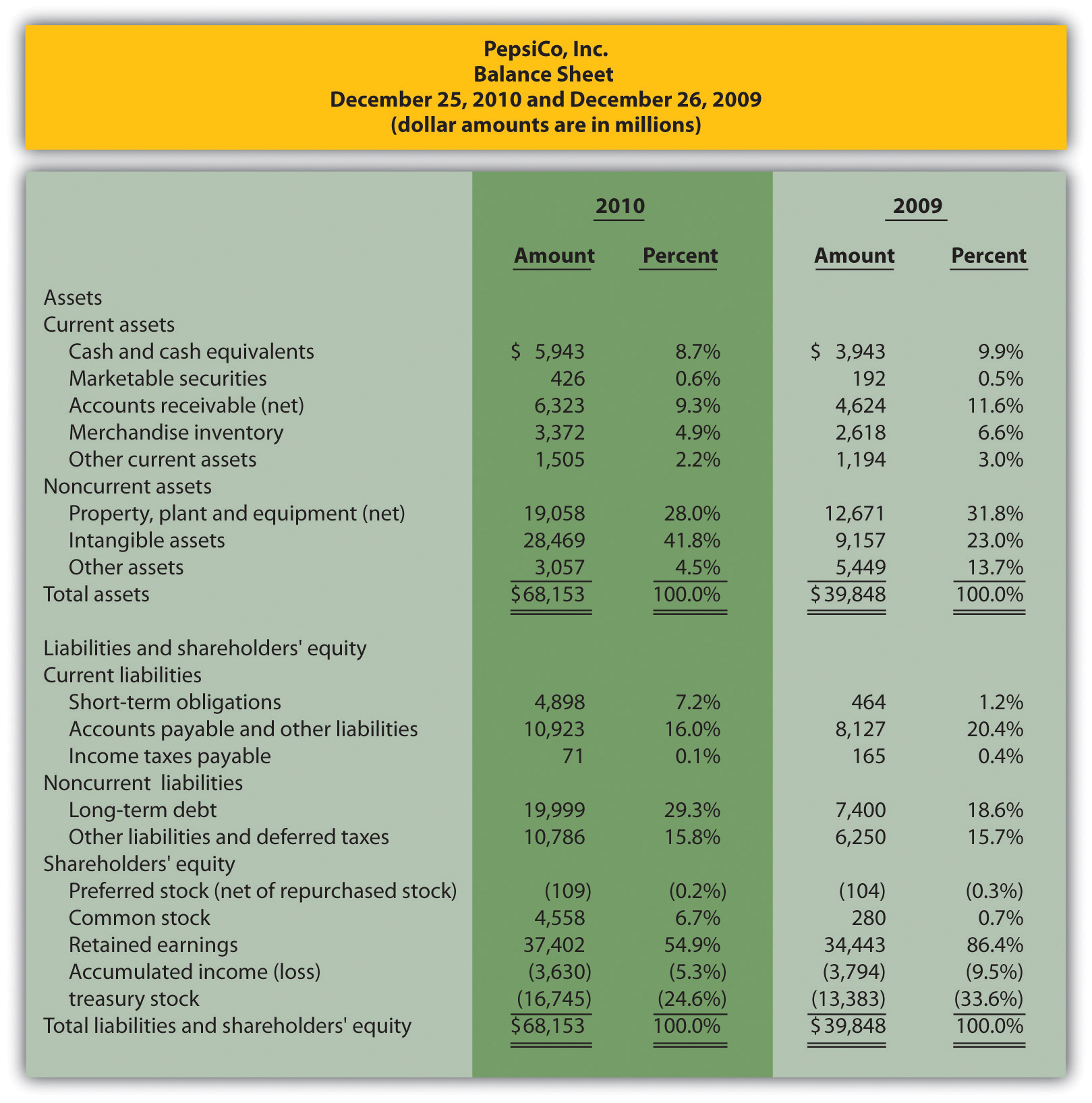

The company also pays interest to the shareholders which is 2 of the total revenue for the year. The term common size income statement refers to the presentation of all the line items in an income statement in a separate column in the form of relative percentages of total sales primarily. Common size statements are helpful in discovering efficiencies and inefficiencies of the management by comparing. Since we are doing a common size analysis we want the growth rate in sales stated as a percentage.

Common size income statements are expressed in percentages instead of amounts. The formula to calculate the growth rate is. Under vertical common size analysis each. Common size statement is one in which all the items are expressed as a percentage of a base item.

Common size income statements can be prepared in two ways. The common size statements make it easy to see that company b is proportionally more profitable and better at controlling expenses. A common size income statement is an income statement in which each line item is expressed as a percentage of the value of sales to make analysis easier.