Income Tax Rates Kansas

In the 2019 tax year the top income tax rate is 5 7 with three income tax brackets.

Income tax rates kansas. The highest kansas tax rate increased from 5 2 to 5 7 last year up from 4 6 for the 2016 income tax year. Kansas income tax rate 2019 2020. Income tax rates in kansas are 3 10 5 25 and 5 70. You will need to complete your federal income tax return prior to completing your kansas k 40.

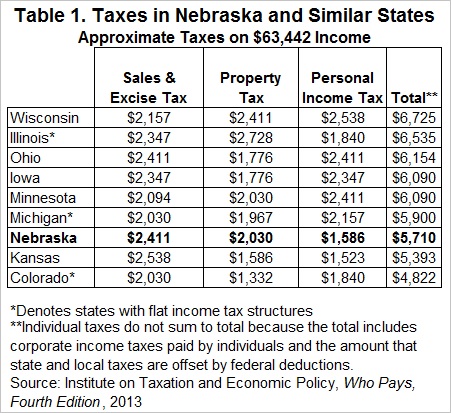

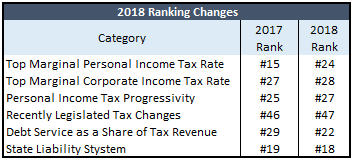

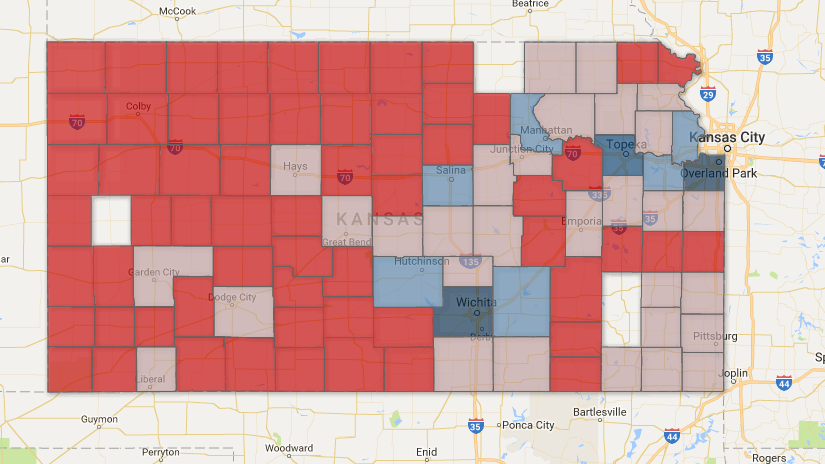

Below we have highlighted a number of tax rates ranks and measures detailing kansas s income tax business tax sales tax and property tax systems. Kansas residents and nonresidents of kansas earning income from kansas sources are required to annually file an income tax return k 40. There are three tax brackets in the sunflower state with your state income tax rate depending on your income level. How does kansas rank.

The first step towards understanding kansas s tax code is knowing the basics. Kansas collects a state corporate income tax at a maximum marginal tax rate of 7 000 spread across two tax brackets. Kansas maximum marginal income tax rate is the 1st highest in the united states ranking directly below kansas. Kansas income tax conforms to many provisions of the internal revenue service.

After years of keeping income taxes to a top rate of 4 6 kansas raised income tax rates for tax year 2017 a change that has so far stuck. Kansas state income tax rate table for the 2019 2020 filing season has three income tax brackets with ks tax rates of 3 1 5 25 and 5 7 for single married filing jointly married filing separately and head of household statuses. Individual income tax tax rates resident married joint. There are a total of twenty four states with higher marginal corporate income tax rates then kansas.

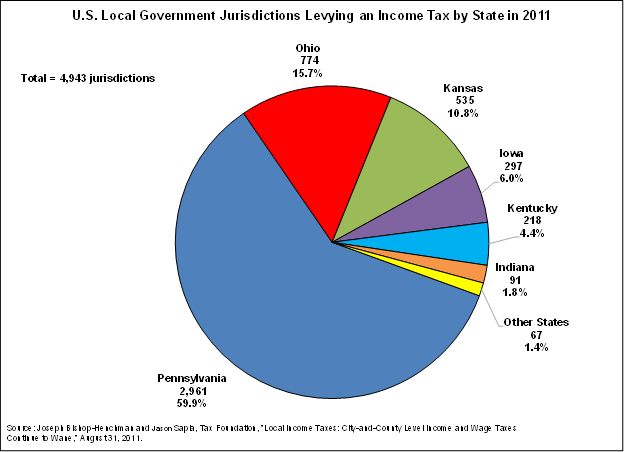

There are no local income taxes on wages in the state though if you have income from other sources like interest or dividends you might incur taxes at the local level. In kansas different tax brackets are. Tax year 2018 and all tax years thereafter taxable income not over 30 000. 79 32 110 taxable income over 30 000 but not over 60 000.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. The flipside of these low income taxes is a sales tax rate that s a bit on the high side. 930 plus 5 25 of excess over 30 000 k s a. Kansas has three marginal tax brackets ranging from 3 1 the lowest kansas tax bracket to 5 7 the highest kansas tax bracket.

Kansas collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Kansas income tax brackets were last changed two years ago for tax year 2018 and the tax rates were previously changed in 2016.