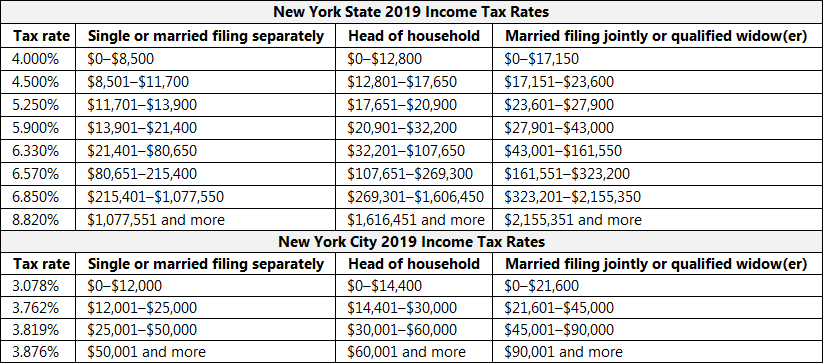

Income Tax Rates New York City

There is no new york city income tax imposed on nonresidents who work in new york city although they may have to pay the resident local income tax in their own municipality.

Income tax rates new york city. Nys taxable income less than 65 000. Nyc tax rate schedule. Married and filing a joint nys return and one spouse was a full year new york city resident and the other was a nonresident for all of the tax year. Today we ll explore what it is the rates for 2020 as well as deductions and available credits.

New york city resident tax. The new york city income tax is one of the few negatives of living in this incredible city. New york city has local income tax for residents so residents of new york city pay only the new york income tax and federal income tax on most forms of income. Nys taxable income 65 000 or more.

:max_bytes(150000):strip_icc()/GettyImages-1161240357-7ccd50e8080a4155a3dc7a24cccbf48e.jpg)