Income Tax Rates Georgia

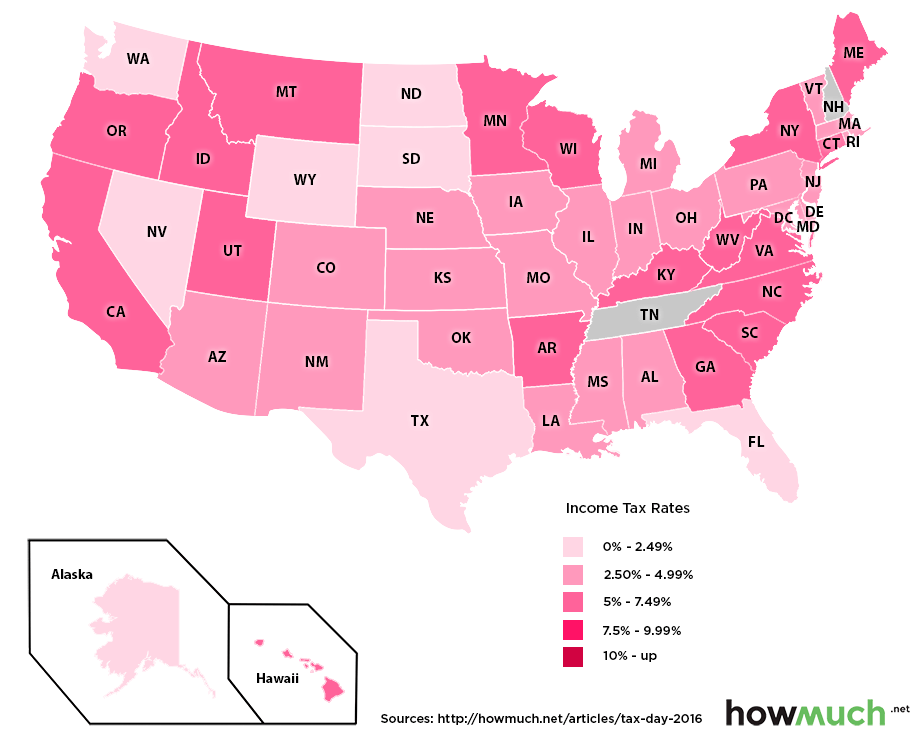

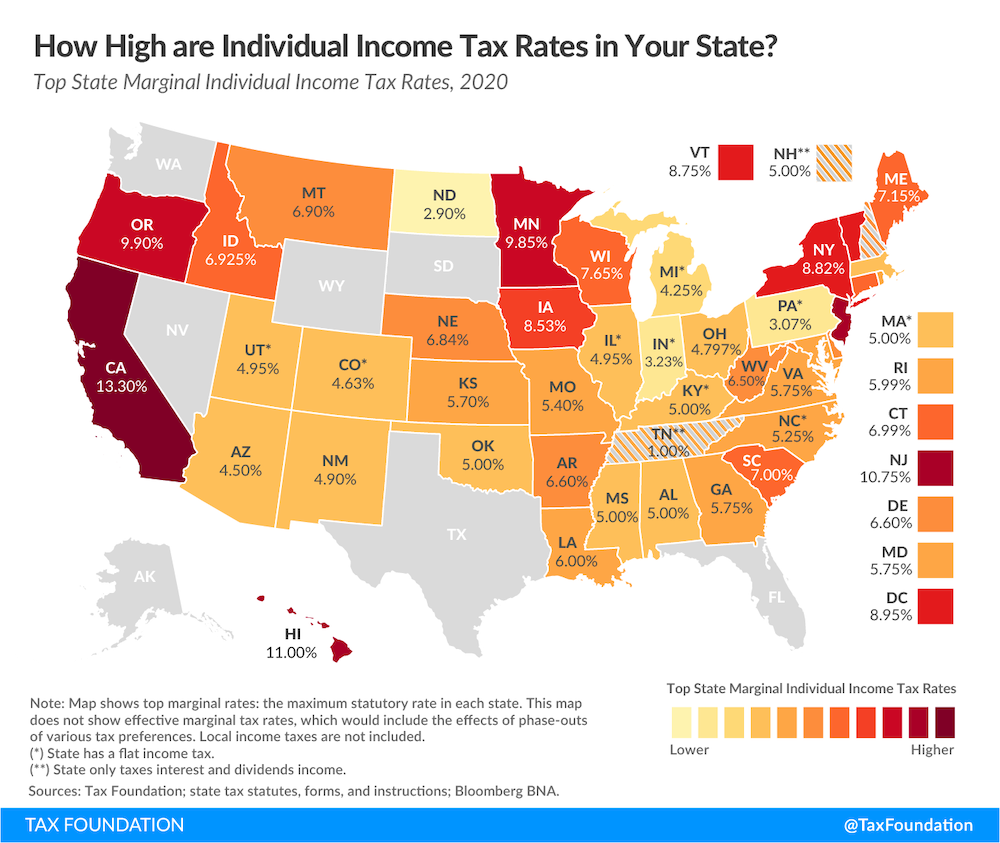

The georgia income tax has six tax brackets with a maximum marginal income tax of 5 75 as of 2020.

Income tax rates georgia. Georgia income tax rate and tax brackets shown in the table below are based on income earned between january 1 2019 through december 31 2019. Detailed georgia state income tax rates and brackets are available on this page. This page provides georgia personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Personal income tax rates.

Georgia s income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009. In georgia different tax brackets are. The top georgia tax rate has decreased from 6 to 5 75 while the tax brackets are unchanged from last year. Personal income tax rate in georgia averaged 18 81 percent from 2004 until 2019 reaching an all time high of 25 percent in 2008 and a record low of 12 percent in 2005.

Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 5 75 the highest georgia tax bracket. Outlook for the 2020 georgia income tax rate is for the top tax rate to decrease further from. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Personal income is subject to a flat tax rate of 20.

The personal income tax rate in georgia stands at 20 percent.