Income Tax Rates On Irrevocable Trusts

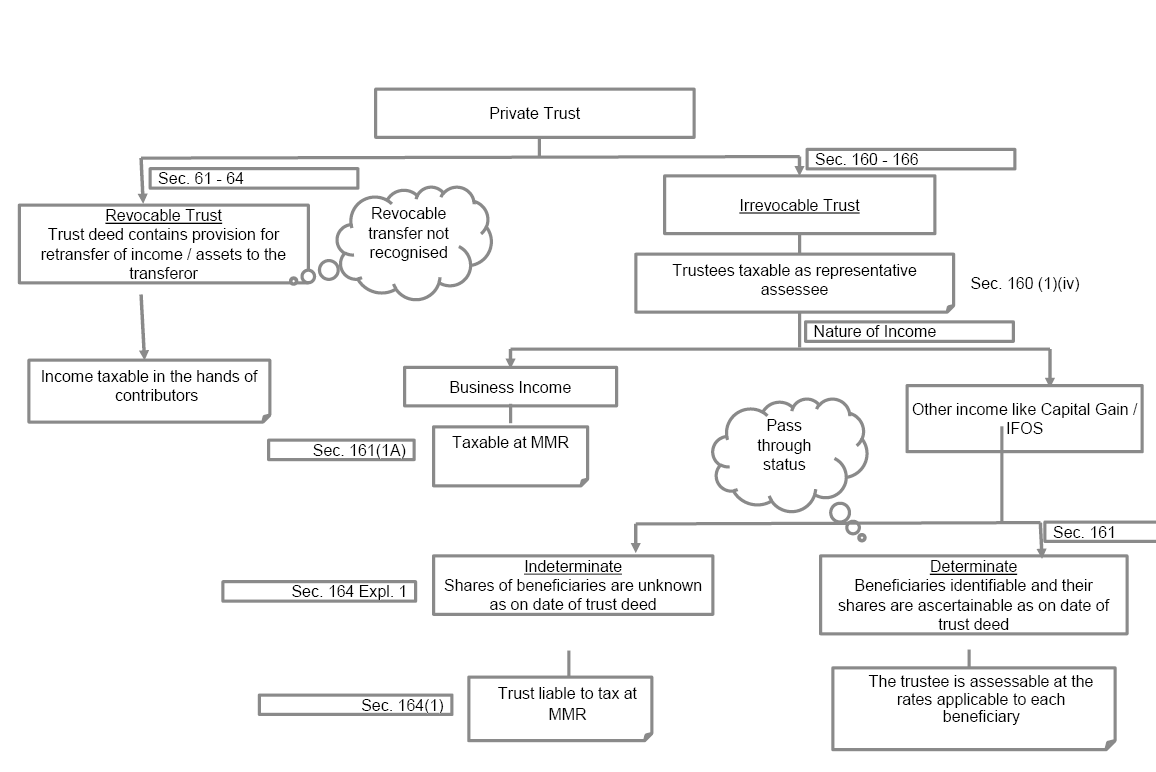

Where the income consists of or includes profits and gains of business the entire income of the trust is charged at the maximum marginal rate of tax except in cases of the a trust which has been declared by any person exclusively for the benefit of any relative dependent on him and also such trust is the only trust so declared by him.

Income tax rates on irrevocable trusts. Here are the rates and thresholds for 2020. The tax rate schedule for estates and trusts in 2020 is as follows. 0 2 600 10. The irs requires trusts to file their own income tax returns known as fiduciary returns using form 1041.

Revocable and irrevocable trusts are treated quite differently under u s. For example an individual making over 12 750 per year is in the 12 tax bracket. In a way that shields them from the 40 estate and gift tax. Here is a chart of the individual income tax rates.

These trusts are designed to terminate upon the grantor s death at which time the assets are distributed to beneficiaries. They re required to file irs form 1041 the u s. If and when the trust makes distributions to beneficiaries those individuals and organizations receiving assets are also subject to tax on. The gst tax exemption amount which can be applied to generation skipping transfers including those in trust during 2020 is 11 580 000 increased from 11 4 million in 2019.

This is because the trust tax brackets are some of the highest in the country. If an irrevocable trust earns income that is ordinarily taxable it is then subject to income tax. Income tax return for estates and trusts. Best online banks.

During the grantor s lifetime the trust s income is reported on the grantor s income tax returns. Irrevocable trusts often mandate required distributions of income to the trust s beneficiaries. Taxable income tax rate. 2 601 9 450 24.

However when the grantor dies the revocable trust becomes irrevocable and cannot be changed. One thing that can be confusing about trust tax brackets is that some trusts follow a fiscal tax year. How irrevocable gift trusts work. The rate remains 40 percent.

The main reason for this disparity is that the assets of a. Trust tax rates follow similar rates to those paid by individuals but reach those rates at much lower thresholds. Tax consequences for revocable and irrevocable trusts. Their tax brackets are adjusted each year for inflation just like personal income tax brackets.

Estates and trusts that generate income during the year are subject to irs set tax rates.