Income Tax Brackets 2020 Nys

This page has the latest new york brackets and tax rates plus a new york income tax calculator.

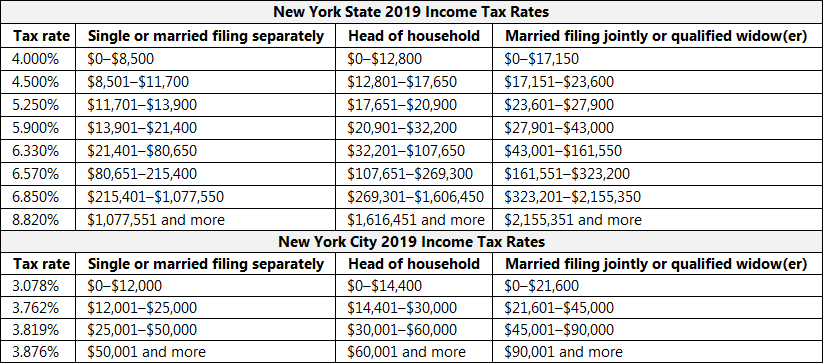

Income tax brackets 2020 nys. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. New york income taxes. 2019 new york tax brackets and rates for all four ny filing statuses are shown in the table below. New york s top marginal income tax rate of 8 82 is one of the highest in the country but very few taxpayers pay that amount.

For your 2019 taxes which you ll file in early 2020 only individuals making. The ny tax forms are below. 2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. For tax year 2020 arkansas s individual income tax rate schedule for high earners has been consolidated from six brackets into four and the top marginal rate dropped from 6 9 to 6 6 percent.

The new york city school tax credit is available to new york city residents or part year residents who can t be claimed as dependents on another taxpayer s federal income tax return. The new york income tax has eight tax brackets with a maximum marginal income tax of 8 82 as of 2020. New york s 2020 income tax ranges from 4 to 8 82. And nys taxable income is 65 000 or more.

For those subject to the middle rate schedule the top rate has dropped from 6 0 to 5 9 percent. Use the nys tax computation. Income tax tables and other tax information is sourced from the new york department of taxation and finance. Nys tax rate schedule.

Nys adjusted gross income is 107 650 or less. Part year nyc resident tax. Details on how to only prepare and print a new york 2020 tax return. The state applies taxes progressively as does the federal government with higher earners paying higher rates.

Detailed new york state income tax rates and brackets are available on this page. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples. And nys taxable income is less than 65 000. You can take a refundable credit of 125 if you re married file a joint return and have income of 250 000 or less.

31 2020 can be e filed in conjunction with a irs income tax return. 2020 new york tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. New york state tax. New york state income tax rate table for the 2019 2020 filing season has eight income tax brackets with ny tax rates of 4 4 5 5 25 5 9 6 21 6 49 6 85 and 8 82.

Nys adjusted gross income is more than 107 650.