Interest Income Yield Definition

Yield on earning assets.

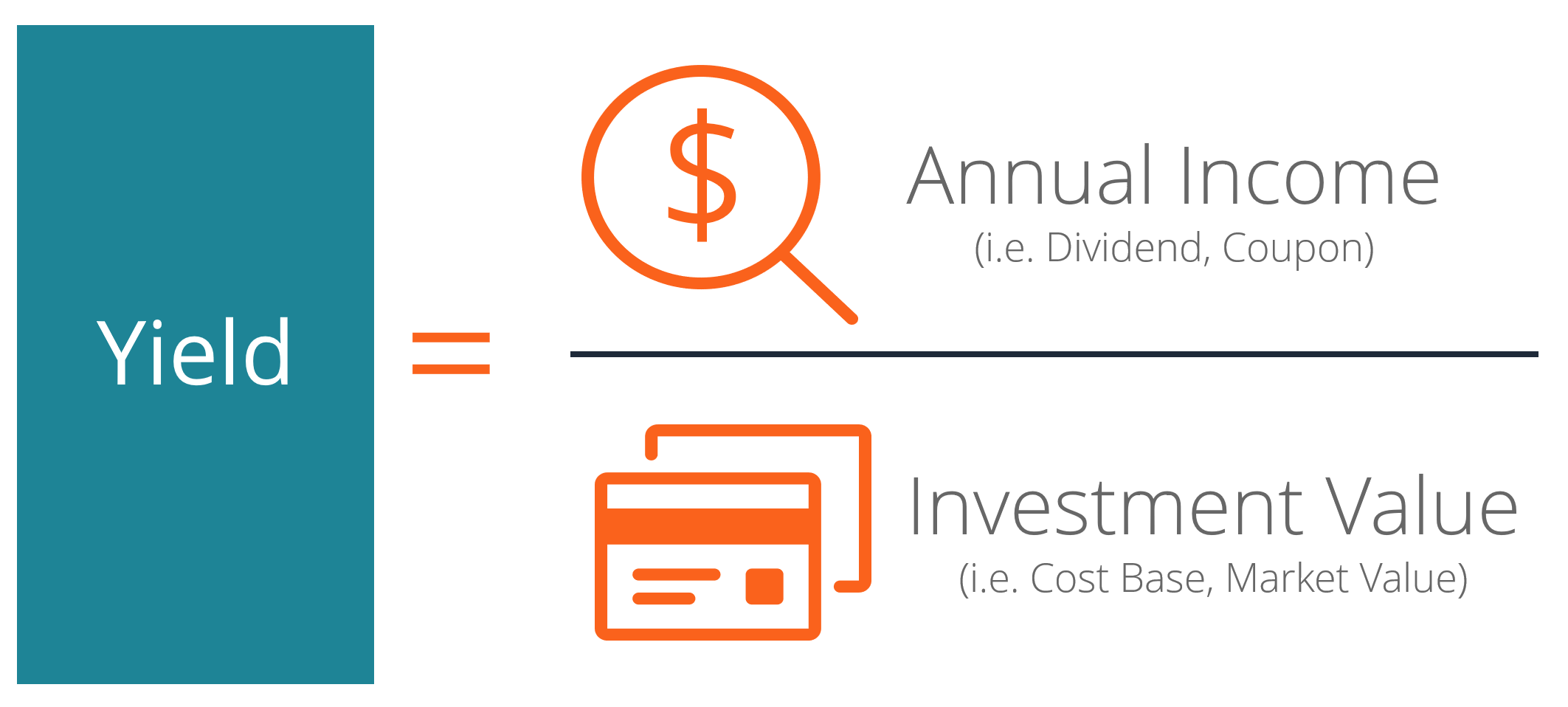

Interest income yield definition. The current yield interest yield income yield flat yield market yield mark to market yield or running yield is a financial term used in reference to bonds and other fixed interest securities such as gilts it is the ratio of the annual interest payment and the bond s current clean price. Interest income is money earned by an individual or company for lending their funds either by putting them into a deposit account in a bank or by purchasing certificates of deposits callable certificate of deposit a callable certificate of deposit is an fdic insured time deposit with a bank or other financial institutions. This practice referred to as burning the yield is done. A striking difference between a yield and an interest rate is that yield is the profit made on an investment and an interest rate is the reason behind such a profit.

Interest income is the revenue earned by a lender for use of his funds or an investor on their investment over a period of time. Net interest income is a financial performance measure that reflects the difference between the revenue generated from a bank s interest bearing assets and expenses associated with paying on its. Yield on earning assets yea indicates how well assets are. This revenue is typically taxable and reported in the other income section of the income statement.

The current yield only therefore refers to the yield of the bond at the current moment. Interest yield the interest paid on a bond or loan stock etc expressed as a percentage of the current market price of the bond or stock. A financial solvency ratio that compares a financial institution s interest income to its earning assets. The average yield on is the sum of all interest dividends or other income that the investment generates divided by the age of the investment or length of time the investor has held it.

For example a bond offering an interest payment of 10 per year and having a current market price of 50 would have a yield of 20.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)