Income Tax Brackets 2020 Nyc

2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1.

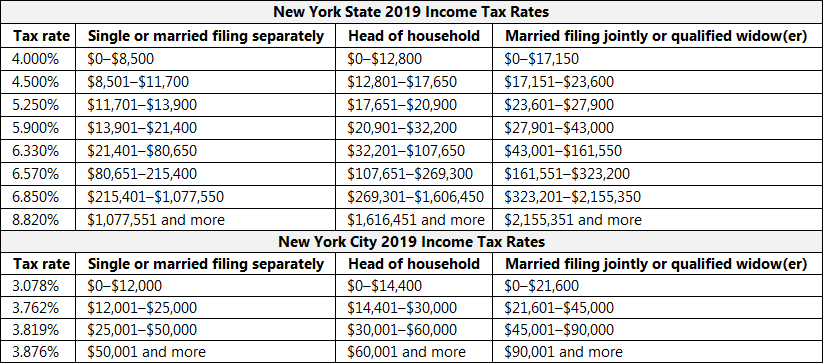

Income tax brackets 2020 nyc. Income tax tables and other tax information is sourced from the new york department of taxation and finance. New york s top marginal income tax rate of 8 82 is one of the highest in the country but very few taxpayers pay that amount. 2019 new york tax brackets and rates for all four ny filing statuses are shown in the table below. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

New york state income tax rate table for the 2019 2020 filing season has eight income tax brackets with ny tax rates of 4 4 5 5 25 5 9 6 21 6 49 6 85 and 8 82. Taxes on director s fee consultation fees and all other income. 2020 new york tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. From year 2023 onwards the income tax rates will be further adjusted as follows.

From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. The new york income tax has eight tax brackets with a maximum marginal income tax of 8 82 as of 2020. There is no new york city income tax imposed on nonresidents who work in new york city although they may have to pay the resident local income tax in their own municipality. The state applies taxes progressively as does the federal government with higher earners paying higher rates.

Detailed new york state income tax rates and brackets are available on this page. Those earning between p250 000 and p400 000 per year will be charged a lower income tax rate of 15 on the excess over p250 000. New york s 2020 income tax ranges from 4 to 8 82. New york income taxes.

The new york city school tax credit is available to new york city residents or part year residents who can t be claimed as dependents on another taxpayer s federal income tax return. Those earning an annual salary of p250 000 or below will continue to be exempted from paying income tax. For your 2019 taxes which you ll file in early 2020 only individuals making. New york city has local income tax for residents so residents of new york city pay only the new york income tax and federal income tax on most forms of income.

This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals.