Negative Interest Expense On Income Statement

For example 500 tool purchase in january returned for refund resulting in 500 credit in tool expense for march.

Negative interest expense on income statement. However they believed that the negative interest could be included as part of the net interest income or expense. Interest expense is one of the core expenses found in the income statement income statement the income statement is one of a company s core financial statements that shows their profit and loss over a period of time. One committee member said it was confusing to her that this negative interest would still be included in the effective interest rate and it would therefore be disclosed under ifrs 7 as part of interest income and expense. Entry in a later month or year results in a credit or negative entry in the expense account.

A corresponding credit entry is then made to the income tax expense account decreasing the amount of expenses for the current year. If the number is positive the net effect of the two means expense. In non accounting terms this is a mistake. It represents interest payable on any borrowings bonds loans convertible debt or lines of credit.

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of. Year to date expense correctly stated miscode. Net refers to the fact that management has simply subtracted interest income from interest expense to come up with one figure. Total operating income or ebit is derived by subtracting your operating expenses and.

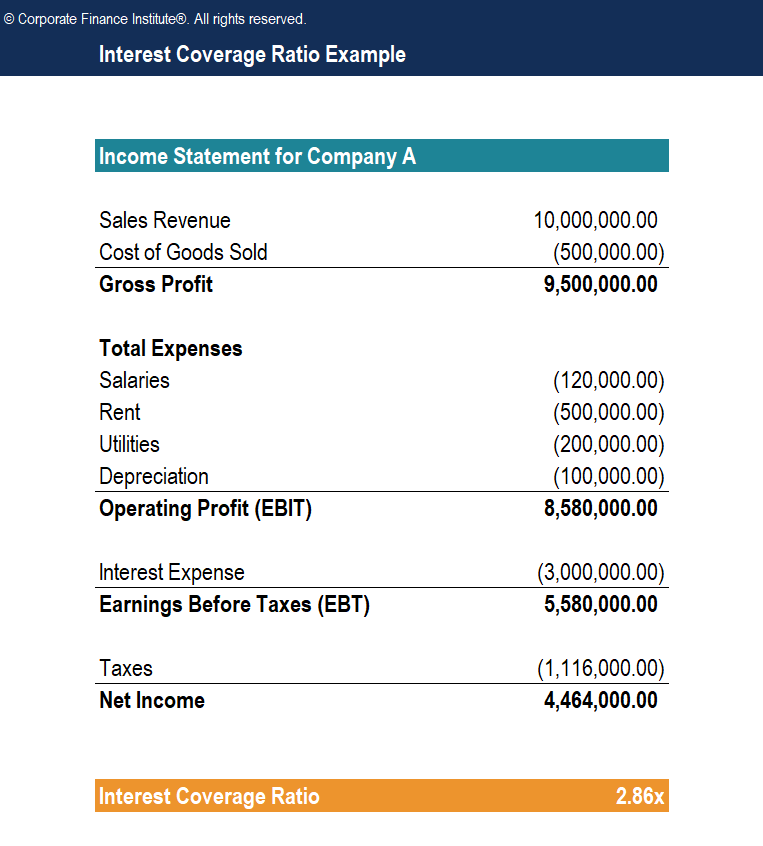

In other words if a company paid 20 in interest on its debts and earned 5 in interest from its savings account the income statement would only show interest expense net of 15. As a result of this analysis the staff recommended the following presentation in the statement of comprehensive income. Sometimes interest expense is combined with interest income. This applies accordingly to interest resulting from a negative interest rate on a financial liability which must not be presented as a negative part of interest expense i e a reduction.

Net interest expense is the total interest net of any interest income that a company receives on investments. Interest expense is a non operating expense shown on the income statement. On a financial statement the income can be listed separately from expenses or provide a net interest number which is either positive or negative. On an earnings statement your interest expense is deducted from your total operating income.

The variance report notes the correction. Entering negative liability if a business is fortunate enough to have a negative tax liability due to tax credits the entries vary depending on how the owner wishes to report this.