Income Tax Method Definition

Has a profit of 5 000 after considering the interest receivable of 500 but as per income tax interest is taxable when it actually received.

Income tax method definition. The objective of stabilization implemented through tax policy government expenditure policy monetary policy and debt management is that of maintaining high employment and price stability. Don t confuse these two accounting methods with the two types of gst accounting methods cash and non cash. Income tax payable is one component necessary for calculating an organization s deferred tax liability. Contributions by girija gadre arti bhargava and labdhi mehta.

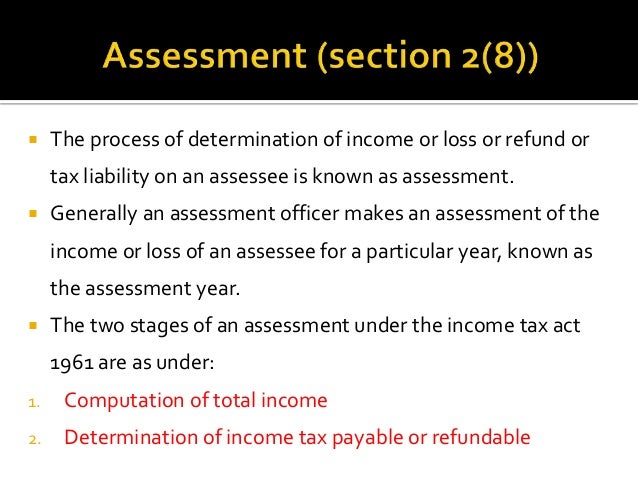

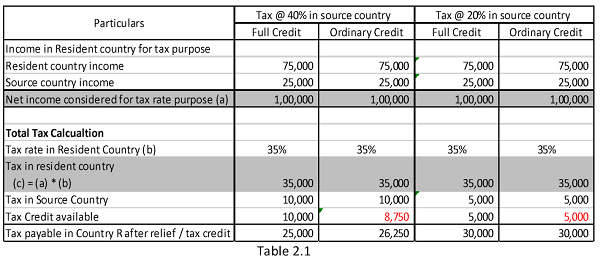

The amounts you include as your assessable income in any income year depend on whether you account for your income on a cash basis or accruals basis. 2 deferred tax liabilities dtl dtl arises when book profit is more than profit calculated as per tax we understand this with the below example. An example of a tax deduction is a realized capital loss on a stock which can be deducted from your overall income tax bill so long as the shares sold were owned for investment purposes. Income tax method of accounting means the accounting basis used to prepare financial statements for united states federal income tax purposes provided such basis is consistent with federal income tax requirements for members who are taxed as corporations under the internal revenue code.

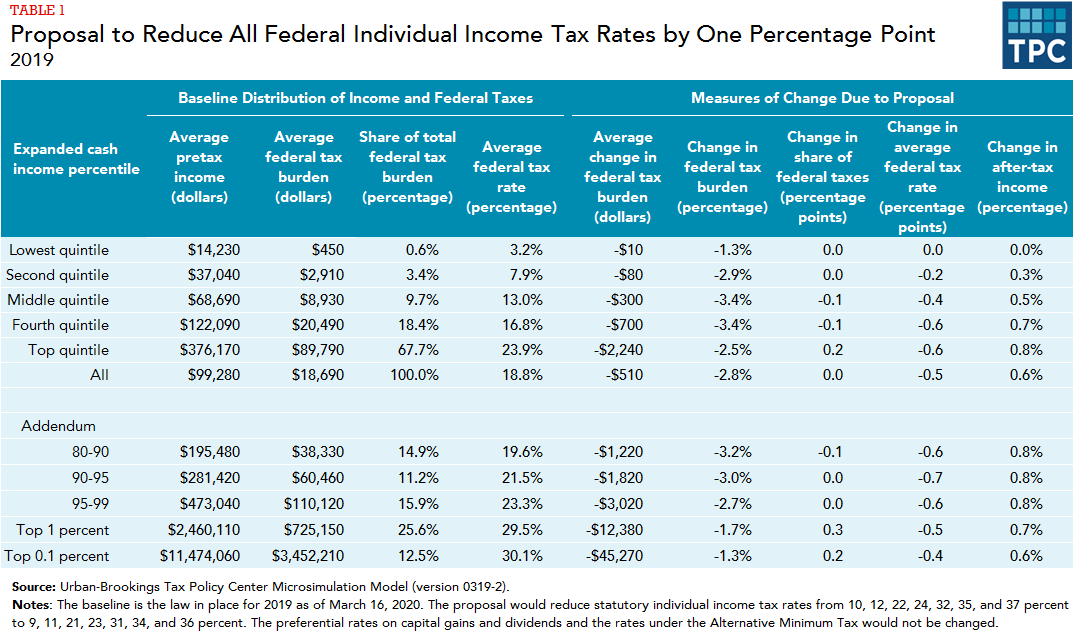

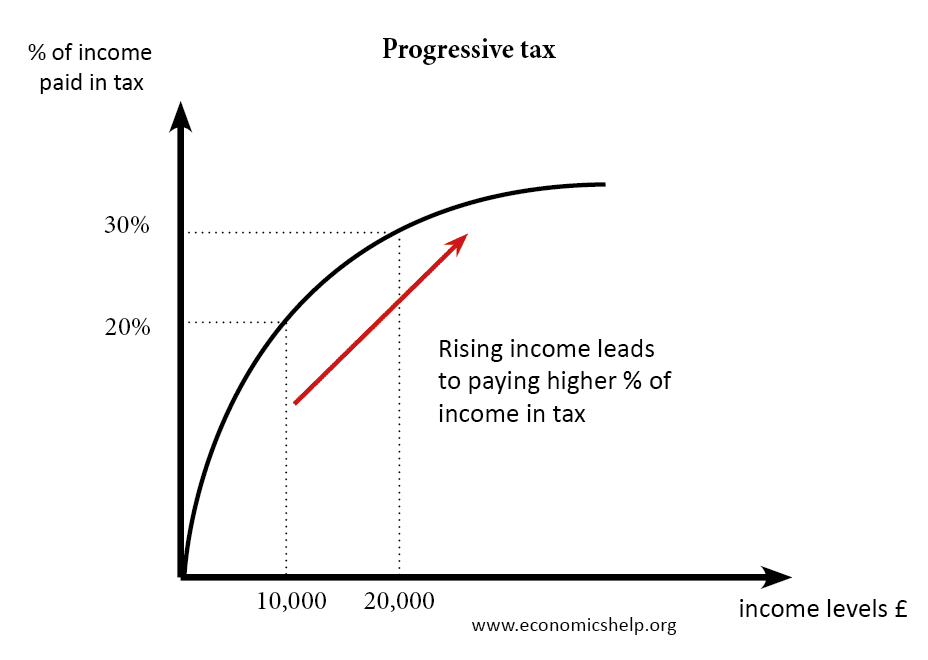

Mercantile system of accounting requires recording all transactions when they accrue or when they become due. Under cash system of accounting transactions are only recorded when actually paid or received. The second objective income redistribution is meant to lessen inequalities in the distribution of income and wealth. The income tax system in the united states is considered a progressive system although it has been growing flatter in recent decades.

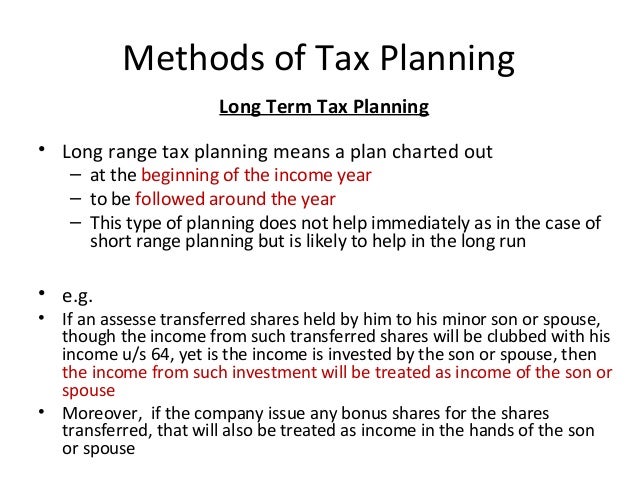

In 2020 there are only seven tax brackets with rates of 10. The income approach is a real estate appraisal method that allows investors to estimate the value of a property based on the income it generates. The income tax act permits two methods of accounting mercantile system of accounting and cash system of accounting. Accounting methods for business income.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/income-tax-4097292_19201-3af2a17857e34c5fb24b9986fa3d1991.jpg)