Us Income Tax Withholding History

Precedents for withholding u s.

Us income tax withholding history. The additional 3 8 percent is still applicable making the maximum federal income tax rate 40 8 percent. Tax system the u s. In their history of the u s. When both the united states of america 1861 1871 and the confederate states of america 1863 1865.

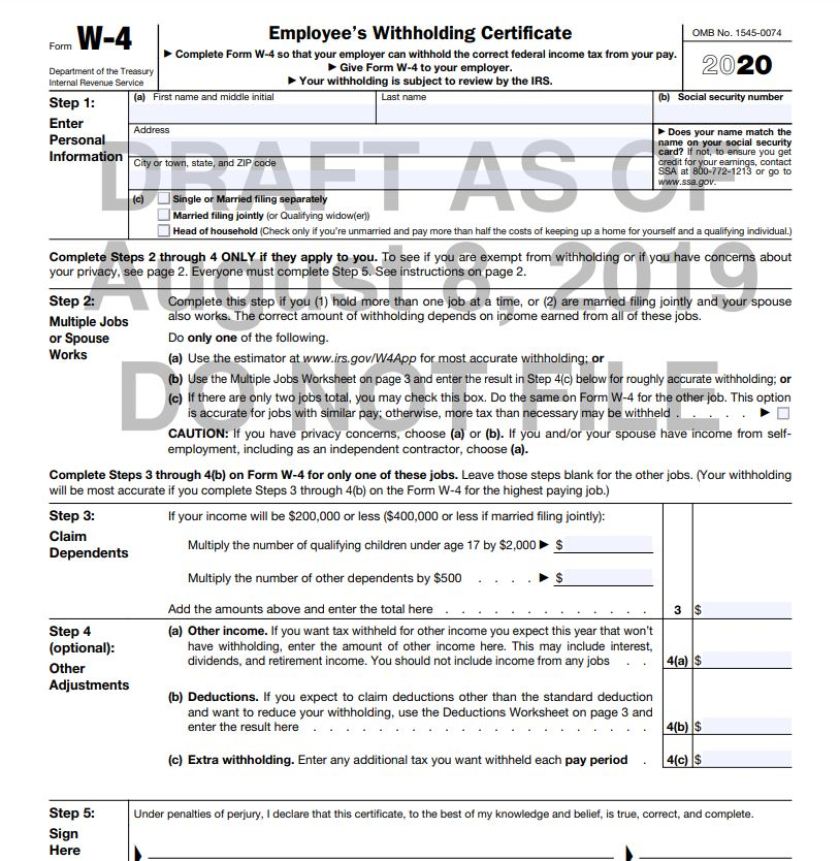

You can use the tax withholding estimator to estimate your 2020 income tax. The first state income tax as the term is understood today in the united states was passed by the state of wisconsin in 1911 and came into effect in 1912. The amount you earn. This greatly eased the collection of the tax for both the taxpayer and the bureau of internal revenue.

However it also greatly reduced the taxpayer s. This history is important because it shows that the tax law is always changing. The highest income tax rate was lowered to 37 percent for tax years beginning in 2018. The introduction of the mandatory withholding tax on employee wages in 1943 increased tax revenue to almost 45 billion by 1945.

Taxes go back as far as the war between the states when the treasury withheld taxes owed by federal employees under the income tax law adopted in 1862 until an 1864 amendment exempted federal salaries from taxation. All persons making us source payments to foreign persons withholding agents generally must report and withhold 30 of the gross us source payments such as dividends interest and royalties. The money taken is a credit against the employee s annual income tax. Department of treasury describes tax withholding.

Maryland individual added county withholding tax and non resident tax. During world war ii congress introduced payroll withholding and quarterly tax payments with the vote of the current tax payment act of 1943. The amount of income tax your employer withholds from your regular pay depends on two things. Under us domestic tax laws a foreign person generally is subject to 30 us tax on the gross amount of certain us source non business income.

The history of taxation in the usa begins with the colonial protest against british taxation policy in the 1760s leading to the american revolution the independent nation collected taxes on imports whiskey and for a while on glass windows states and localities collected poll taxes on voters and property taxes on land and commercial buildings. The information you give your employer on form w 4. For help with your withholding you may use the tax withholding estimator. What this means for you.

In 2010 the irs collected nearly 1 2 trillion through income tax on individuals and another 226 billion from corporations.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png)