Income Tax Car Definition

An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income.

Income tax car definition. The definition includes cars that are 100 battery electric or have plug in hybrid powertrains. Income tax is used to fund public services pay government. Tax preparation fees legal services bookkeeping and advertising costs can also be used to reduce business income. Taxation rates may vary by type or characteristics of the taxpayer.

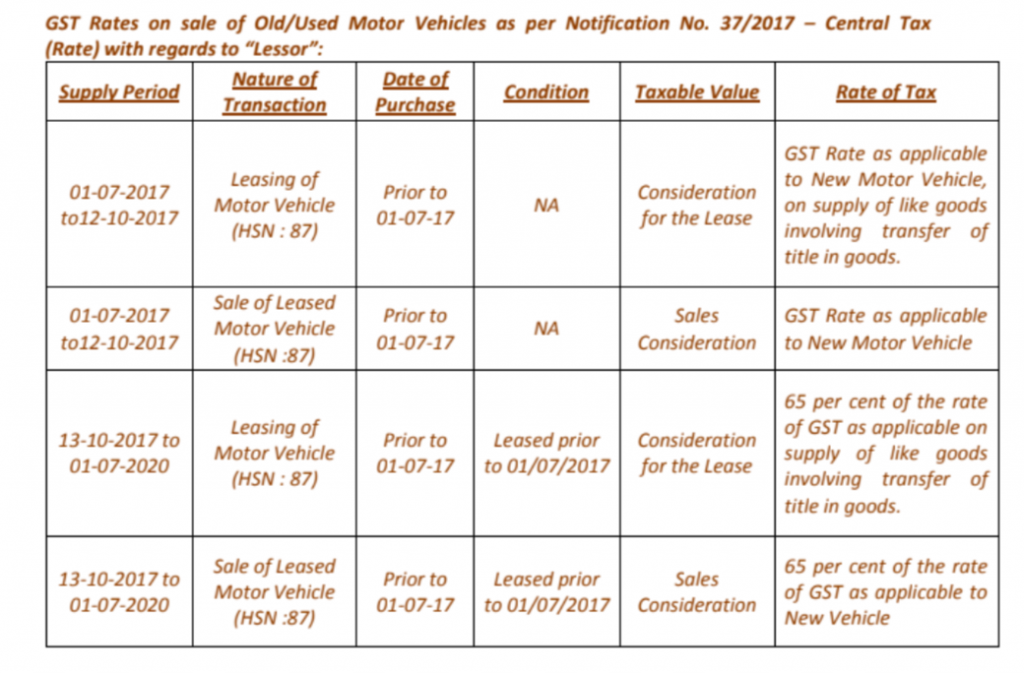

According to the amendment in respect of heavy goods vehicle the minimum income per vehicle. Vehicle income tax vit taxes in the informal sector. Recently the provisions of section 44ae of the income tax act have been amended w e f. Our tax team look at hmrc s definitions of a car a van and a car derived van or combi van.

01 04 2019 i e from assessment year 2019 20 by the finance act 2018. Registered vehicles that are not being used or parked on public roads and which have been taxed since 31 january. Income tax generally is computed as the product of a tax rate times taxable income. Vehicle income tax vit this is a tax collected from commercial vehicle operators on quarterly basis.

Income under section 44ae whether to be computed as per gross vehicle weight or unladen weight introduction. This information relates to car expenses only. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. A company car will generate a benefit in kind based on 0 to 37 of the list price depending on the emissions the car generates cars that generate 1 to 50 g km of co2 now dependent on their electric mileage range if the car is available.

In addition to income tax rebates or. If you use your own car in performing your work related duties including a car you lease or hire you may be able to claim a deduction for car expenses. Vehicle excise duty ved also known as vehicle tax car tax or road tax and formerly as a tax disc is an annual tax that is levied as an excise duty and which must be paid for most types of vehicles which are to be used or parked on public roads in the united kingdom. If the travel was partly private you can claim only the work related portion.

The govt has decided to provide an additional income tax deduction of 1 5 lakh on the interest paid on loans taken to purchase electric vehicles sbi launched green car loan in april 2019 which. Special considerations a central issue relating to corporate taxation is the.