Income Limits While On Social Security

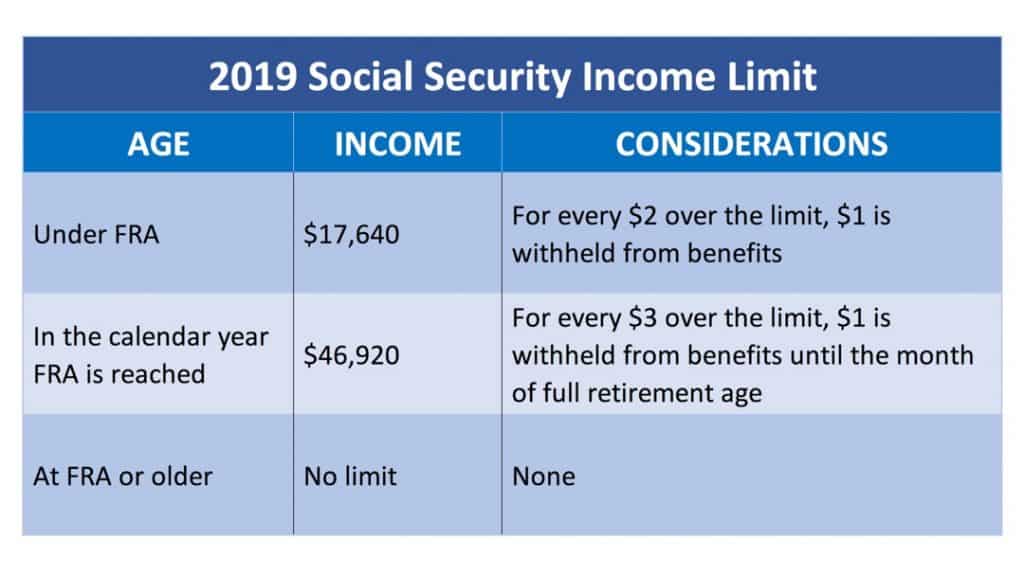

In the year you reach full retirement age.

Income limits while on social security. For every 3 you earn over the income limit social security will withhold 1 in benefits. If you will reach full retirement age during that same year it will be reduced every month until you reach full. Even if you file taxes jointly social security does not count both spouses incomes against one spouse s earnings limit it s only interested in how much you make from work while receiving benefits. Social security s annual earnings limit the maximum people who claim social security early can make from work without triggering a benefit reduction no longer applies as of the month you attain full retirement age which is currently 66 and is gradually rising to 67 over the next several years.

The amount of money you can earn before losing benefits will depend on how old you are. 28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages. The 17 640 amount is the number for 2019 but the dollar amount of on the income limit will increase on an annual basis going forward. If you re collecting social security but haven t yet reached fra and won t be.

We hope this post on ssi income limits was helpful. 2020 s earnings test limits. Social security benefits are not. For every 2 over the limit 1 is withheld from benefits.

In other words if your income exceeds the cap on yearly earnings which in 2020 is 18 240 for people who claim benefits before full retirement age social. Limits on income while receiving social security benefits. For every 3 over the limit 1 is withheld from benefits until the month you reach full retirement age. If you have further questions about social security ssi or ssdi please let us know in the comments section below.

Find out the earnings limits that apply to those who claim social security benefits before reaching full retirement age. No limit on earnings. If you take social security benefits before you reach your full retirement age and you earn an annual income in excess of the annual earnings limit for that year your monthly social security benefit will be reduced for the remainder of the year in which you exceed the limit. Historically social security was designed to replace earnings lost due to disability and retirement.

For every 2 over the limit 1 is withheld from benefits. Be sure to check out our other articles on social security including ssi payments schedule and social security questions and answers. You need to keep up with the year to year changes to stay informed. Under full retirement age.

Your 2020 guide to working while on social security the motley fool.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)