Income Tax Rate 2020 In Ghana

As for non residents on the other hand the same payment calls for a 15 wht rate but considered final.

Income tax rate 2020 in ghana. Residents are subject to tax at rates ranging between 0 and 30 on the following annual graduated scale of income. 2 act 2018 act 979. Amendments to the income tax act 2015 act 896 the commissioner general of the ghana revenue authority gra wishes to inform the general public that the following amendments have been made to the income tax act 2015 act 896 by the income tax amendment act 2019 act 1007. This part is useful for everybody.

The ghana revenue authority has announced the passage of the income tax amendment act 2019 act 1007 which includes amendments to the individual income tax brackets and rates for 2020. In the long term the ghana personal income tax rate is projected to trend around 25 00 percent in 2021 according to our econometric models. Gh 400 x 5 gh 20. Following tax proposals made by the government of ghana in the 2019 budget and economic policy statement tax amendments have been passed to give legal backing to the implementation of the proposals.

That is income tax amendment no. Non residents pay taxes at the flat rate of 25. Personal income tax rate in ghana is expected to reach 25 00 percent by the end of 2020 according to trading economics global macro models and analysts expectations. It is built using the latest tax rates from ghana revenue authority gra.

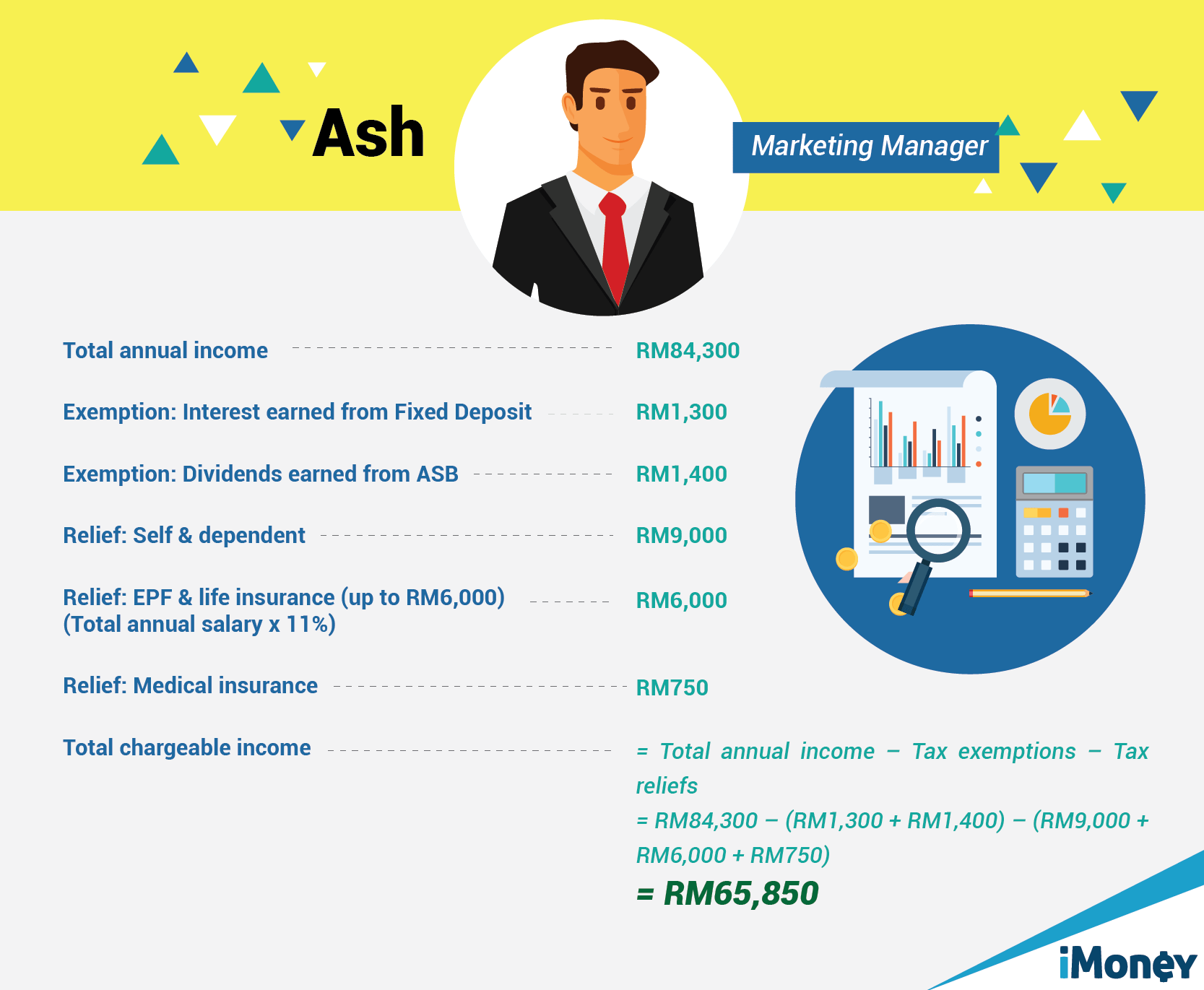

Kofi s qualifying employment income is gh 12 000 800 x 12 200 x 12 50 of kofi s basic salary is gh 400 800 x 50 overtime pay is gh 500. His overtime pay for the month is gh 500. Income tax types in ghana. The government of ghana acquires its income tax in several ways.

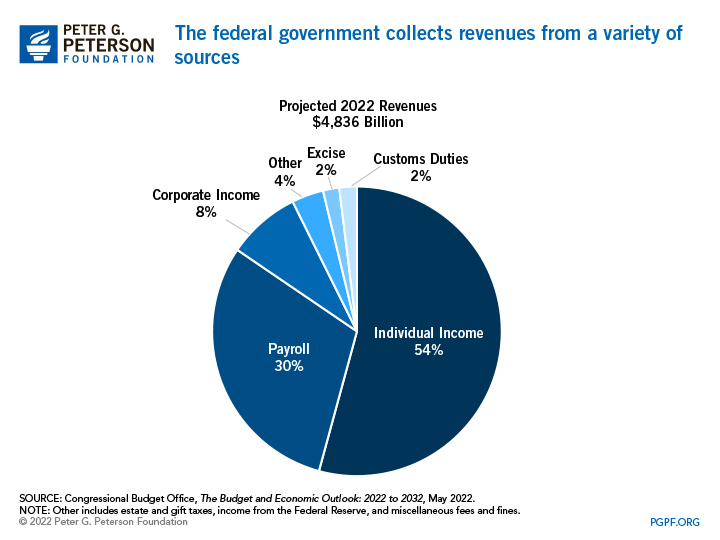

It contributes largely to the total revenue of the country. 1 the annual maximum tax rate applicable on chargeable income exceeding ghs 240 000 remains at 30 percent. Withholding tax in ghana 2020 features some noticeable changes both in resident and non resident persons. This tax is usually imposed to all companies operating in ghana.

Pay as you earn paye. New tax rates effective 1 st january 2020. Notably the personal income tax rates applicable to resident individuals have been revised to take effect from 1 january 2019. Ghana paye calculator calculates your income tax based on your salary and ssnit contribution 5 5 and gives you an accurate representation of what you are to pay.

This tax is usual at a flat rate of 25. Over ghs 3 828 up to 5 028 5. For resident individuals the rates and brackets are as follows based on annual income. Overtime tax is computed as follows.

These include the following. Up to ghs 3 828 0.