Us Kenya Income Tax Treaty

Article 21 3 of the un model tax convention provides for source based taxation of other income.

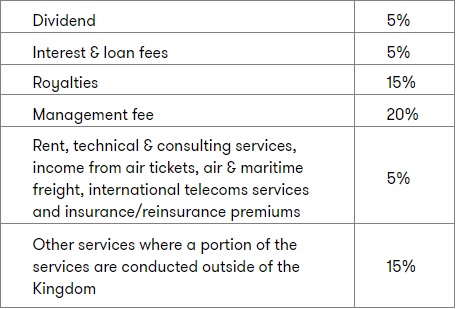

Us kenya income tax treaty. Foreign tax credits are claimable where there is a double tax treaty dtt between kenya and the other tax jurisdiction. Unilateral tax credits are also available for kenyan citizens. The income tax treaty applies to all persons who are residents of kenya or mauritius or both countries and applies to all income taxes or taxes that are of a substantially similar character to income tax. Withholding tax paid abroad may be claimed against kenya income tax only if there is a unilateral or bilateral provision for relief.

Newly listed companies enjoy a reduced rate for 3 5 years following the year of listing the rate 20 27 and period depending on the percentage of capital listed must be more than 20. A protocol to the treaty was also signed. Kenya has only eleven bi lateral tax treaties that allow for direct tax offsets and relief from double taxation. It gives states the right to tax other income where their domestic legislation provides for the taxation of that income.

Kenya has dtts in force with the following countries. The united states has tax treaties with a number of foreign countries. These reduced rates and exemptions vary among countries and specific items of income. Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from u s.

Withholding tax paid abroad. Kenya corporate income tax. Treaty resident who receives income from a treaty country and who is subject to taxes imposed by foreign countries may be entitled to certain credits deductions exemptions and reductions in the rate of taxes of those foreign countries. Kenya uk dtaa mainly based on the oecd model.

Treaty provisions generally are reciprocal apply to both treaty countries. The general corporate income tax rate in kenya is 30 with a branch of a foreign company taxed at 37 5. Grants uk favourable taxation rights at kenya s.