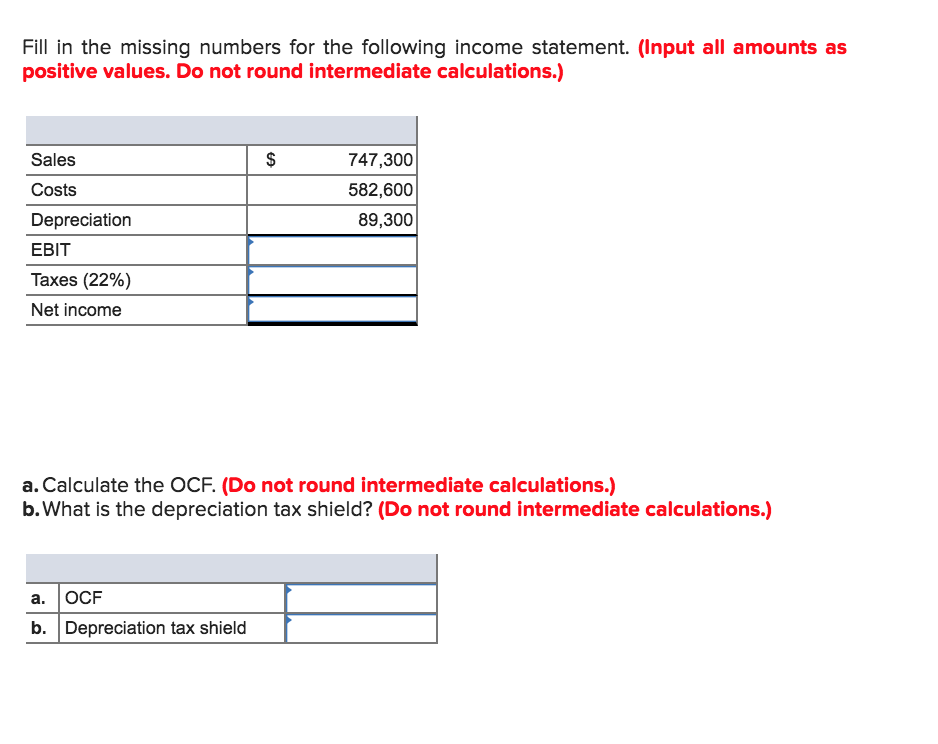

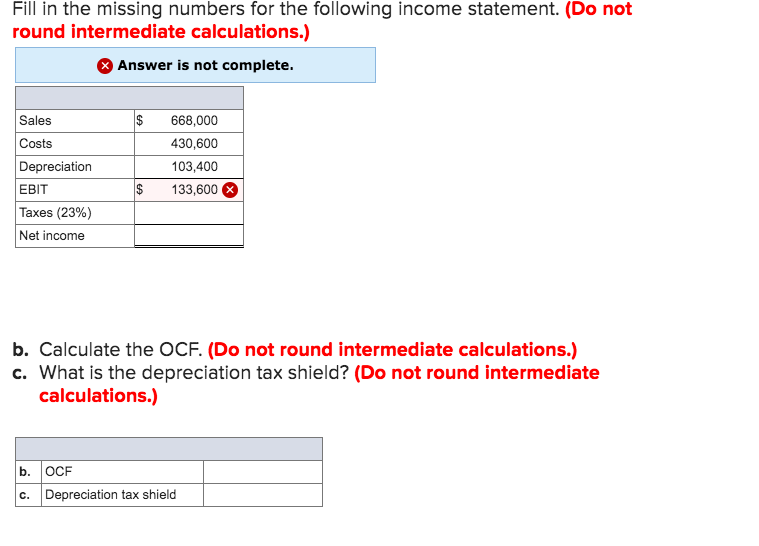

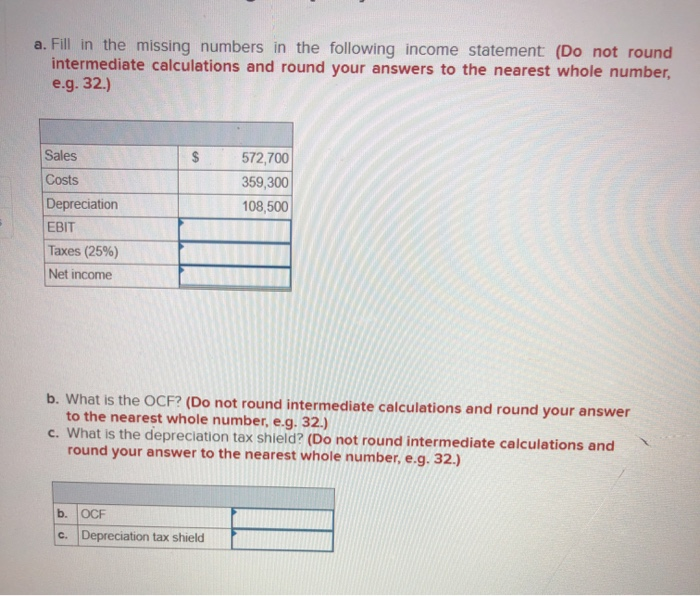

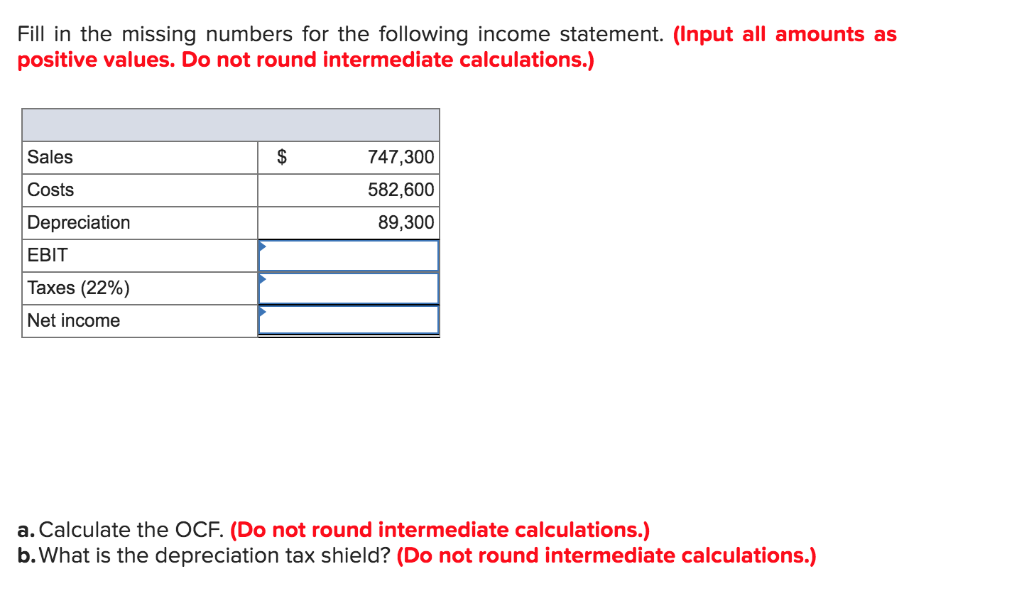

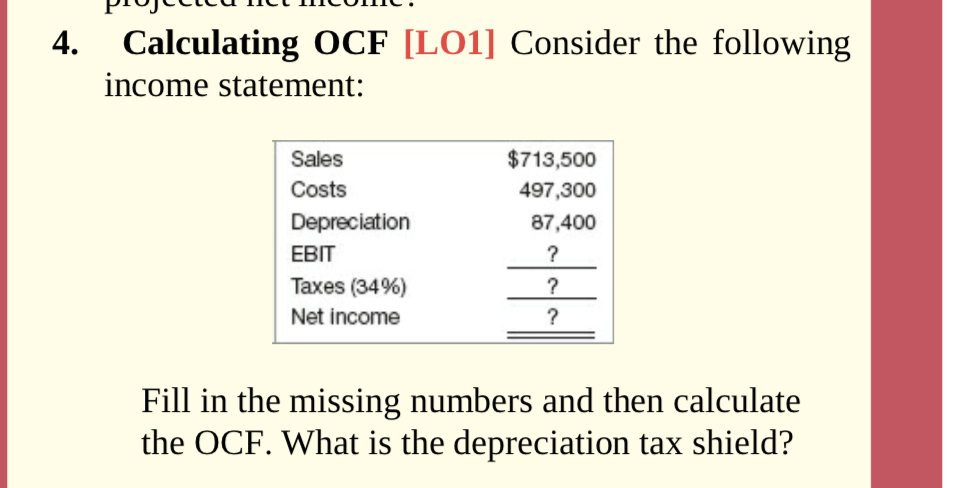

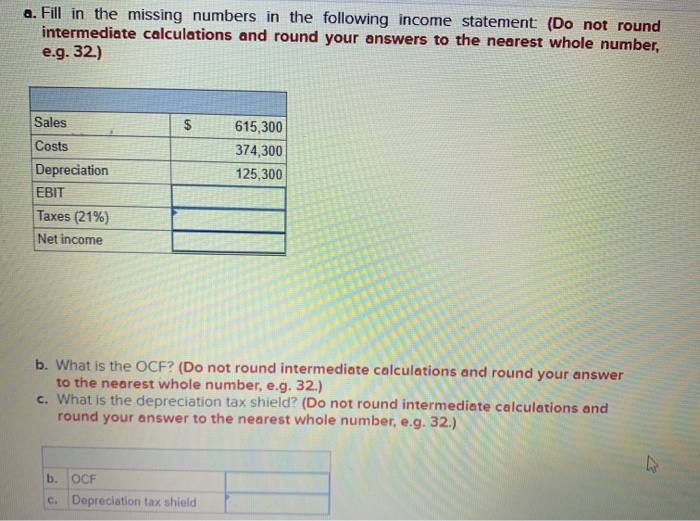

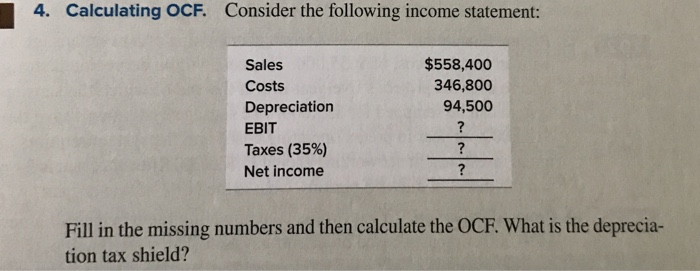

Depreciation Missing Income Statement

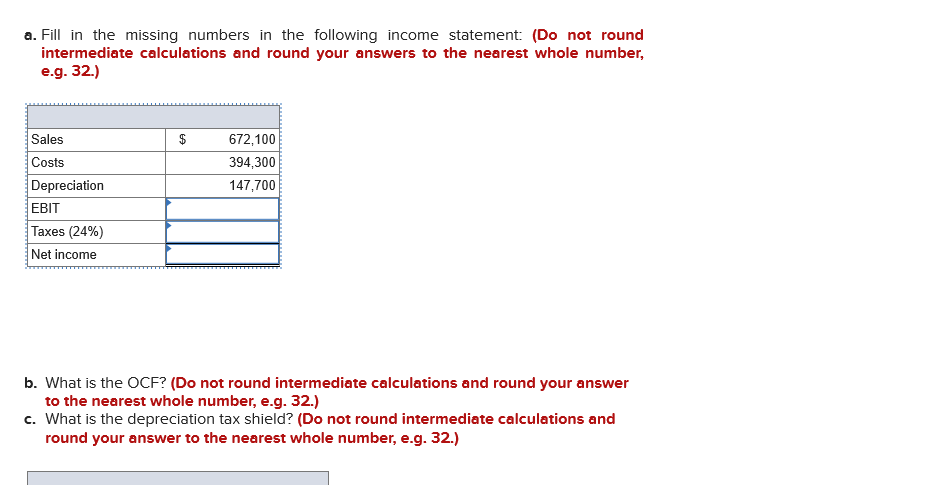

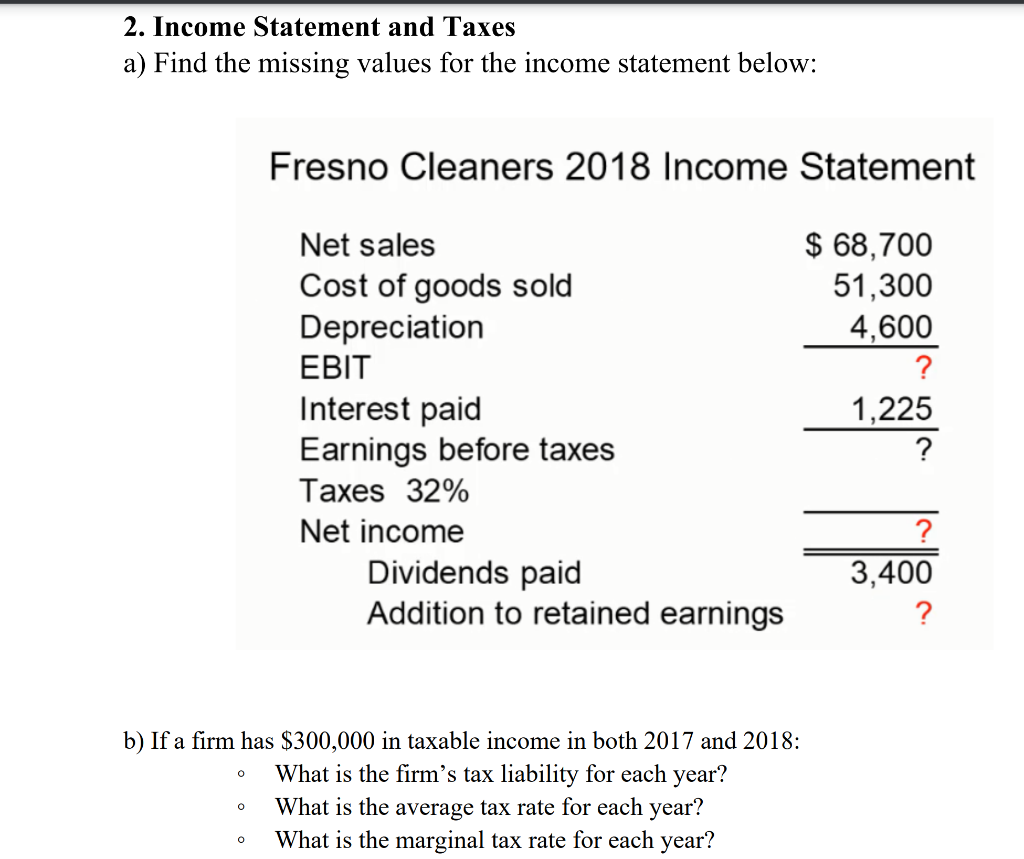

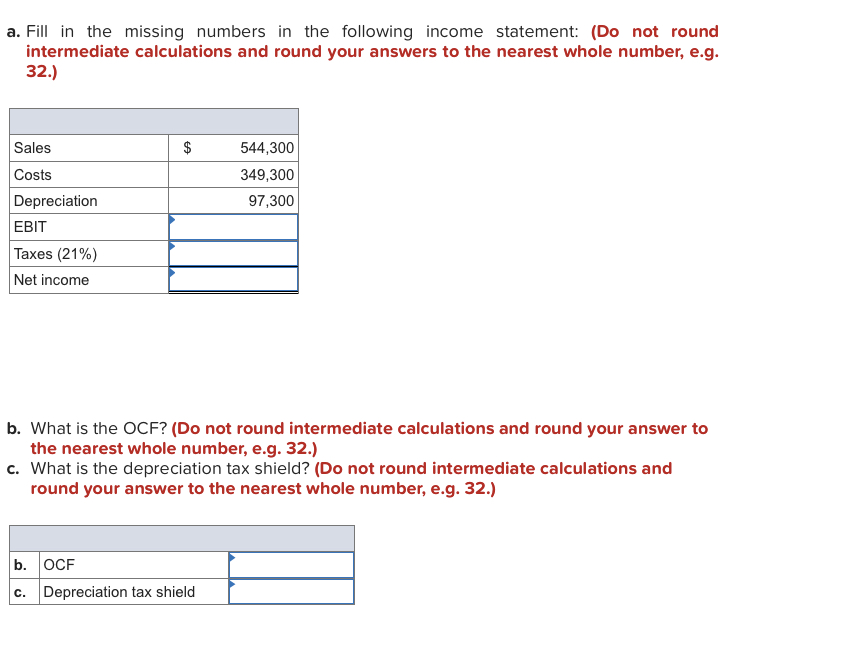

Most businesses have one revenue section at the very beginning followed by the expenses incurred in acquiring or producing the goods or services intended for sale and were sold followed by their selling administrative and general expenses and then their interest on debt and taxes on income.

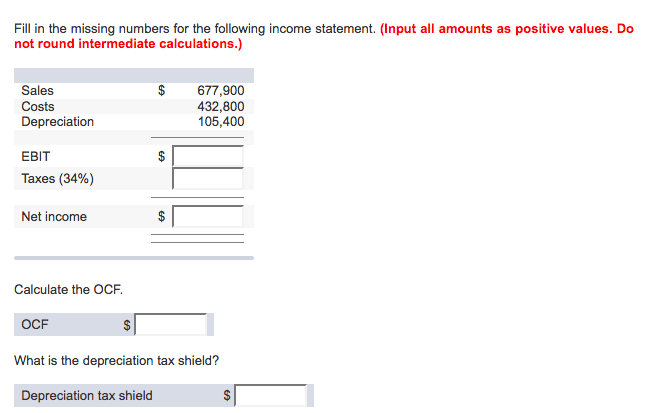

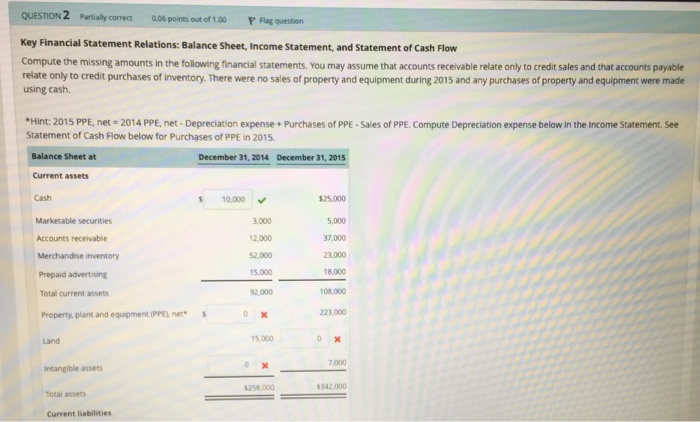

Depreciation missing income statement. Example of depreciation usage on the income statement and balance sheet. If the income statement includes subtotals like total expenses for example the easiest method is to use the subtotal number where our missing account is and subtract out the other accounts. A company acquires a machine that costs 60 000 and which has a useful life of five years. Physical assets such as machines equipment or vehicles degrade over time and reduce in value incrementally.

Depreciation is instead recorded in a contra asset account namely provision for depreciation or. One expense reported here relates to depreciation. Using our example the monthly income statements will report 1 000 of depreciation expense. Depreciation on the income statement is an expense while it is a contra account on the balance sheet.

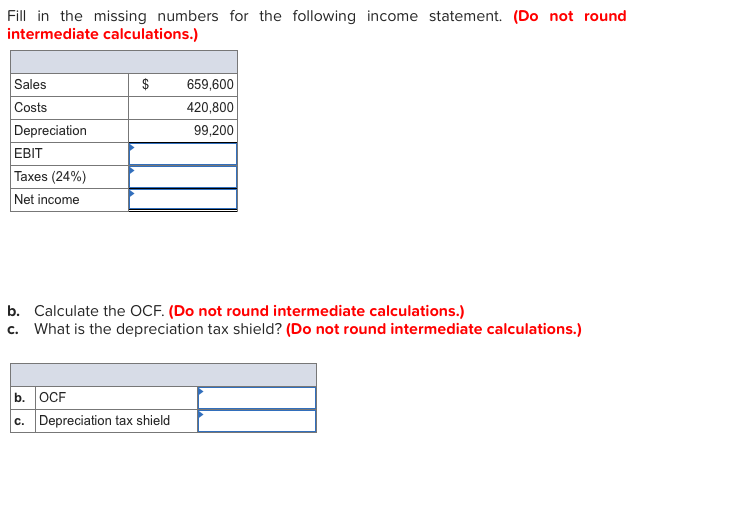

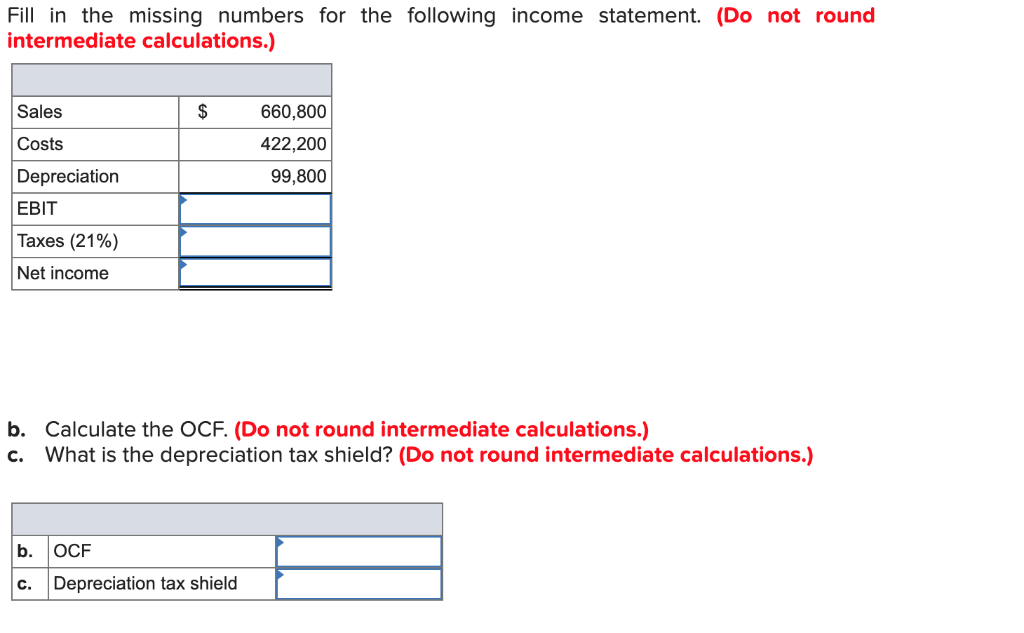

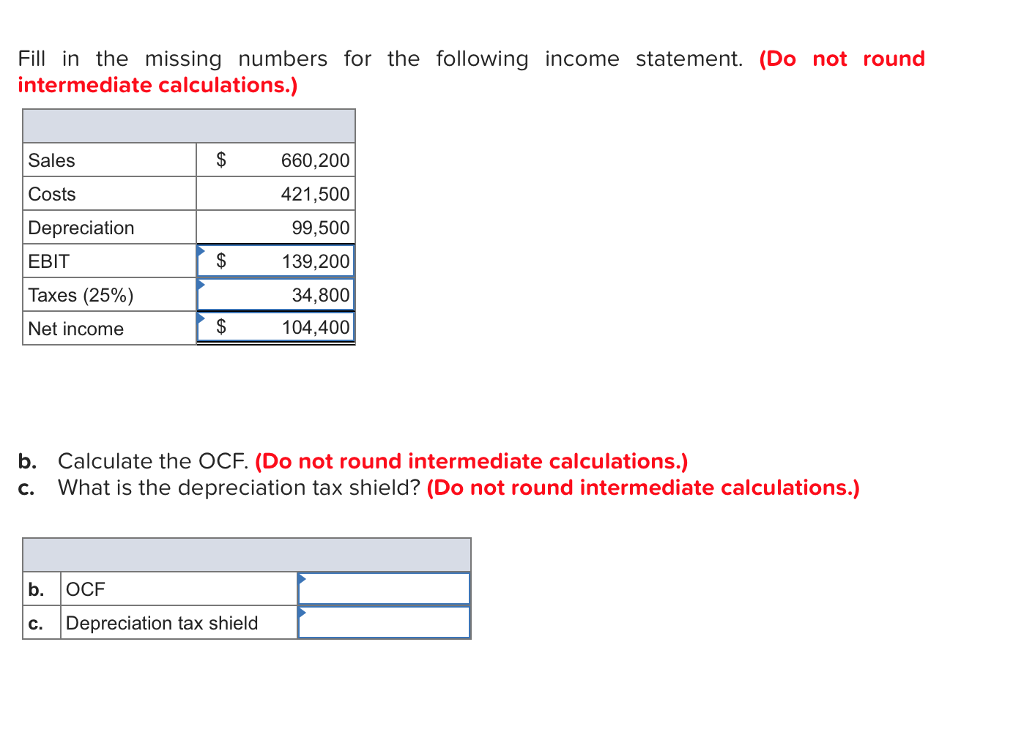

The income statement reports all the revenues costs of goods sold and expenses for a firm. This expense is most common in firms with copious amounts of fixed assets. Determine a missing amount from an income sheet by performing some basic calculations. However depreciation is not deducted from non current assets directly.

Unlike other expenses depreciation expenses are listed on income statements as. Depreciation is an expense which is charged in the current year s income statement. Definition of provision for depreciation or accumulated depreciation or difference between depreciation and provision for depreciation. So if interest expenses are present in the cash flow statement those should be added to the income before income taxes item as well to get ebitda earnings before interest taxes depreciation and amortization.

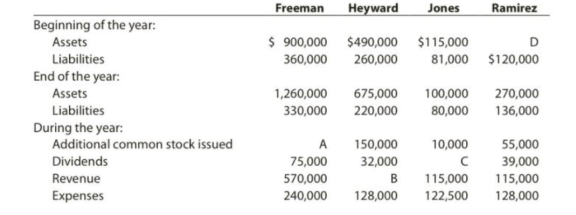

Begingroup although if there are interest expenses as well they are also probably hidden in other items. Add specific expenses and subtract the sum from the expense total to find a missing single expense. Depreciation expense is an income statement item. This means that it must depreciate the machine at the rate of 1 000 per month.

For example consider an income statement in which the expenses total 25 000. Determine what section of the income statement the missing part should be included in. It is accounted for when companies record the loss in value of their fixed assets through depreciation. The quarterly income statements will report 3 000 of depreciation.