Income Tax Rates Throughout History

Historical highest marginal personal income tax rates 1913 to 2020.

Income tax rates throughout history. Here are the current federal income tax rates. Rates of income tax reduced significantly. The highest income tax rate was lowered to 37 percent for tax years beginning in 2018. Download toprate historical xlsx 12 15 kb.

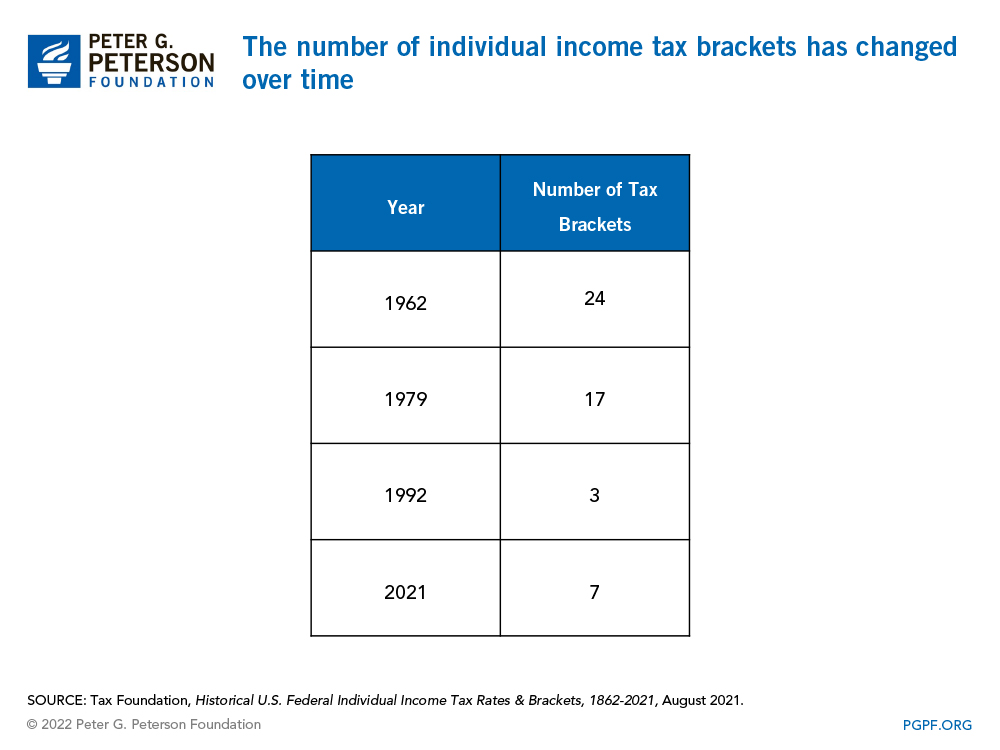

Progressives should stop fixating on the tax rates from 60 years ago. In the 1960s the tax brackets on the high end started to disappear and during ronald reagan s presidency we went down to just two brackets. The additional 3 8 percent is still applicable making the maximum federal income tax rate 40 8 percent. 10 25 rates for most people and 35 in the top bracket over 379 000.

By 1918 the top rate of the income tax was increased to 77 on income over 1 000 000 to finance world war i. Download toprate historical pdf 8 91 kb. The institution of income tax ombudsman set up in 12 cities throughout the country to look into tax. Here s a look at income tax rates and brackets over the years.

Taxation taxation history of taxation. That meant that many middle class citizens were in. Federal individual income tax rates history nominal dollars income years 1913 2013 nominal married filing jointly married filing separately single head of household marginal marginal marginal marginal tax rate over but not over tax rate over but not over tax rate over but not over tax rate over but not over. First a refresher course.

The income tax act 1922 gave for the first time a specific nomenclature to various income tax authorities. Although views on what is appropriate in tax policy influence the choice and structure of tax codes patterns of taxation throughout history can be explained largely by administrative considerations. To greenberg the takeaway from this is simple. 2021 tax rates and income brackets use these.

Then the internal revenue service adjusts the income brackets each year usually in late october or early november based on inflation. For example because imported products are easier to tax than domestic output import duties were among the earliest taxes. Congress sets the rates and a baseline income amount that falls into them when a tax law is created or changed. The top marginal tax rate was reduced to 58 in 1922 to 25 in 1925 and finally to 24 in 1929.

The organisational history of the income tax department starts in the year 1922. All in all the idea that high income americans in the 1950s paid much more. What this means for you. 2011 income tax brackets.