Income Tax Rates New Zealand 2019

They help your employer or payer work out how much tax to deduct before they pay you.

Income tax rates new zealand 2019. This includes income from self employment or renting out property and some overseas income. Ignore and log out continue close hi. New zealand has progressive or gradual tax rates. Detailed salary report based on career education experience gender age etc.

Tax codes and tax rates for individuals how tax rates and tax codes work. Tax codes only apply to individuals. We either automatically assess you or you need to file an ir3 return. The personal income tax rate in new zealand stands at 33 percent.

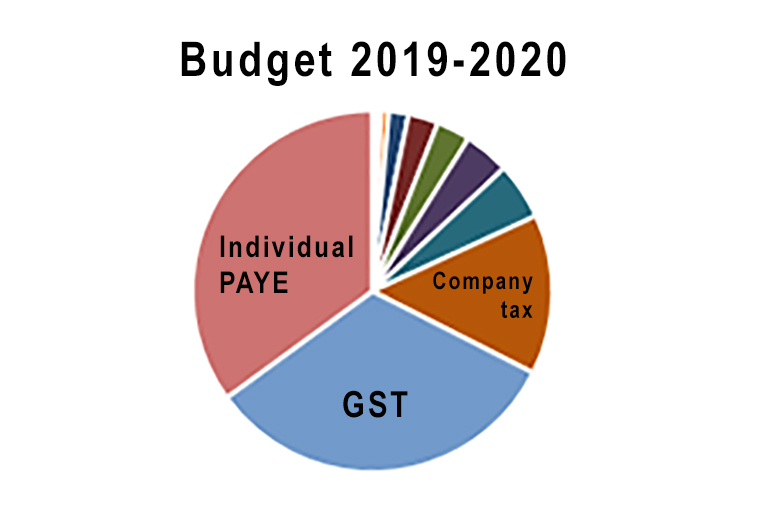

2019 2020 state income tax rates sales tax rates and tax laws. Companies and corporates are taxed at a flat rate of 28. Our gst system is simpler than similar systems in many. New zealand has several types of tax including taxes levied on goods and services and specific excise taxes on petrol tobacco and alcohol in addition individuals companies and other entities are required by law to pay taxes on any income or profit they make.

Tax rates are used to work out how much tax you need to pay on your total income for the year from all sources. Individuals pay progressive tax rates. A new zealand partnership and a member firm of the kpmg global organisation of independent member firms. If you make 50 000 a year living in new zealand you will be taxed 8 745 that means that your net pay will be 41 255 per year or 3 438 per month.

Your average tax rate is 17 49 and your marginal tax rate is 31 46 this marginal tax rate means that your immediate additional income will be taxed at this rate. Tax rates income tax. Kpmg s individual income tax rates table provides a view of individual income tax rates around the world. The rates increase as your income increases.

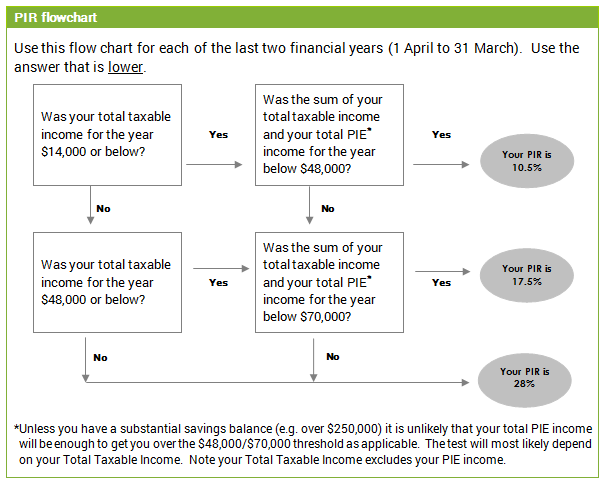

New zealand s personal income tax rates depend on your income increases. Average salary in new zealand is nz 78 438 us 59 644. The top personal tax rate is 33 for income over nz 70 000. The lowest personal tax rate is 10 5 for income up to 14 000.

Which tax rate applies to me. Personal income tax rate in new zealand averaged 35 21 percent from 2004 until 2020 reaching an all time high of 39 percent in 2005 and a record low of 33 percent in 2011. You will not receive kpmg subscription messages until you agree to the new policy. This page provides new zealand personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

New zealand has a bracketed income tax system with four income tax brackets ranging from a low of 11 50 for those earning under 14 000 to a high of 35 50 for those earning more then 70 000 a year. You pay tax on this income at the end of the tax year. Tax codes are different from tax rates.