Income Tax Zone In India

Direct tax in the form an income tax were introduced by the british in india in 1860 to overcome the difficulties created by the indian rebellion of 1857.

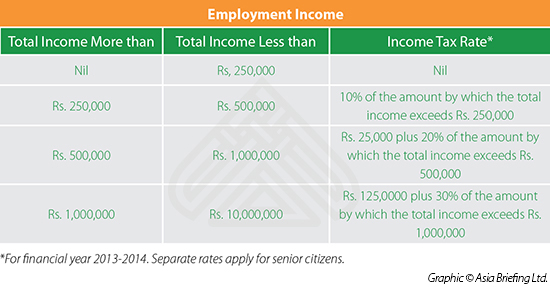

Income tax zone in india. Income tax brackets in india for fy 2020 21 ay 2021 22 updated on november 15 2020 11028 views paying income tax is a duty of every indian citizen. Generally the income is taxable if it exceeds more than 2 50 000 in case of individual rs 3 lakh in case of senior citizen and up to rs 5 lakh in case of super senior citizen. Second schedule of the special economic zone act of india section 10 15 viii. The third india income tax slab in 2019 is for individuals over 80 years of age and provides the lowest levels of personal income tax in india.

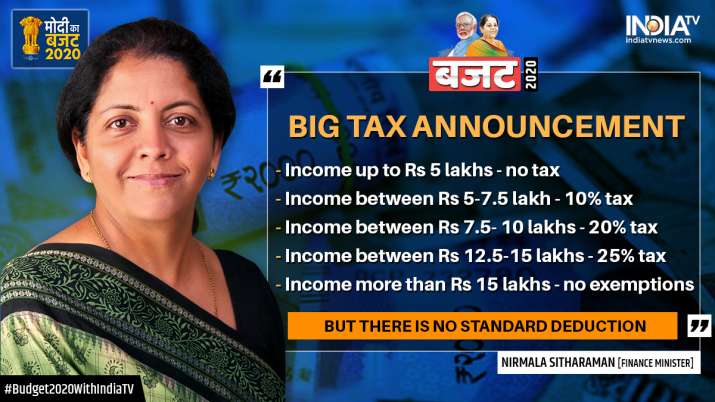

Alternative minimum tax amt amt is applicable to all persons other than a company having income from a business or profession. Budget 2020 has given an option to choose between the existing income tax regime and a new regime for the coming financial year 2020 21. Interest on deposits in an offshore bank on or after 1st april 2005 of a non resident or not ordinarily resident is exempted form paying tax. The organisational history of the income tax department however starts in the year 1922 when the income tax act 1922 gave for the first time a specific nomenclature to various income tax authorities.

The second india income tax slab in 2019 is for individuals over 60 years of age but under 80 years of age. Agricultural income is defined in section 10 1 of the income tax act 1961. Under the income tax act 1961 the percentage of income. Income tax india to stay updated ask 1800 180 1961 1961 income tax department skip to main content employees corner.

Income tax in india is governed by entry 82 of the union list of the seventh schedule to the constitution of india empowering the central government to tax non agricultural income. Resident individuals are eligible for a tax rebate of the lower of the income tax or inr 12 500 where the total income does not exceed inr 500 000. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail.