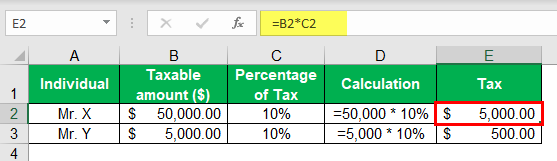

Income Tax Calculator Definition

It is mainly intended for residents of the u s.

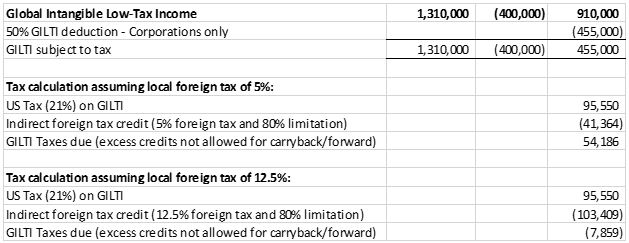

Income tax calculator definition. Income taxes in the u s. Are calculated based on tax rates that range from 10 to 37. It usually appears on the next to last line of the income statement right before the net income calculation. The changes to the tax withholding schedules announced in the federal budget 2020 21 are not reflected in this calculator as the 2020 21 calculator won t be.

2016 2017 2017 2018 2018 2019 2019 2020 2020 2021 pre budget 2020 2021. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. It can be used for the 2013 14 to 2019 20 income years.

10 12 22 24 32 35 and 37. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. A tax bracket is a range of incomes that the government taxes at a specific rate. And is based on the tax brackets of 2019 and 2020.

The income tax calculator estimates the refund or potential owed amount on a federal tax return. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. As of 2020 there are currently seven federal tax brackets in the us.

The irs determines the amount of tax an individual or business owes by dividing their income into tax brackets. A financial advisor can help you understand how taxes fit into your overall financial goals. The 2020 tax values can be used for 1040 es estimation planning ahead or comparison. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/income-tax-4097292_19201-3af2a17857e34c5fb24b9986fa3d1991.jpg)