Federal Income Tax Withholding Tables For Pensions

If your pension started a few years ago and now you are starting social security benefits you will likely need to increase your tax withholding.

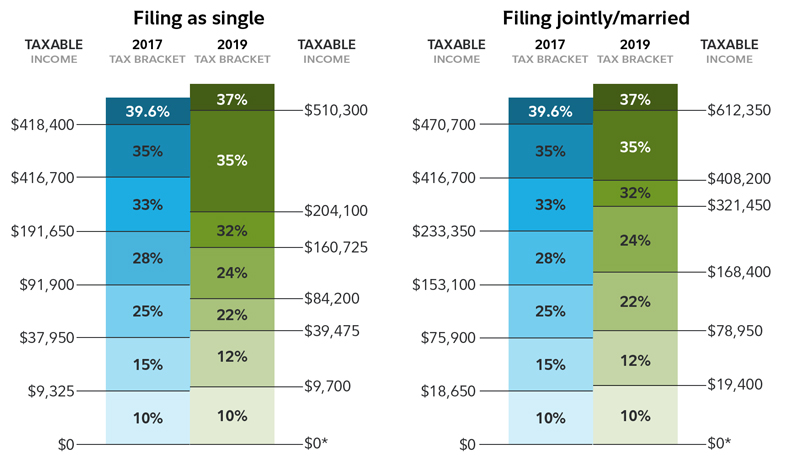

Federal income tax withholding tables for pensions. Next calculate the tax withholding rate. The publication may be used as well to calculate withhold federal income tax from annuities and pensions. Generally pension and annuity payments are subject to federal income tax withholding. The federal tax rate on pensions is the ordinary income tax rate although not all pension distributions are taxable.

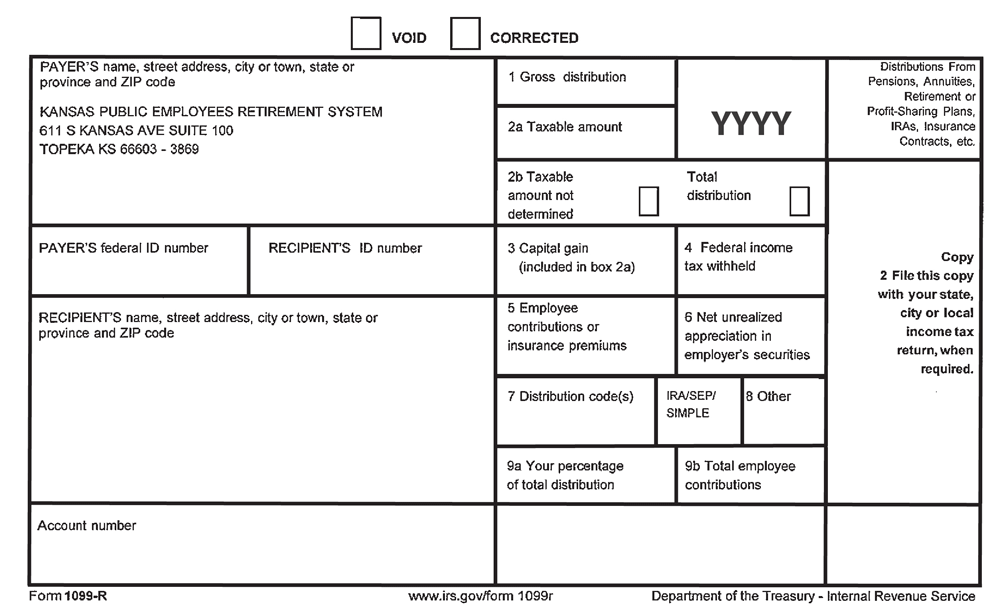

The internal revenue service released the federal withholding tables to help employers figure out how much tax to withhold from the employer s paycheck. Free step by step webinar september 19. If you contributed post tax dollars to the pension you will not be taxed on those amounts. The rules also apply to payments from an individual retirement arrangement ira an annuity endowment or life insurance contract issued by a life.

New hampshire and tennessee only tax investment income and several states including alabama hawaii illinois mississippi and pennsylvania exempt all income from pensions for state tax purposes. To estimate their needed tax withholding at age 73 take 7 847 divided by the total of their pension and ira income of 71 255 and the result is 11. Due to inflation the federal withholding tables are undergone changes every year. Therefore for purposes of withholding from periodic payments under 3405 a the irs plans to provide in the 2020 publication 15 a employer s supplemental tax guide that the 2020 form w 4p will work with certain withholding tables and computational procedures in the 2020 publication 15 t that are applicable to a 2019 or earlier form w 4.

Ir 2019 155 september 13 2019. The withholding rules apply to the taxable part of payments from an employer pension annuity profit sharing stock bonus or other deferred compensation plan. This method works for forms w 4 from 2019 or earlier and forms w 4 from 2020 or later. From 2020 and beyond the internal revenue service will not release federal withholding tables publication 15.

The same is true for other retirement accounts such as iras and 401 k accounts. However it may not be used to calculate withhold of eligible rollover distribution or aperiodic payments. Washington the new tax withholding estimator launched last month on irs gov includes user friendly features designed to help retirees quickly and easily figure the right amount of tax to be taken out of their pension payments. Irs federal withholding tables 2020.

If you have an automated payroll system use the worksheet below and the percentage method tables that follow to figure federal income tax withholding. Change in withholding when you reach age 72 when you reach age 72 you are required to start taking distributions from traditional ira accounts and other qualified retirement plans like a 401 k. Have 11 in federal taxes withheld from their pension and ira distributions. The mobile friendly tax withholding estimator replaces the withholding calculator.

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)